What Is The Lcm Of 6 12 And 14 - Searching for a method to remain arranged effortlessly? Explore our What Is The Lcm Of 6 12 And 14, designed for daily, weekly, and monthly planning. Perfect for trainees, specialists, and busy parents, these templates are easy to customize and print. Stay on top of your tasks with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and trouble-free. Start planning today!

What Is The Lcm Of 6 12 And 14

What Is The Lcm Of 6 12 And 14

Schedule A is an IRS form used to claim itemized deductions on a tax return Form 1040 See how to fill it out how to itemize tax deductions and helpful tips · Schedule A (Form 1040 or 1040-SR): Itemized Deductions is an Internal Revenue Service (IRS) form for U.S. taxpayers who itemize their tax-deductible expenses rather than take the standard.

Schedule A Itemized Deductions IRS Tax Forms

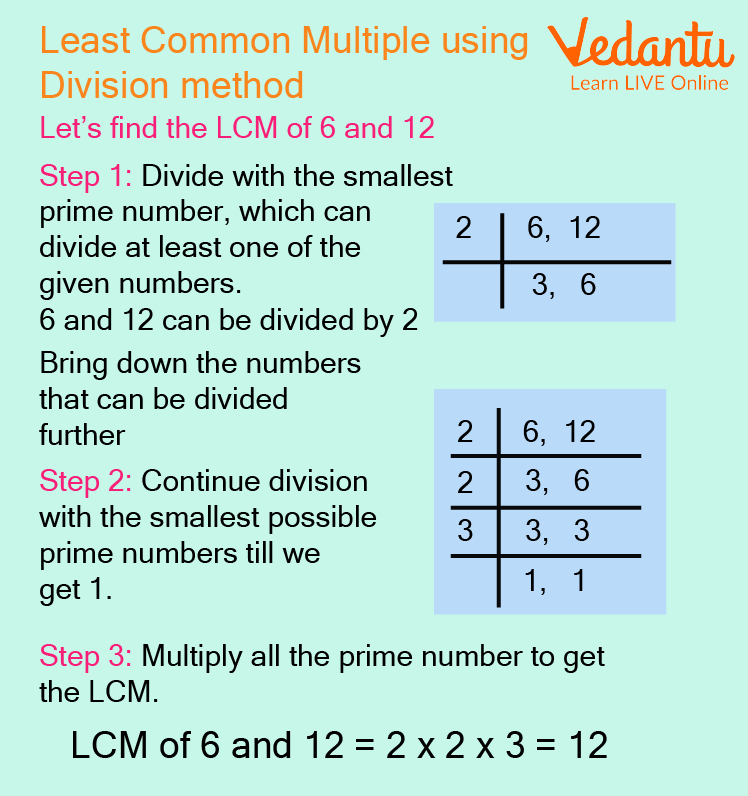

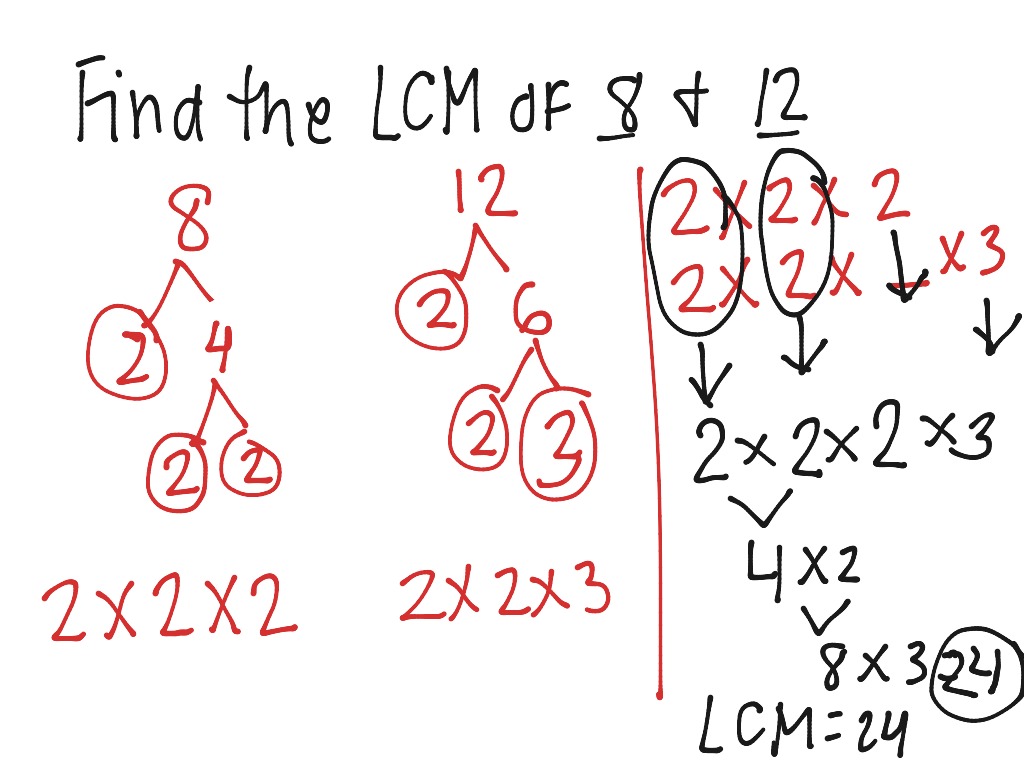

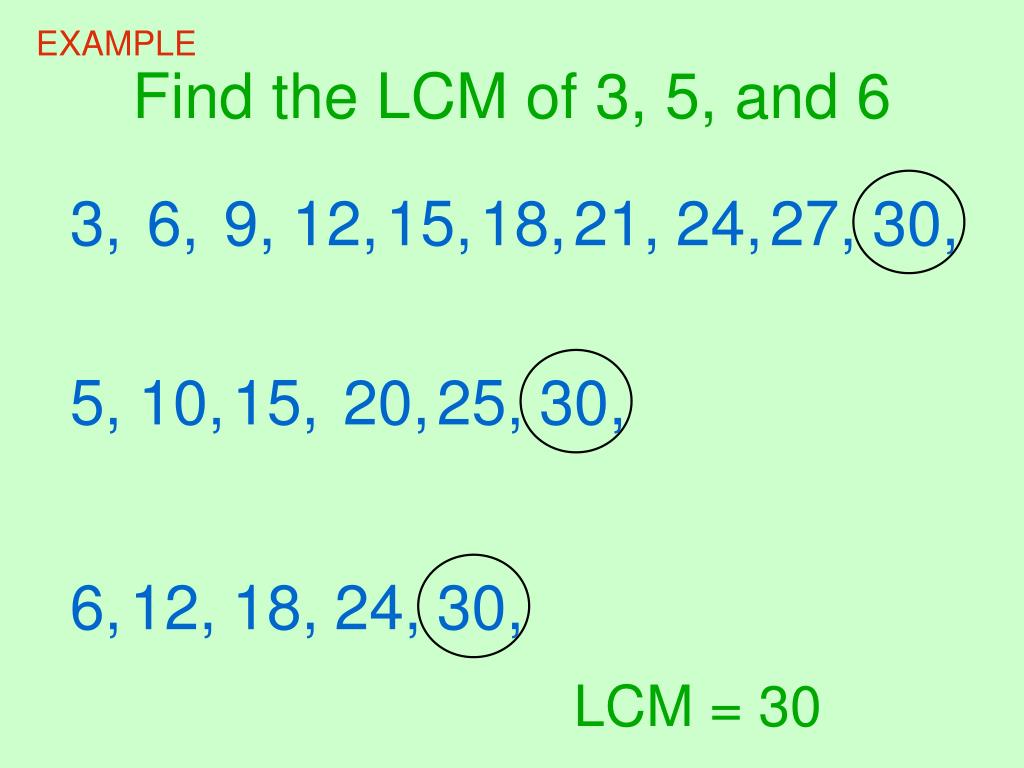

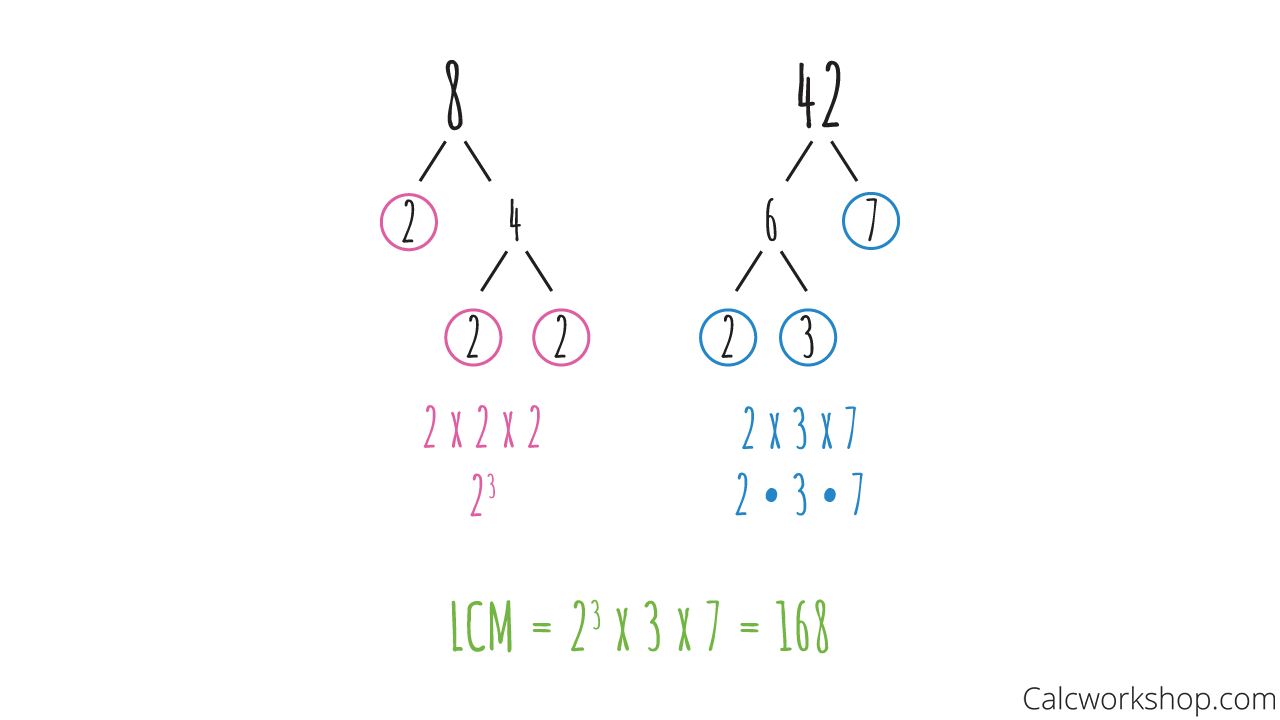

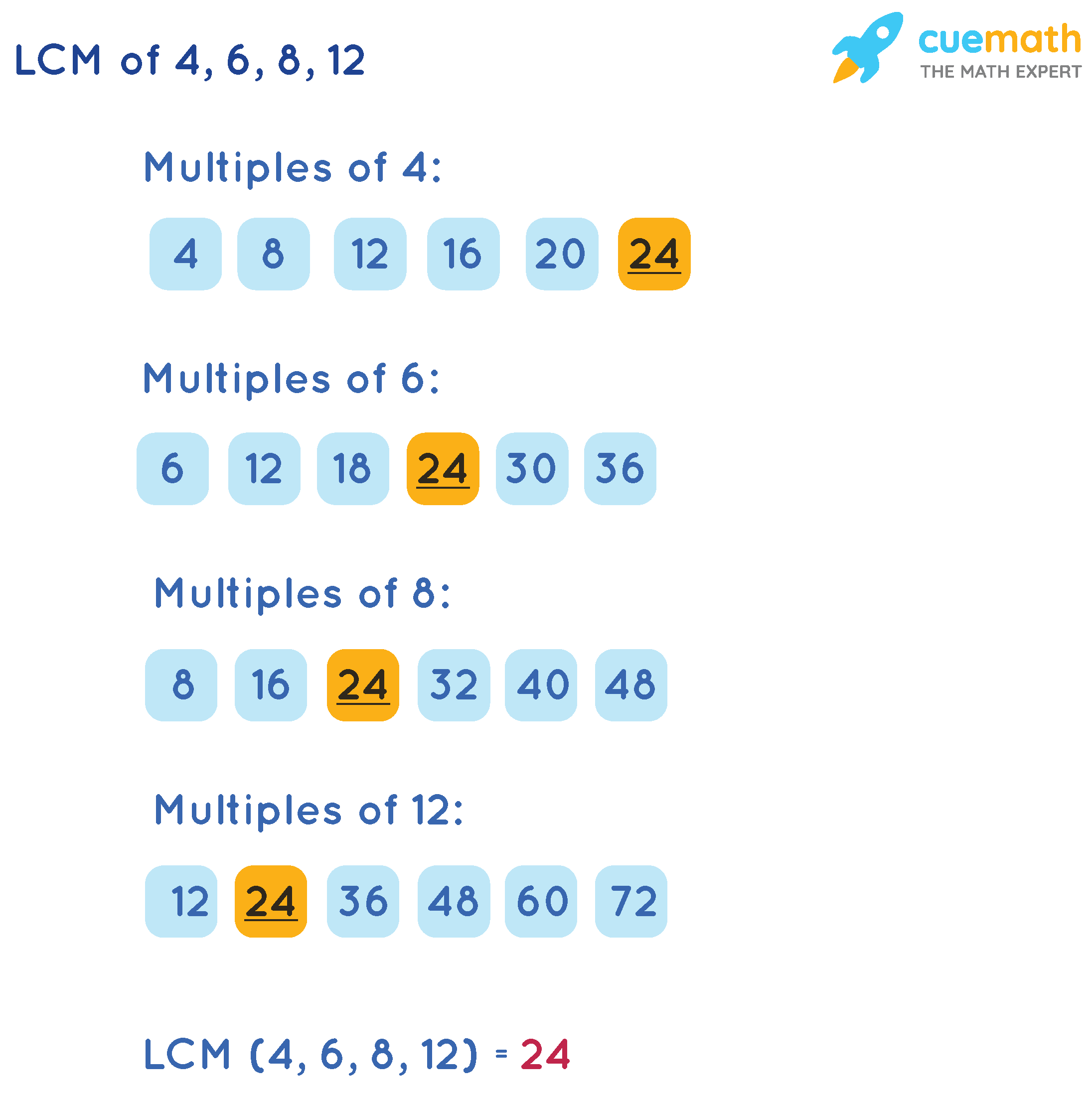

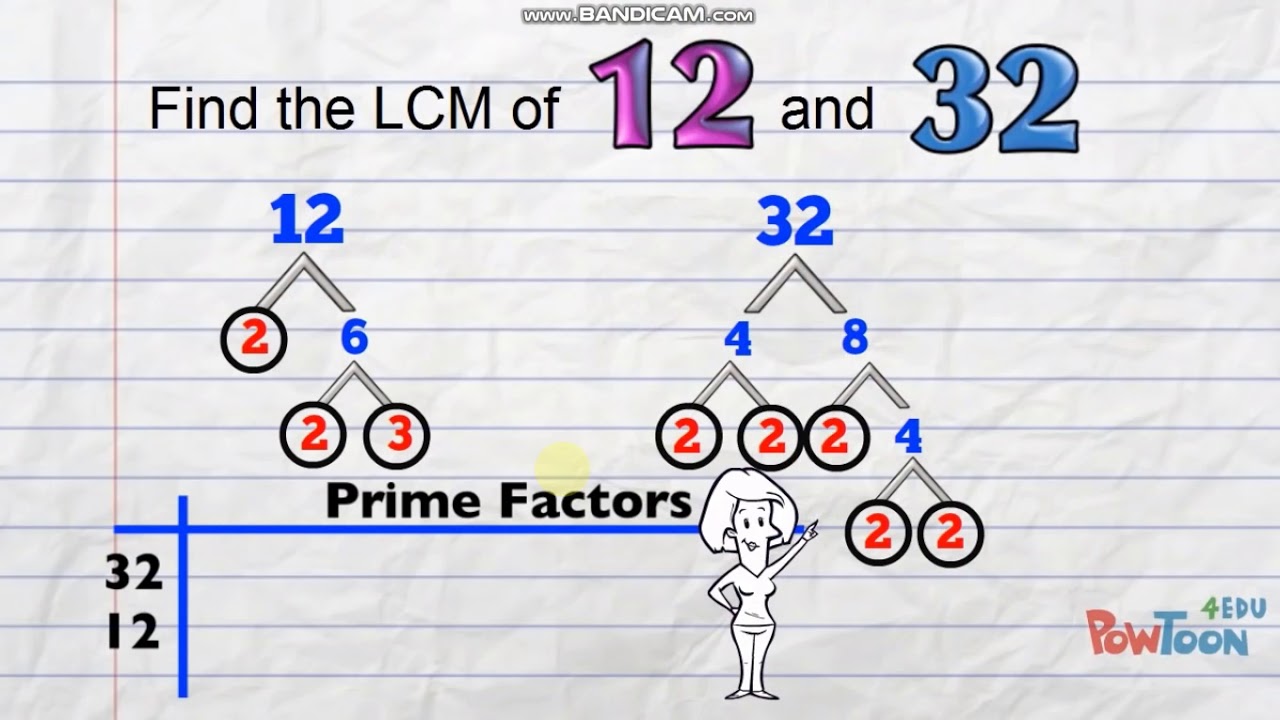

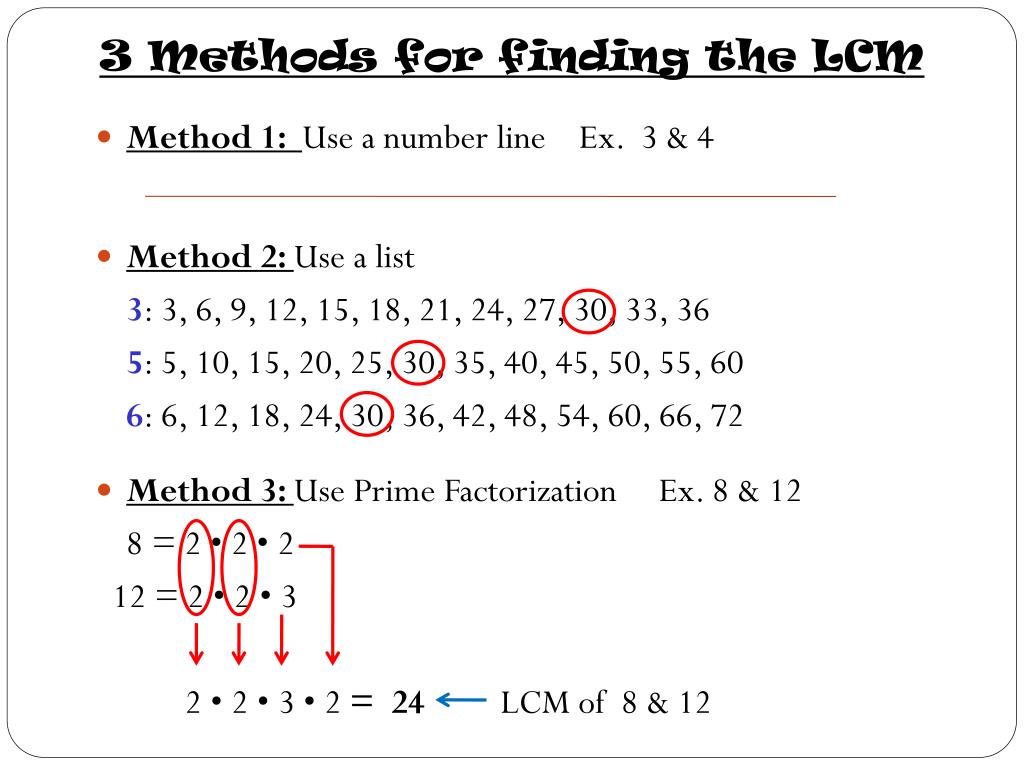

How To Find LCM Of 12 15 And 21 How To Find LCM Of Three Numbers

What Is The Lcm Of 6 12 And 14Schedule A is an optional schedule of Form 1040, which is the form U.S. taxpayers use for their personal income tax return. You must fill out Schedule A if you choose to itemize your deductions. SCHEDULE A Form 1040 Department of the Treasury Internal Revenue Service 99 Itemized Deductions Go to www irs gov ScheduleA for instructions and the latest information Attach to

Schedule A is required in any year you choose to itemize your deductions The schedule has seven categories of expenses medical and dental expenses taxes interest gifts to Define Lowest Common Denominator Download or print the 2023 Federal 1040 (Schedule A) (Itemized Deductions) for FREE from the Federal Internal Revenue Service.

All About Schedule A Form 1040 Or 1040 SR Itemized

Find The LCM And HCF Of The Following Integers By Applying The Prime

Schedule A is a tax form that must accompany your Form 1040 or Form 1040 SR tax return if you choose to itemize your deductions It provides details and numerical amounts for LCM Calculator For 4 Numbers How To Calculate LCM Calculator For 4

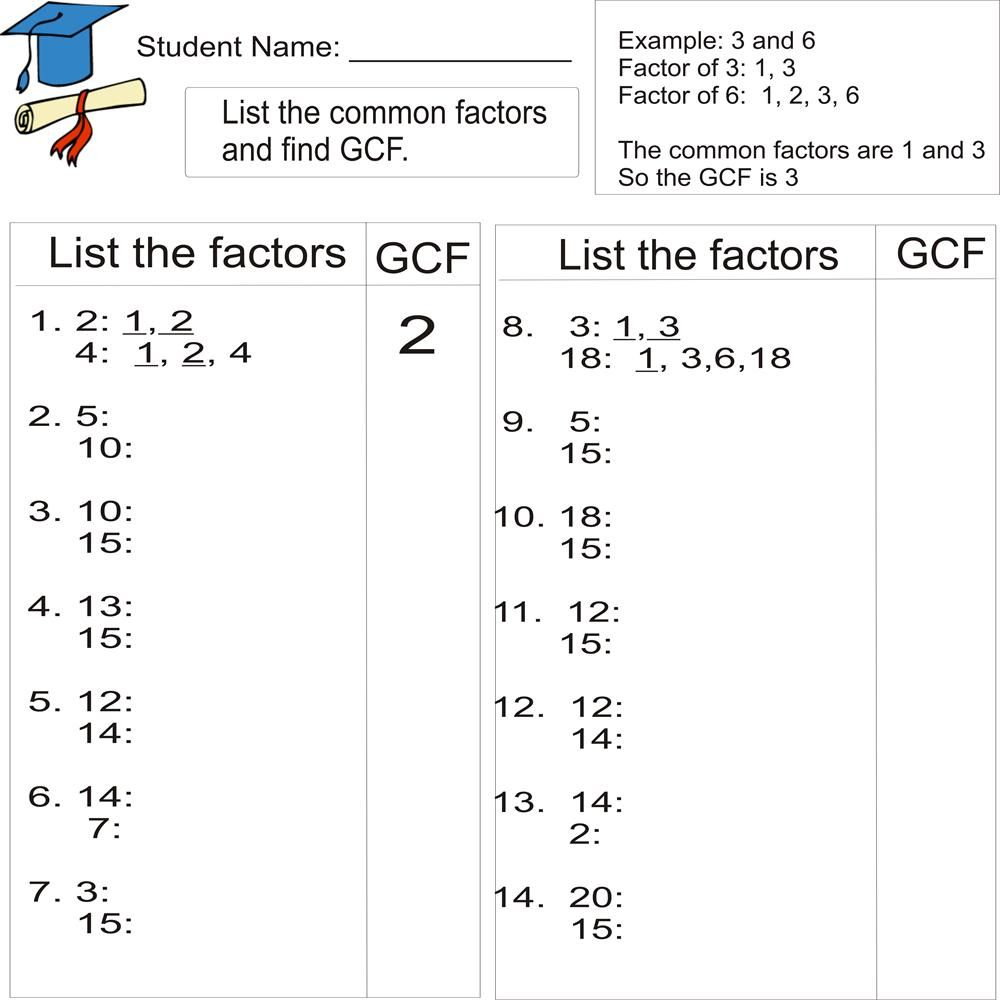

Schedule A Sales Tax Deduction you use If the taxpayer has a large amount of nontaxable income calculate their sales tax deduction using the IRS sales tax deduction calculator See the Gcf Practice Problems Academy 8 10 Telegraph

PPT Least Common Multiples LCM PowerPoint Presentation 40 OFF

Lcm With Variables

Math Common

Least Common Multiple Explained

Example 8 Find LCM Of 12 And 18 Chapter 1 Class 6 Teachoo

Lcm 3 4 And 5

Least Common Multiple Simple How To W 9 Examples

LCM Calculator For 4 Numbers How To Calculate LCM Calculator For 4

Lcm 3 4 And 6

Lcm 3 And 6