How To Calculate Semi Monthly Loan Payments - Searching for a method to remain arranged easily? Explore our How To Calculate Semi Monthly Loan Payments, designed for daily, weekly, and monthly planning. Perfect for trainees, professionals, and hectic moms and dads, these templates are simple to personalize and print. Stay on top of your jobs with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and stress-free. Start planning today!

How To Calculate Semi Monthly Loan Payments

How To Calculate Semi Monthly Loan Payments

Maximize your business deductions and accurately calculate your profit or loss with Federal Form 1040 Schedule C Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if

How To File Schedule C Form 1040 Bench Accounting

How To Calculate Revenue For A Startup

How To Calculate Semi Monthly Loan Payments · What Is a Schedule C Form? Who Files a Schedule C? What’s on a Schedule C? How Do I Fill Out a Schedule C? How Do I Find My Net Profit or Loss? Get Help With Your Self. Schedule C Profit or Loss from Business reports how much money you made or lost in a business you operated as a gig worker freelancer small business owner or consultant in certain business

Download or print the 2023 Federal Profit or Loss from Business Sole Proprietorship 2023 and other income tax forms from the Federal Internal Revenue Service Spot Loan Apply Online Payday Loans Online With Monthly Payments SCHEDULE C (Form 1040) Profit or Loss From Business Go OMB No. 1545-0074 2020 (Sole Proprietorship) to www.irs.gov/ScheduleC for instructions and the latest information. Department.

From Business Profit Or Loss Internal Revenue Service

:max_bytes(150000):strip_icc()/loan-payment-calculations-315564-70a2f63dbd624881b63ec5392209c9a6.gif)

What Is The Formula For A Monthly Loan Payment

Printable Federal Income Tax Schedule C Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor Small businesses and statutory employees How To Calculate Your Monthly Mortgage Payment Given The Principal

The IRS uses the information in the Schedule C tax form to calculate how much taxable profit you made and assess any taxes or refunds owing You can find the fillable form here IRS Schedule Loan Calculator 2 0 On The App Store How To Calculate Monthly Loan Payments Archives California Business

Student Loans Payment Resume Key Dates You Must Consider Now That

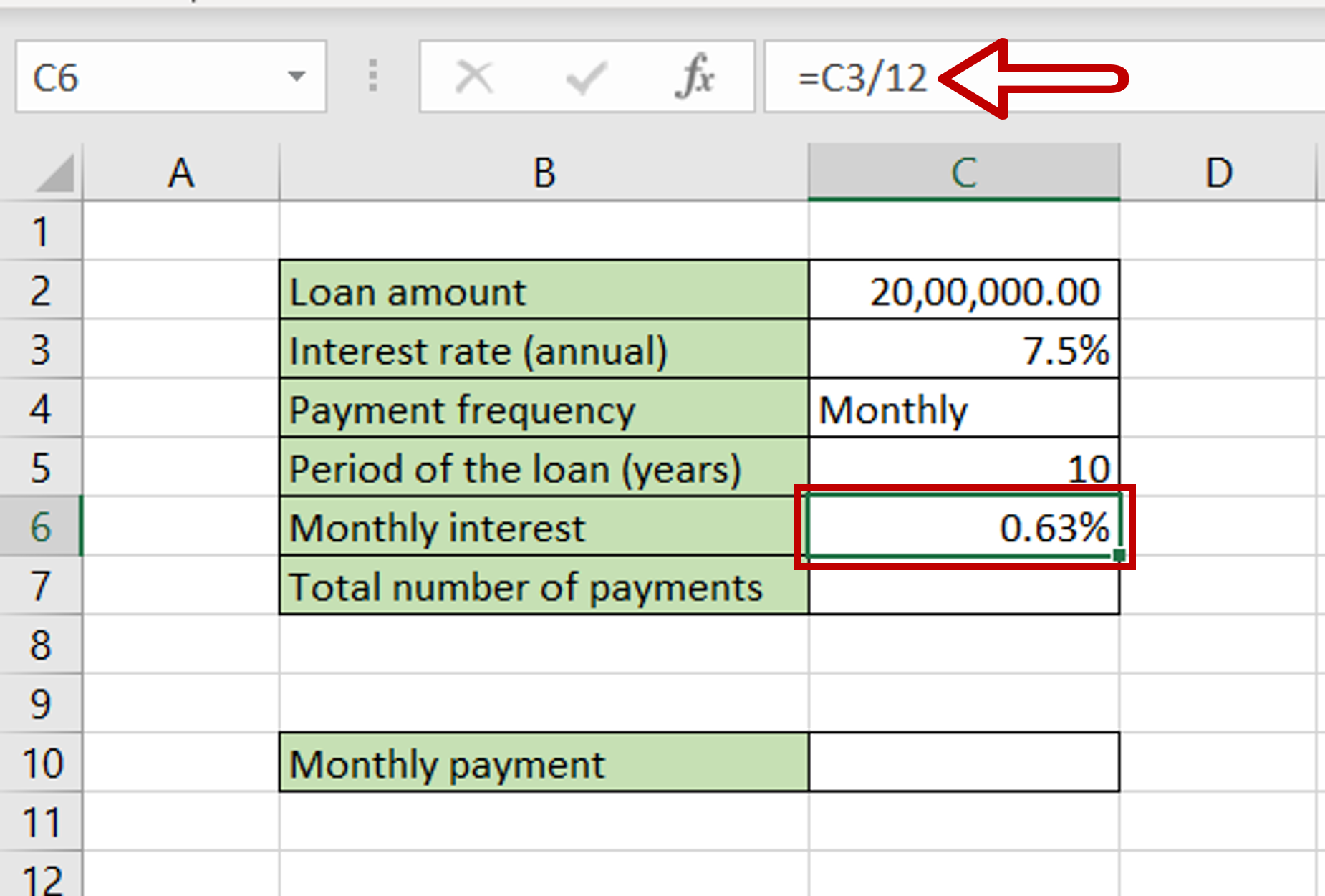

How To Calculate Loan Payments Using The PMT Function In Excel Excel

How To Calculate The Price to Sales Ratio InfoComm

How To Calculate Percentage Increase In Excel ManyCoders

What Is Semi Monthly Pay Plus Calculation HR Glossary AIHR

How To Calculate A Monthly Payment In Excel 12 Steps Atelier yuwa

How To Calculate Monthly Payment On A Loan In Excel SpreadCheaters

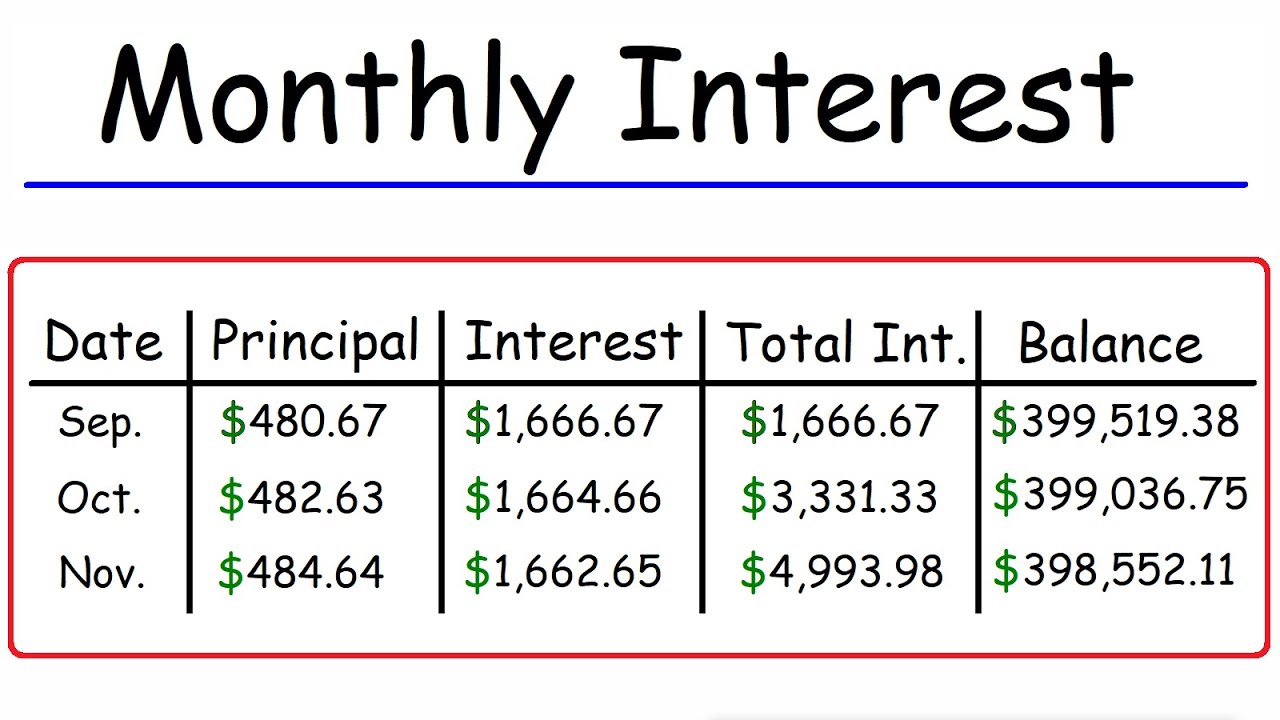

How To Calculate Your Monthly Mortgage Payment Given The Principal

How To Calculate Monthly Payment With APR In Excel ExcelDemy

HOW TO CALCULATE INCOME TAX ON BUSINESS 2024 Business Income Tax