Fixed Rate Mortgage Payment Calculator - Searching for a way to stay arranged easily? Explore our Fixed Rate Mortgage Payment Calculator, designed for daily, weekly, and monthly planning. Perfect for students, specialists, and hectic moms and dads, these templates are simple to tailor and print. Remain on top of your tasks with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and trouble-free. Start preparing today!

Fixed Rate Mortgage Payment Calculator

Fixed Rate Mortgage Payment Calculator

Information about Form 2290 Heavy Highway Vehicle Use Tax Return including recent updates related forms and instructions on how to file Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles SCHEDULE 1 (Form 2290) (Rev. July 2019) Department of the Treasury Internal Revenue Service Schedule of Heavy Highway Vehicles For the period July 1, 2019, through June 30, 2020 Complete and file both copies of Schedule 1. One copy will be stamped and returned to

Form 2290 Heavy Vehicle Use Tax E File Schedule 1 Copy In

Mortgage Rates Jump Above 6 For First Time Since 2008 The New York Times

Fixed Rate Mortgage Payment CalculatorFile Form 2290 for the selected tax period by either printing and mailing the return or by electronically filing the completed tax return. File Form 2290 and Schedule 1 by the last day of the month following the month in which the taxable gross weight increased Figure the additional tax using the following worksheet Attach a copy of the worksheet for each vehicle

How to print the Form 2290 Schedule 1 Copy Watermarked Schedule 1 copy is a must to register your vehicle with the state authorities and you need to take a print out of this receipt as a proof of payment of tax 2290 vehicle use tax [img_title-17] SCHEDULE 1 (Form 2290) (Rev. July 2022) Department of the Treasury Internal Revenue Service. Schedule of Heavy Highway Vehicles. For the period July 1, 2022, through June 30, 2023 OMB No. 1545-0143. Complete and file both copies of Schedule 1.

2290 Heavy Highway Vehicle Use Tax Return Tax2290

Mortgage Principal Payment Calculator Nightgast

You get your 2290 Schedule 1 in minutes through your registered email You can also opt to receive Schedule 1 via fax or postal mail Why you should E File your 2290 with ExpressTruckTax Get Stamped Schedule 1 in Minutes Guaranteed Schedule 1 or your Money Back Free 2290 VIN Correction Home Mortgage Monthly Payment HOME SWEET HOME

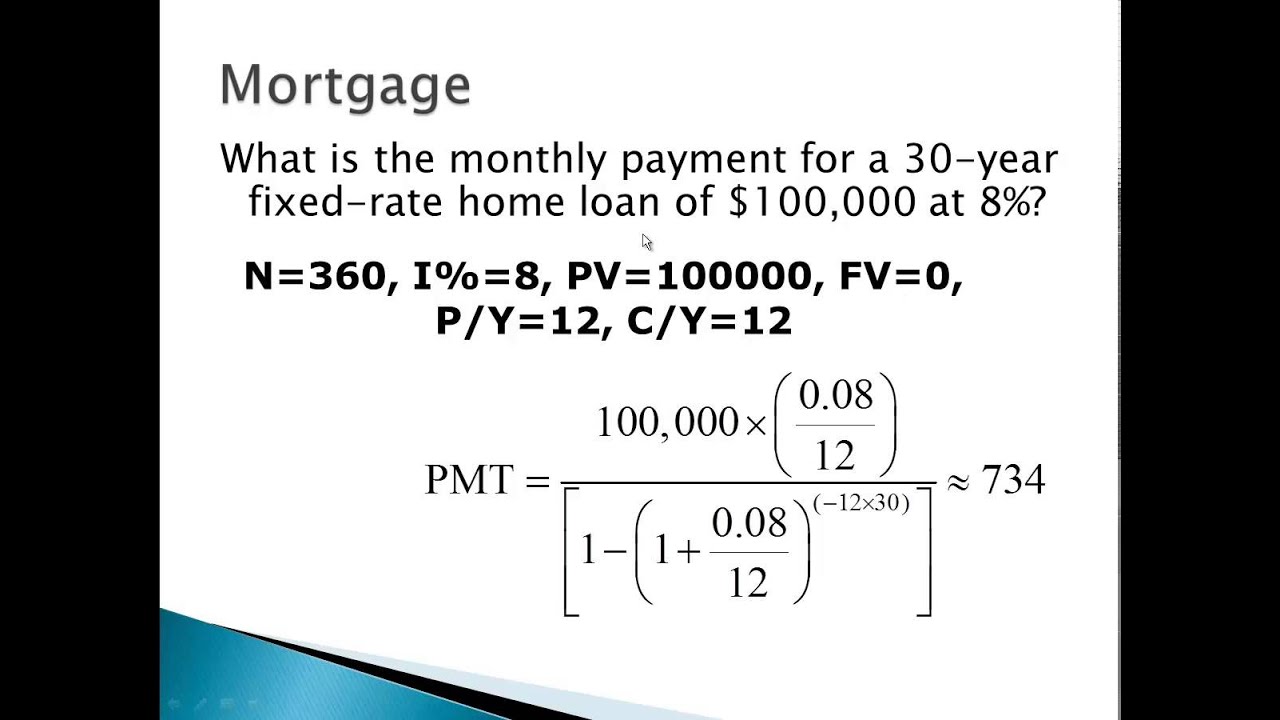

SCHEDULE 1 Form 2290 Rev July 2020 Departrnent of the Treasury Internal Revenue Service Name Schedule of Heavy Highway Vehicles For the period July 1 2020 through June 30 2021 Complete and file both copies Of Schedule 1 Mortgage Calculator YouTube [img_title-13]

Benefits Of An Adjustable Rate Mortgage Fifth Third Bank

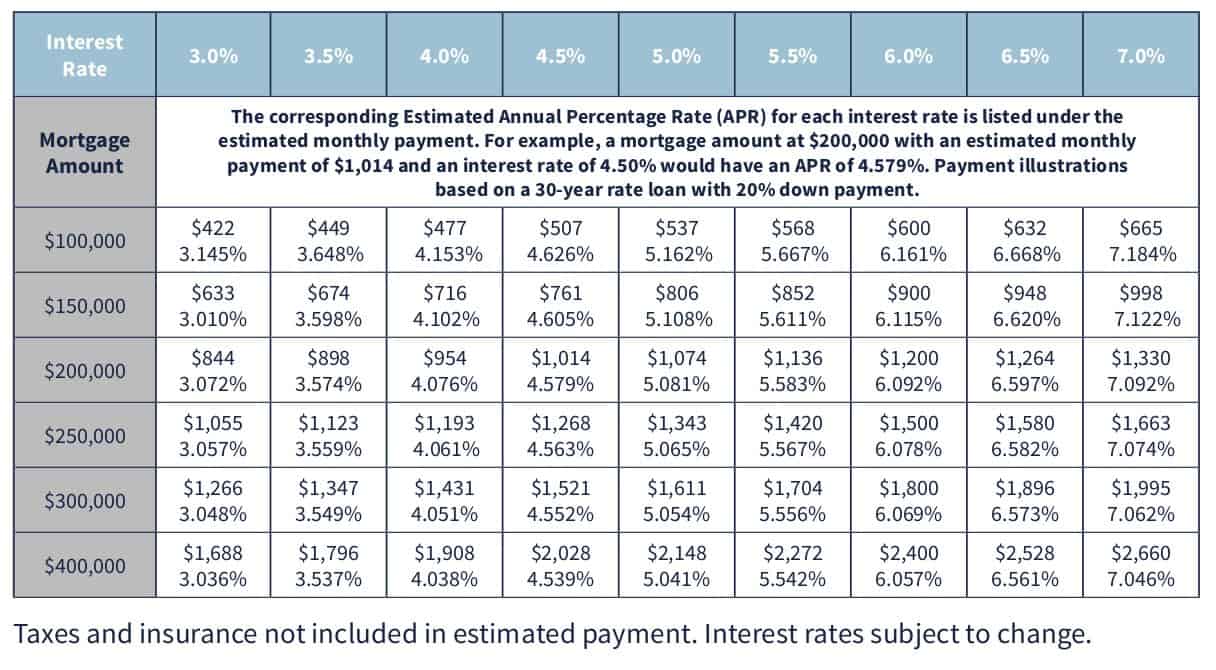

This Infographic Shows The Monthly Mortgage Payment For A 30 year Fixed

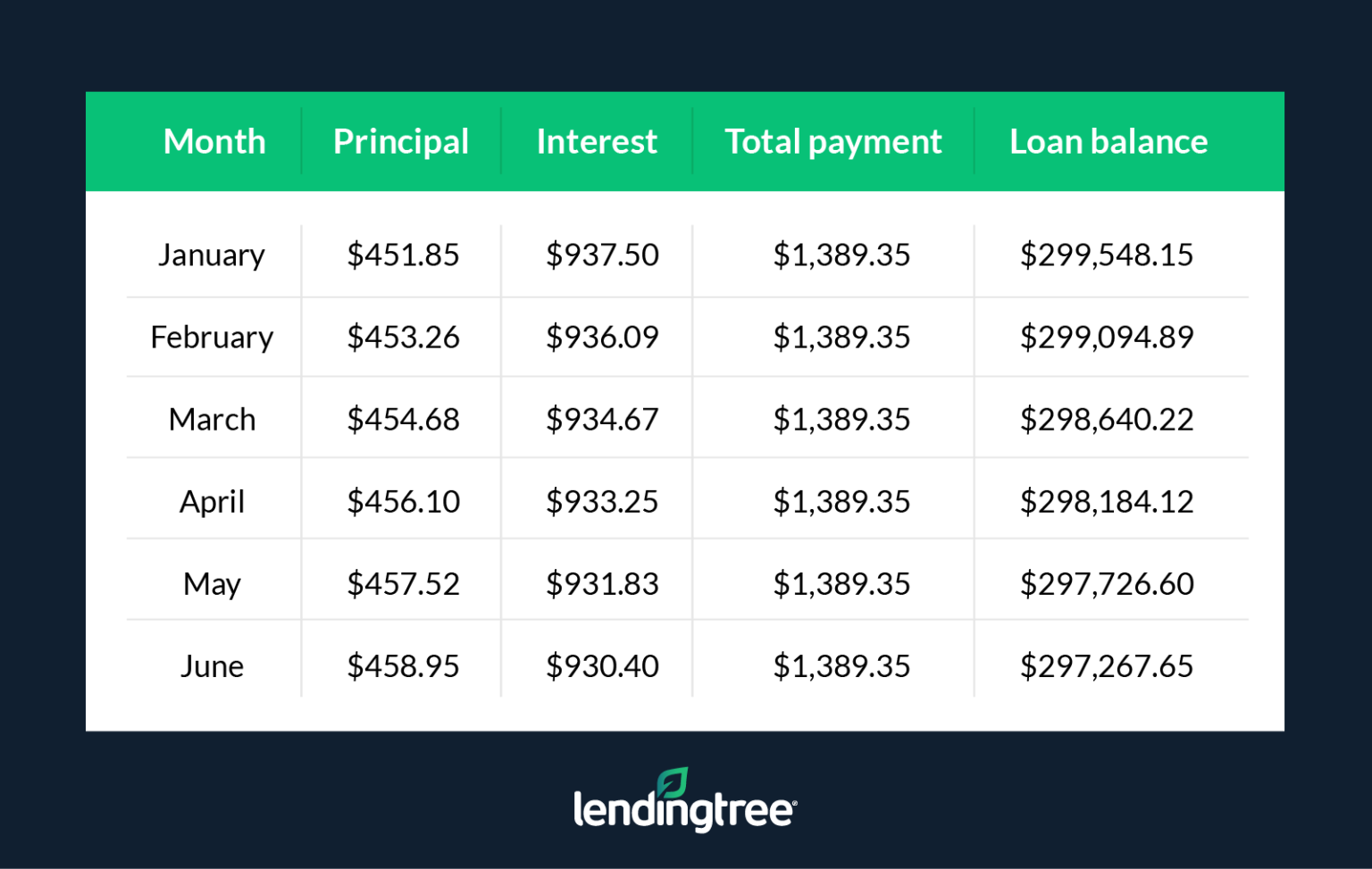

Amortizing Loan Fees Over The Life Of A Loan

A Quick Mortgage Guide For Real Estate Buyers

Mortgage Rates Chart Calculator At Katina Burton Blog

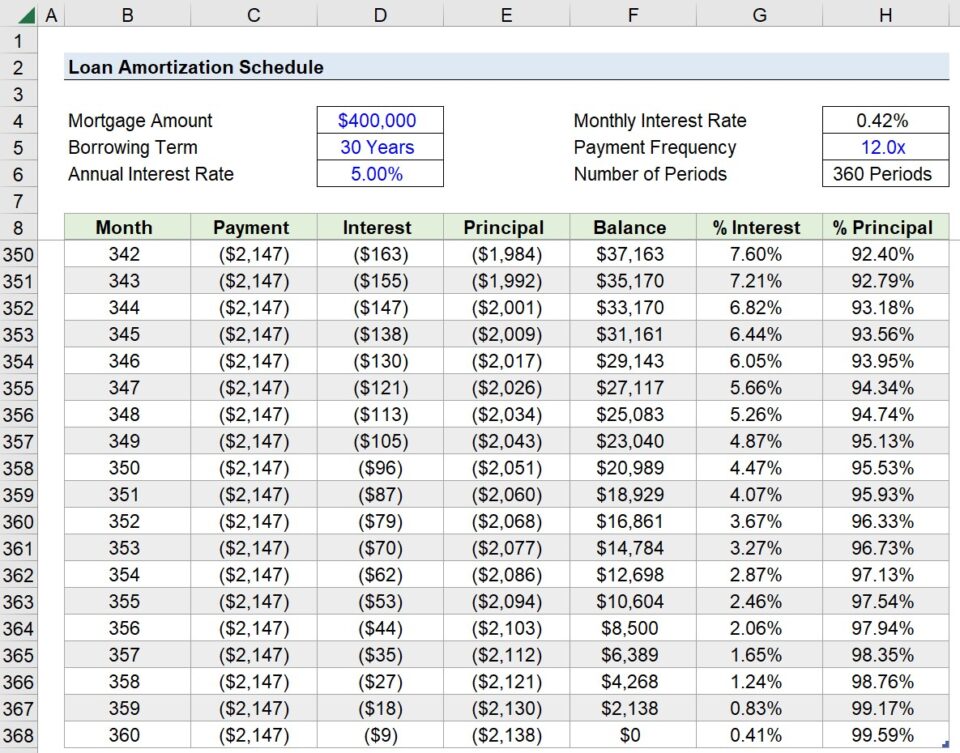

Here s How A Mortgage Amortization Schedule Works LendingTree

53 Mortgage Calculator With Amortization Extra Payments SitheagAnya

Home Mortgage Monthly Payment HOME SWEET HOME

[img_title-14]

[img_title-15]