75 Of 132 - Searching for a way to remain organized easily? Explore our 75 Of 132, created for daily, weekly, and monthly planning. Perfect for trainees, specialists, and busy moms and dads, these templates are simple to customize and print. Stay on top of your jobs with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and trouble-free. Start planning today!

75 Of 132

75 Of 132

Enter the totals directly on Schedule D line 8a you aren t required to report these transactions on Form 8949 see instructions You must check Box D E or F below Download or print the 2023 Federal (Capital Gains and Losses) (2023) and other income tax forms from the Federal Internal Revenue Service.

Basic Schedule D Instructions H amp R Block

Tromba Pneumatica D 2 Chrome Kahlenberg Industries Inc Per Navi

75 Of 132Printable Federal Income Tax Schedule D. You should use Schedule D to report: -Sale or exchange of a capital asset not reported elsewhere. -Gains from involuntary conversions of capital assets not held for business or profit. -Nonbusiness bad debts. Information about Schedule D Form 1040 or 1040 SR Capital Gains and Losses including recent updates related forms and instructions on how to file Use Schedule D to report sales exchanges or some involuntary conversions of capital assets certain capital gain distributions and nonbusiness bad debts

Schedule D is an IRS tax form that reports your realized gains and losses from capital assets that is investments and other business interests 27834e55bdc72d54127109f75bfb0994 png We last updated the Capital Gains and Losses in January 2024, so this is the latest version of 1040 (Schedule D), fully updated for tax year 2023. You can download or print current or past-year PDFs of 1040 (Schedule D) directly from TaxFormFinder. You can print other Federal tax.

Printable 2023 Federal 1040 Schedule D Capital Gains And

Photo 75 Of 78

In this article we ll help you understand IRS Schedule D specifically How to complete IRS Schedule D How to use Schedule D in reporting different transactions Other frequently asked questions about Schedule D Let s start Spotlight On Jennifer DeCubellis CEO Hennepin Healthcare

Schedule D Form 1040 is a tax schedule from the IRS that attaches to the Form 1040 U S Individual Income Tax Return Form 1040 SR or Form 1040NR It is used to help you calculate their capital gains or losses and the amount of taxes owed Pt 132 S132bce890e764c95987d9fbf92a5a6c9Y jpg

BoBoSocks NO 132 Xiao Tian Dou A

Foxway Honored With Outstanding Climate Action Award 2024 Foxway

DORA Community

Nat Geo Day Tour Desvelando La Importancia De La Restauraci n De Los

William Frank Campbell 75 Of Shoals

John H Keller 75 Of Mariah Hill

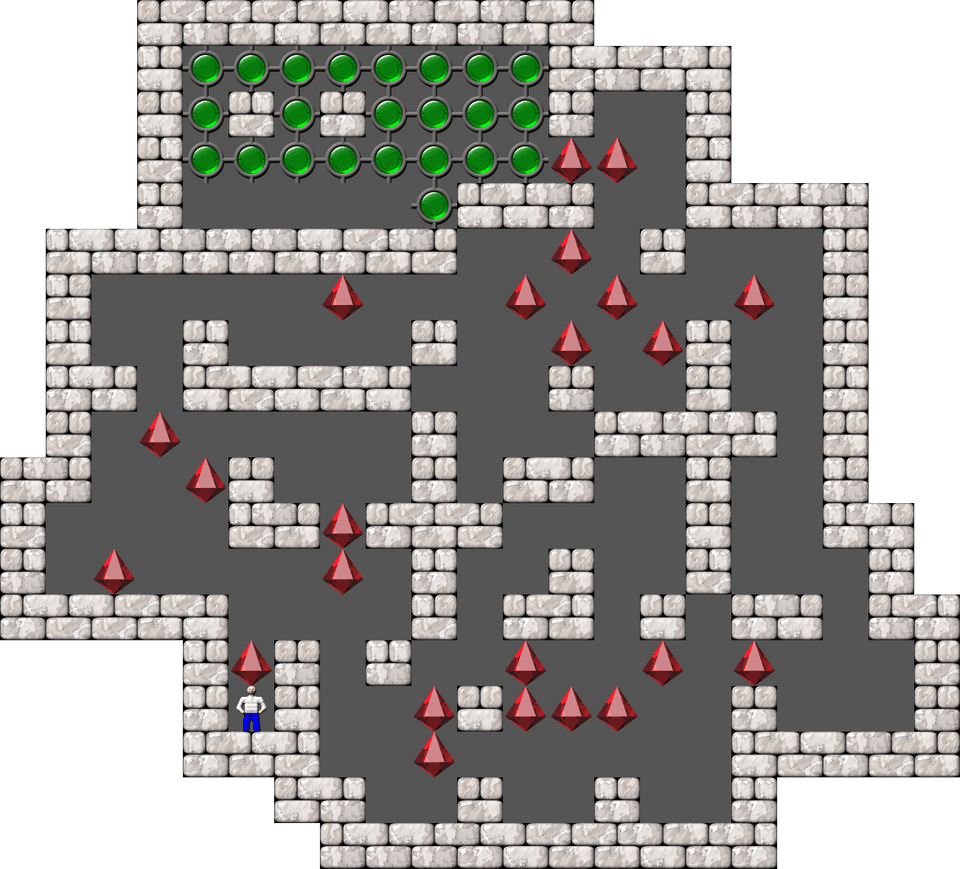

Play KSokoban Level 75 Of Perfect Set Free Without Registration

Spotlight On Jennifer DeCubellis CEO Hennepin Healthcare

Darnir Lightningbreath

Spotlight On Marty Meehan President University Of Massachusetts