512 Divided By 49 - Trying to find a way to remain organized effortlessly? Explore our 512 Divided By 49, created for daily, weekly, and monthly preparation. Perfect for students, specialists, and busy moms and dads, these templates are easy to personalize and print. Remain on top of your tasks with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and trouble-free. Start planning today!

512 Divided By 49

512 Divided By 49

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity Download or print the 2023 Federal 1040 (Schedule C) (Profit or Loss from Business (Sole Proprietorship)) for FREE from the Federal Internal Revenue Service.

What Is Schedule C Form 1040 H amp R Block

The Remainder Obtained When 1 2 49 Is Divided By 20 Is

512 Divided By 49Maximize your business deductions and accurately calculate your profit or loss with Federal Form 1040 Schedule C. Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file

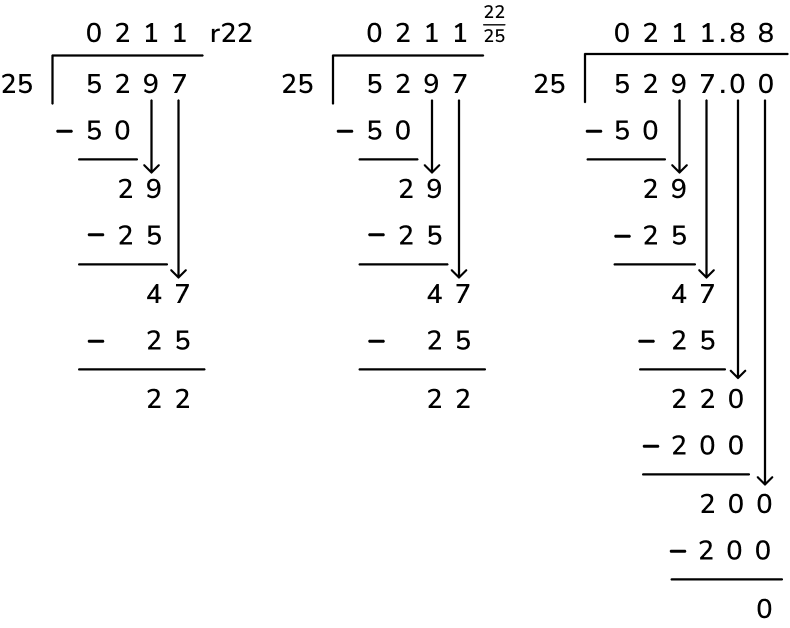

Sole owner of an LLC Business owner with your spouse In a nutshell if you earn income that isn t reported on a W 2 you don t have a business partner and your business isn t incorporated or treated as a corporation for tax purposes Schedule C is for you What Is 512 Divided By 3 Using Long Division · IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is.

Federal 1040 Schedule C Profit Or Loss From Business Sole

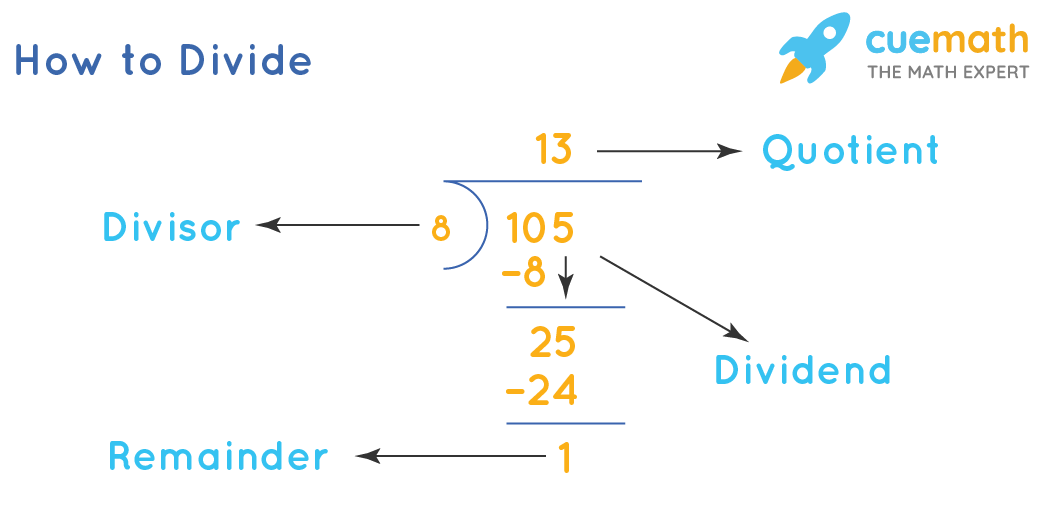

What Is Division With Remainders Explained For Primary School

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if 1940

You can find and download all versions of Schedule C on the IRS website You can also use H R Block Online to access Schedule C and complete your tax return Or if you work with a tax preparer they will help you access and complete Schedule C 5 Divided By 100 XRP Buyback Proposal Sparks Feud Between Terrett And Vallee

512 Divided By 2 Divide Kaise Karte Hain Bhag Karna Sikhe in Hindi

Inicio Cedva Grupo Cedva

Evaluate Cube Root Of 0 512 Divided By Cube Root Of 0 000343 Very

Solve This Using Long Division Brainly

Most Influential Database Papers Ryan Marcus

EcoFlow River 2 Max Review Tom Antos Films

File 22 Divided By 7 Circle png Wikimedia Commons

1940

Trump Media Stock Plummet Former President s Company Loses 2 Billion

The Saints Come Marching In A Musical Pilgrimage To Red Rocks With