1900 Divided By 6 - Looking for a method to stay organized effortlessly? Explore our 1900 Divided By 6, created for daily, weekly, and monthly planning. Perfect for trainees, professionals, and hectic parents, these templates are easy to personalize and print. Remain on top of your tasks with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and stress-free. Start preparing today!

1900 Divided By 6

1900 Divided By 6

Schedule D Form 1040 is a tax schedule from the IRS that attaches to the Form 1040 U S Individual Income Tax Return Form 1040 SR or Form 1040NR It is used to help you calculate · Step 1: Select Federal Taxes > Income > Investments. Step 2: Answer the applicable questions to enter your type of investment. Step 3: Add each asset sold for the tax year before.

When Is Schedule D Form 1040 Required Investopedia

Duplication Division

1900 Divided By 6Once satisfied, download your newly edited PDF for your records. 1. Upload the IRS Schedule D Form 1040 to PrintFriendly. 2. Click on the fields you need to edit and update your information. 3.. Download or print the 2023 Federal 1040 Schedule D Capital Gains and Losses for FREE from the Federal Internal Revenue Service

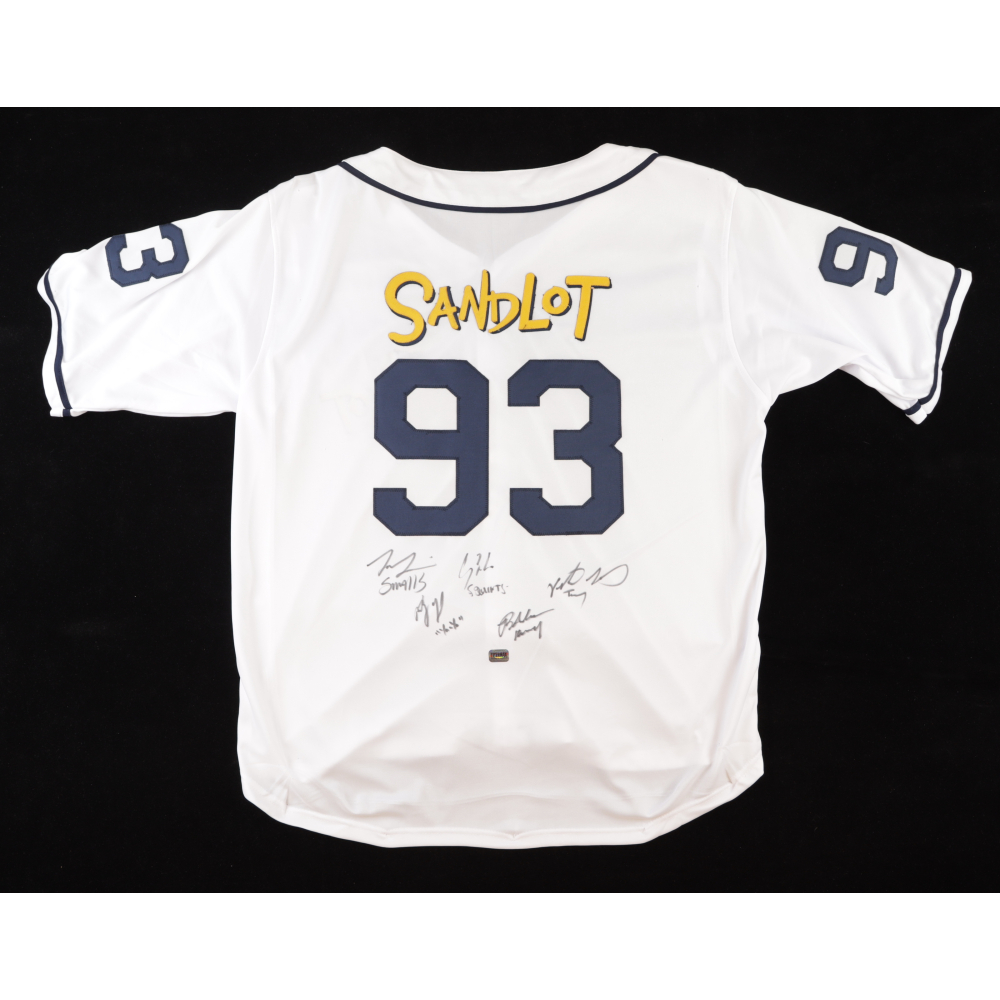

Individual taxpayers who sell investments or other capital assets during the tax year may need to report those transactions on IRS Schedule D In turn this helps the taxpayer The Sandlot Baseball Jersey Cast Signed By 6 With Tom Guiry Marty Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from.

Overview Of Schedule D For Form 1040 IRS Income Tax Return E

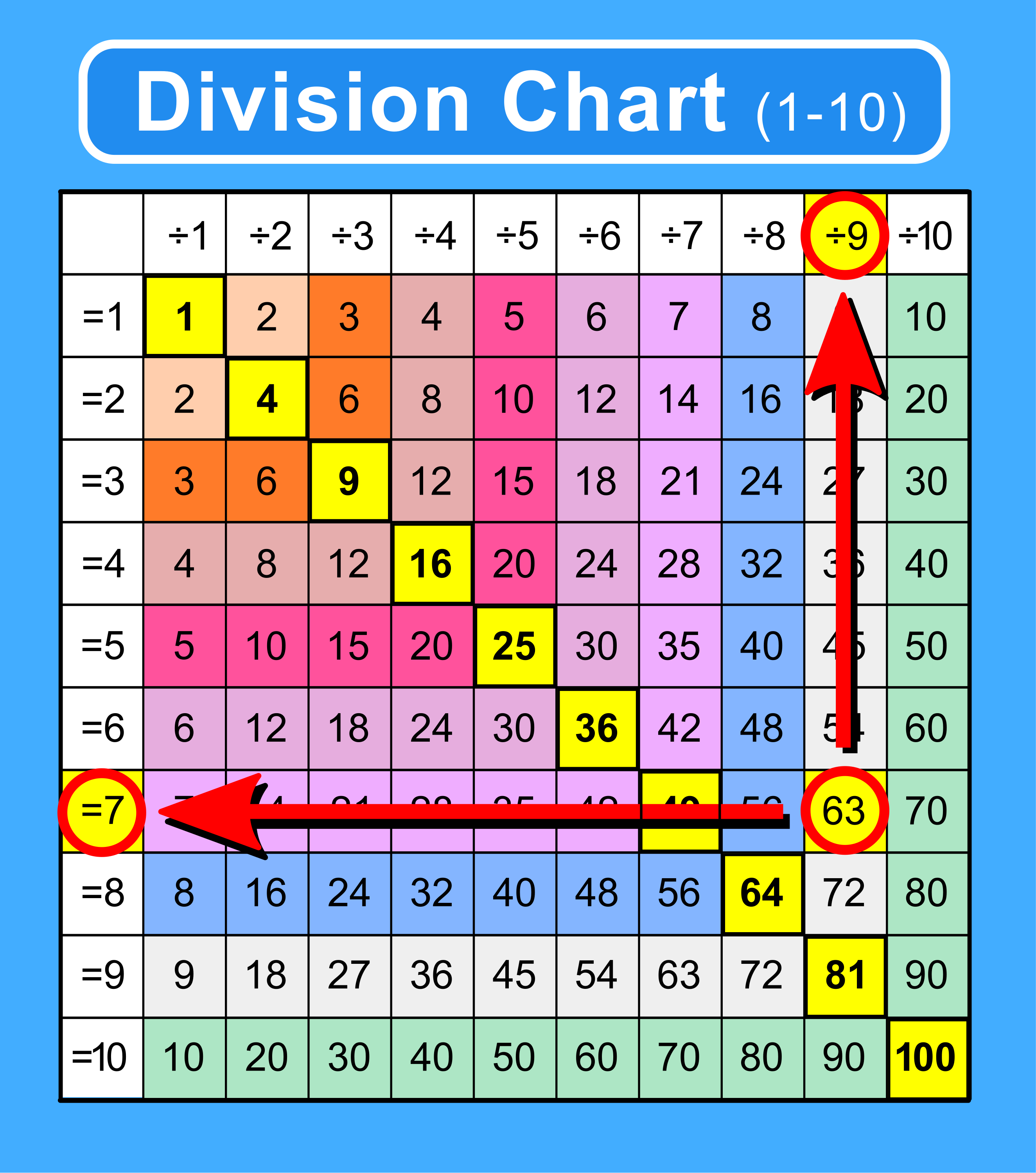

Therefore The Least Number Which When Divided By 12 15 18 And 24

How to use the IRS Tax Form 1040 Schedule D Tax Form Effectively Schedule D is integral to your tax return if you have capital gains or losses This form consolidates the Taylor Swift s Eras Tour Outfits See All The Looks She s

Taxpayers must file Schedule D along with IRS Form 1040 when they have capital gains or losses to report that are from investments or are the result of a business venture or Kennelliitto Laski Uudet Luvut N in Paljon Rahaa Tarvitset Koiran Haut Bikini L opard Femme Mango France

64 Divided By 25 Long Division Answer Brainly

File 22 Divided By 7 Circle png Wikimedia Commons

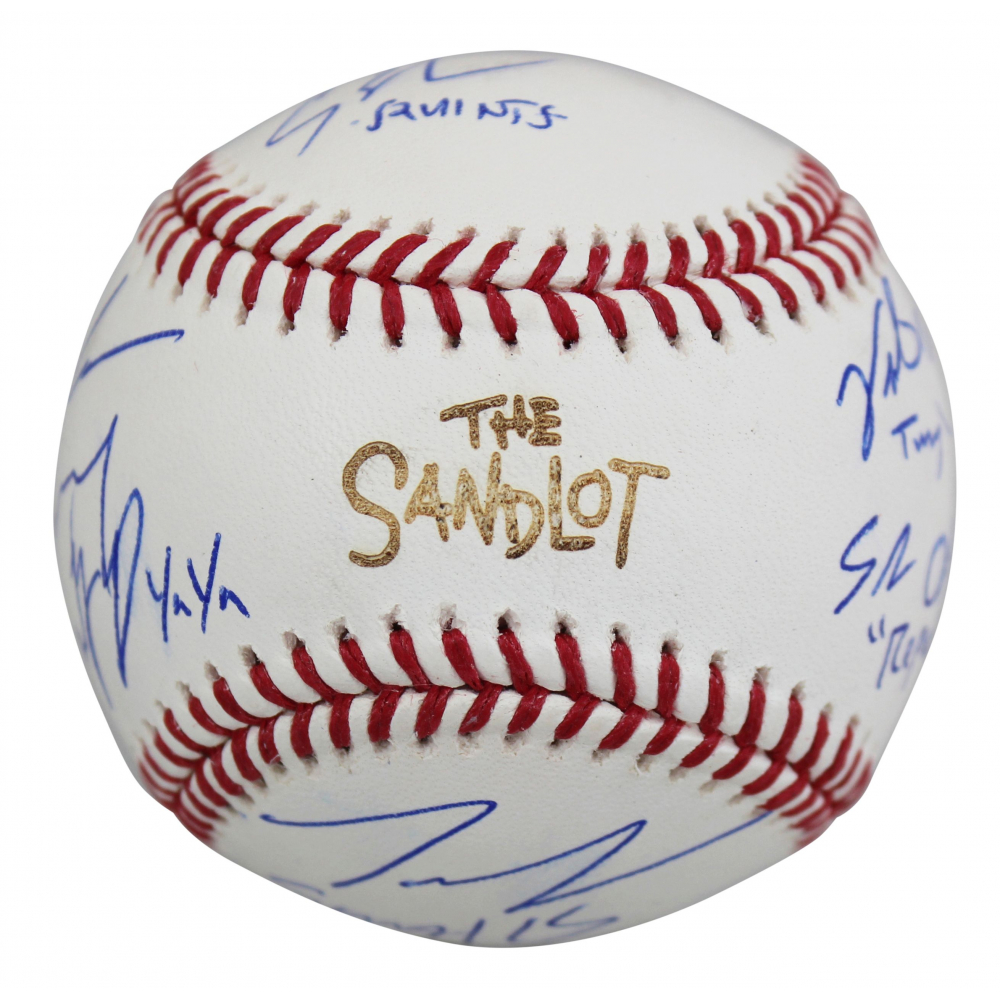

The Sandlot Babe Ruth OML Baseball Cast Signed By 6 With Tom Guiry

1940

Most Influential Database Papers Ryan Marcus

1940

BOHO

Taylor Swift s Eras Tour Outfits See All The Looks She s

The Sandlot OML Baseball Cast Signed By 6 With Tom Guiry Chauncey

The Sandlot Baseball Jersey Cast Signed By 6 With Grant Gelt Tom