X 4 2x 3 8x 2 12x 16 - Looking for a way to remain organized effortlessly? Explore our X 4 2x 3 8x 2 12x 16, created for daily, weekly, and monthly preparation. Perfect for trainees, specialists, and hectic parents, these templates are easy to tailor and print. Remain on top of your tasks with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and stress-free. Start planning today!

X 4 2x 3 8x 2 12x 16

X 4 2x 3 8x 2 12x 16

Download or print the 2023 Federal Capital Gains and Losses 2023 and other income tax forms from the Federal Internal Revenue Service These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Use Schedule D: To figure the overall.

IRS Schedule D Instructions Capital Gains And Losses

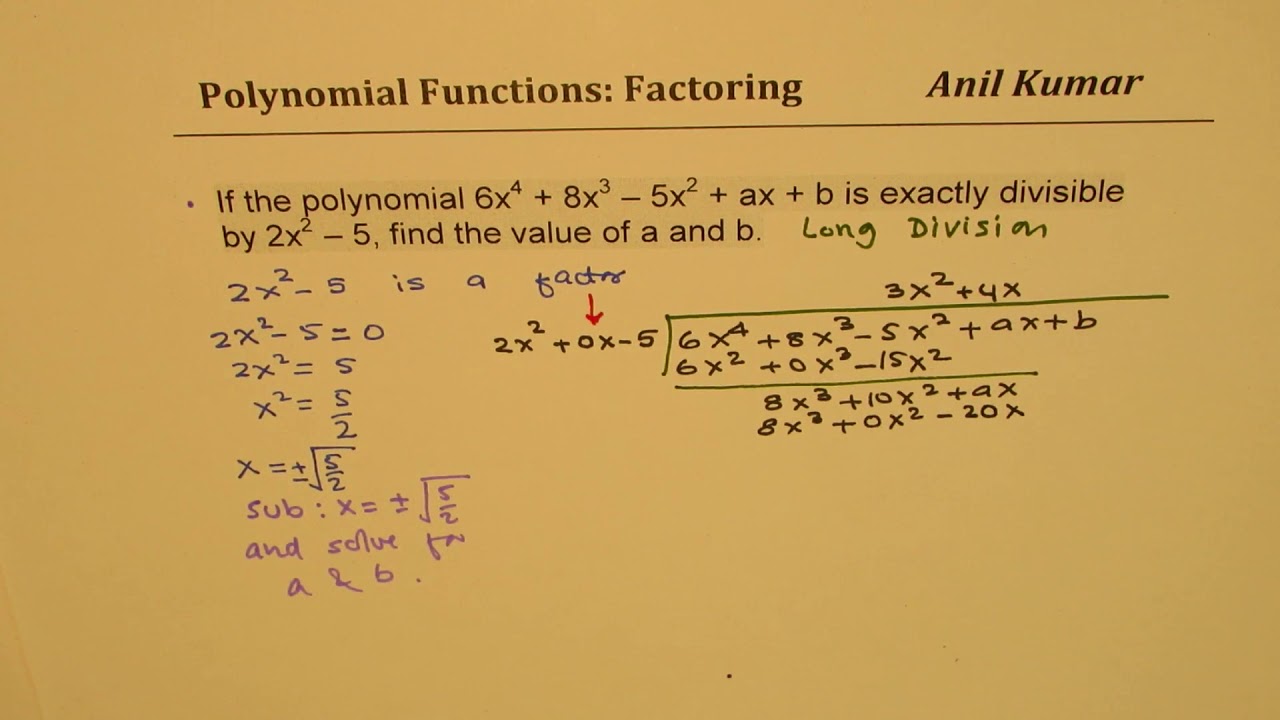

Find A And B If 2x 2 5 Is Factor Of 6x 4 8x 3 5x 2 ax b CBSE 10 MHF4U

X 4 2x 3 8x 2 12x 16Printable Federal Income Tax Schedule D. You should use Schedule D to report: -Sale or exchange of a capital asset not reported elsewhere. -Gains from involuntary conversions of. Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state s revenue department which will result in either a tax refund of excess

Department of the Treasury Internal Revenue Service Sales and Other Dispositions of Capital Assets Go to www irs gov Form8949 for instructions and the latest information File with your Y X 4 2x 3 8x 2 12x 16 Brainly · For the details on how to fill out each of the forms, visit IRS.gov/forms and search for the form you need by name. You can also search the IRS forms database to find the Schedule D.

2023 Instructions For Schedule D 2023 Internal Revenue Service

Factor Completely 4x 3 8x 2 X 2 YouTube

2023 Instructions for Schedule D Form 1040 The file provides detailed instructions for completing Schedule D which is used for reporting capital gains and losses to the IRS It includes information on various forms filing If The Polynomial X 4 2x 3 8x 2 12x 18 Is Divided By Another Polynomial

How do I complete IRS Schedule D There are three parts to this two page tax form Part I Short Term Capital Gains and Losses Generally Assets Held One Year or Less Part II Long Term Capital Gains and Factorise 4x 2 8x 3 Brainly in If The Polynomial X 4 2x 3 8x 2 12x 18 Is Divided By Anothe Polynomial

Q162 Solve 8x 3 9 2x 8x 3 9 2x YouTube

Find The Derivative Of F x x 3 6x 2 8 x 2 YouTube

What Are The Solutions Of The Quadratic Equation 4x 2 8x 12 0

2x 3 8x 2 4x 12 x 2 4x

2x 3 8x 2 5x 8 X 2 Brainly in

Show That 2x 3 is A Factor Of 2x 3 3x 2 5x 6 And Hence Factorise 2x

Factorise The Given Eqn 2x 2 12x 16 Brainly in

If The Polynomial X 4 2x 3 8x 2 12x 18 Is Divided By Another Polynomial

Factor 8x 2 12x 16 Brainly

Rozwi R wnanie Stosuj c Schemat Hornera tex x 4 3x 3 8x 2