What Times 12 Equals 800 - Looking for a method to stay arranged effortlessly? Explore our What Times 12 Equals 800, designed for daily, weekly, and monthly planning. Perfect for students, specialists, and busy moms and dads, these templates are easy to customize and print. Remain on top of your jobs with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and worry-free. Start preparing today!

What Times 12 Equals 800

What Times 12 Equals 800

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The resulting profit or loss is typically Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if

Printable Federal Schedule C Profit Or Loss From Business Tax

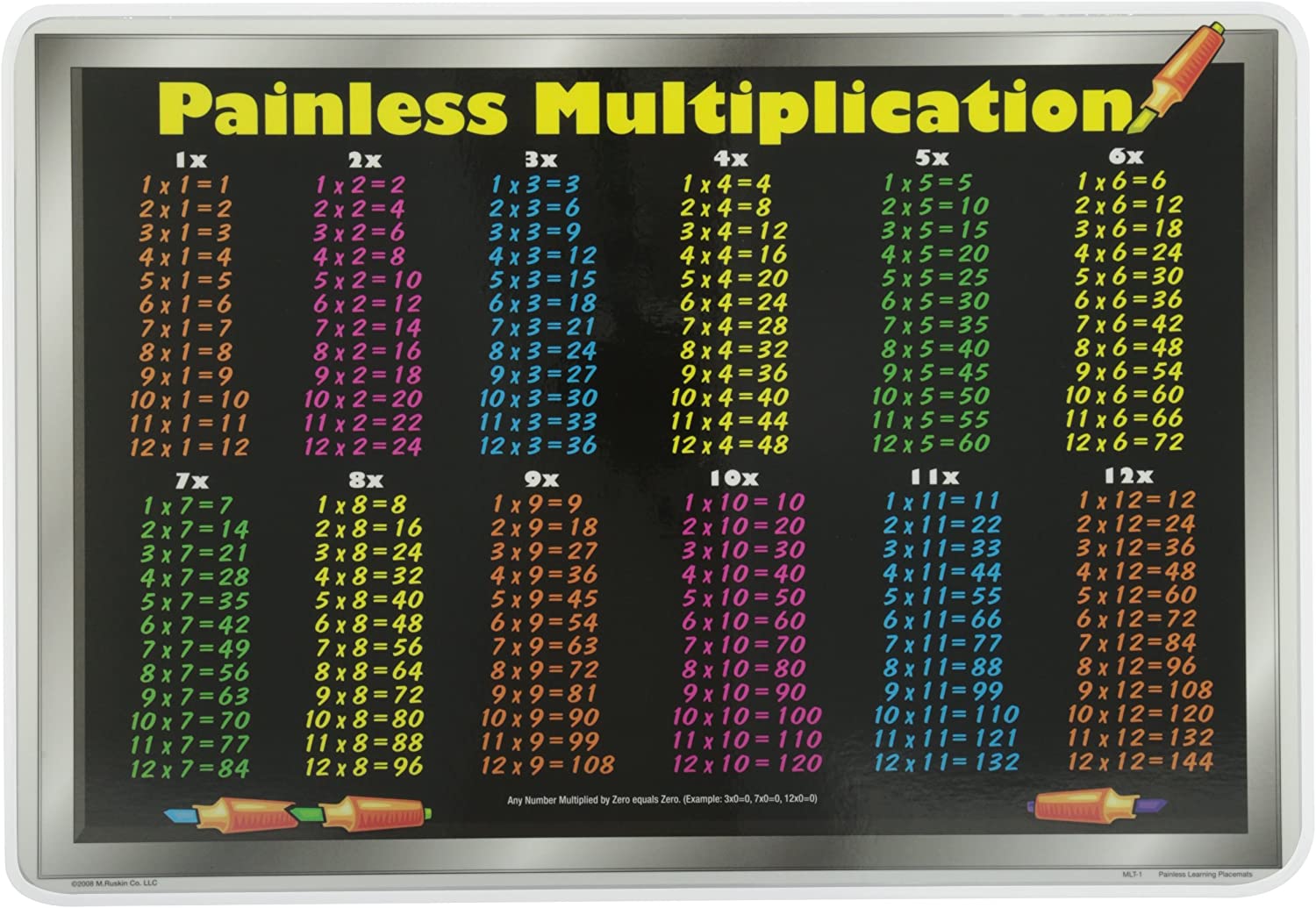

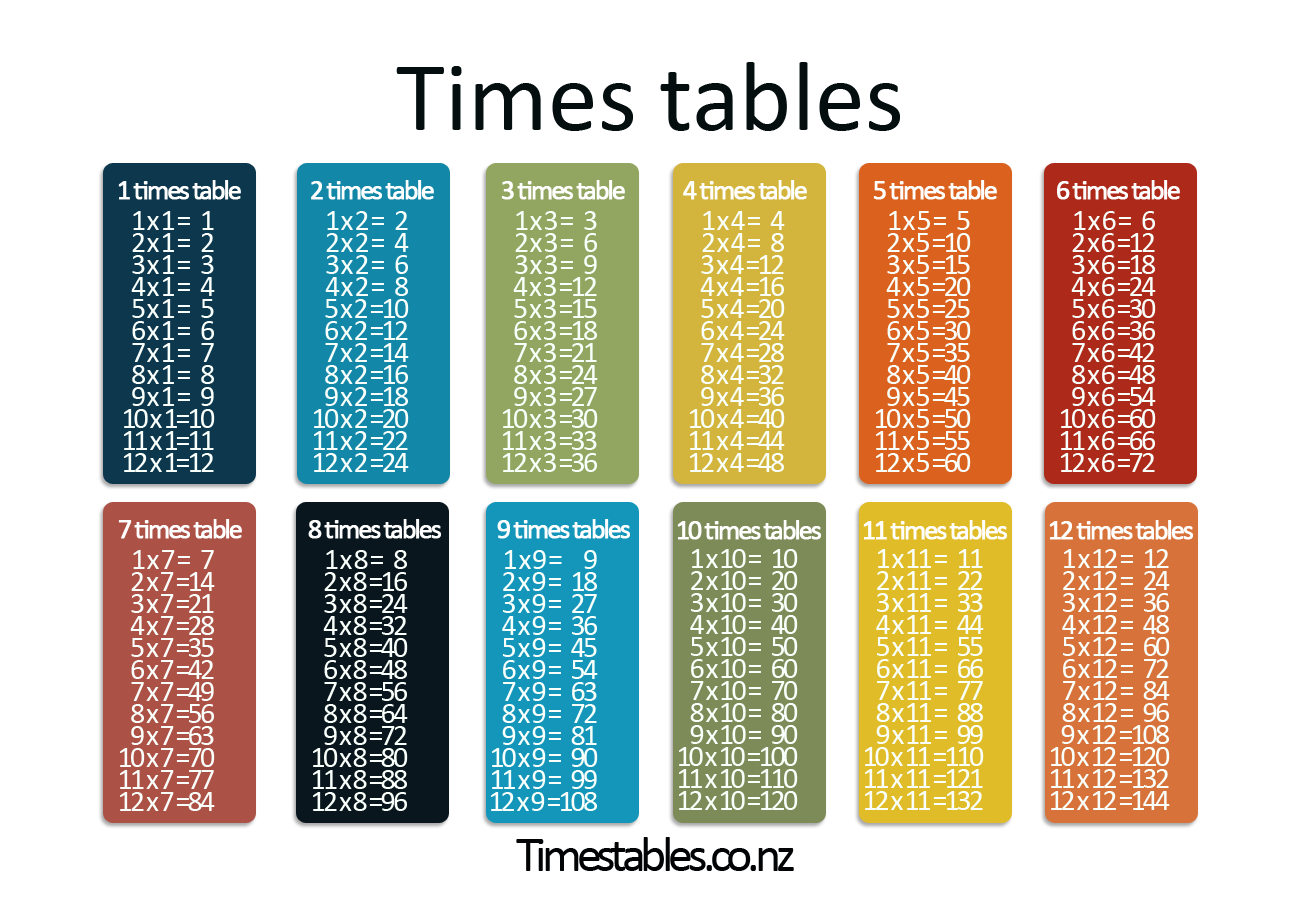

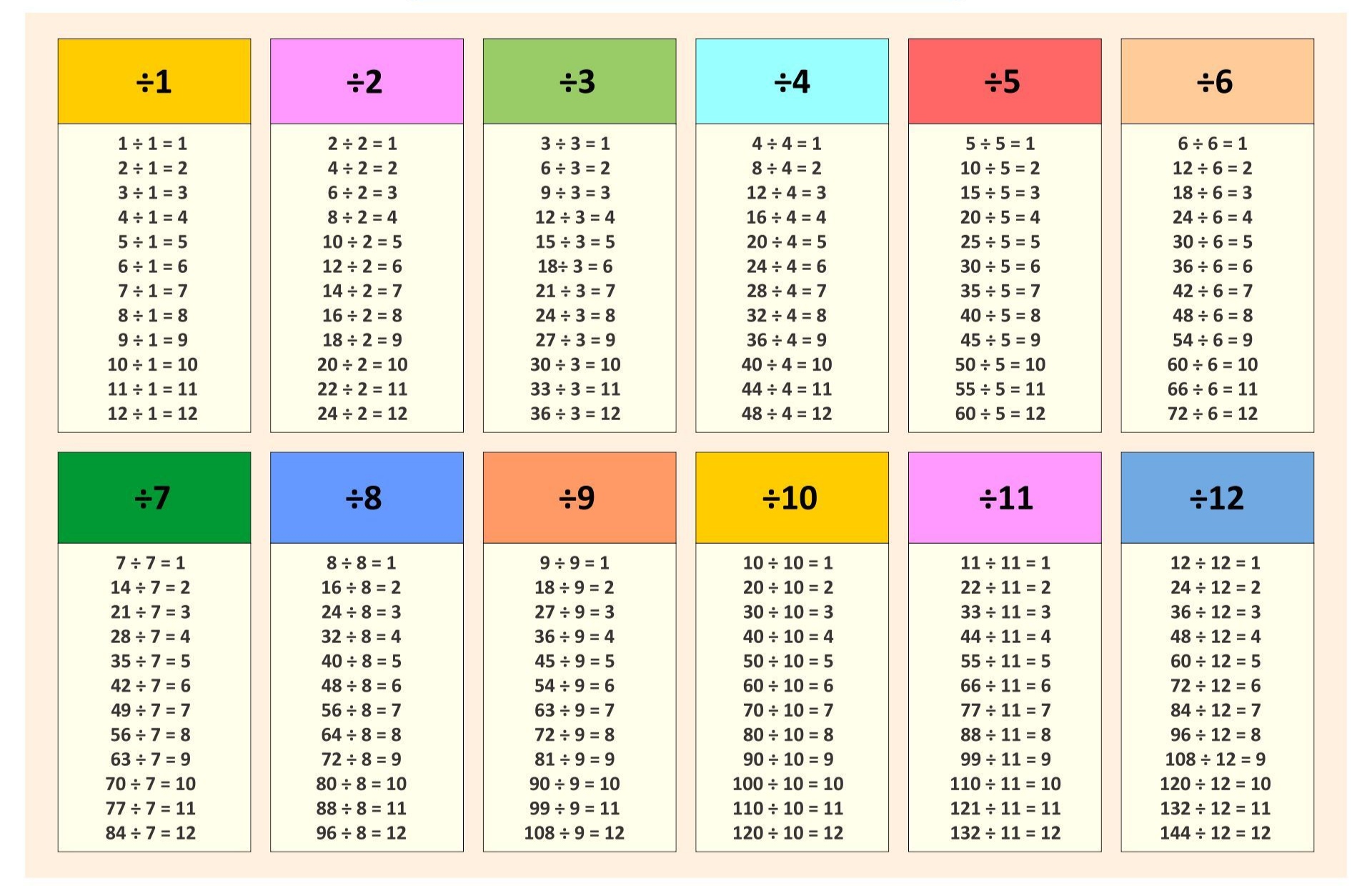

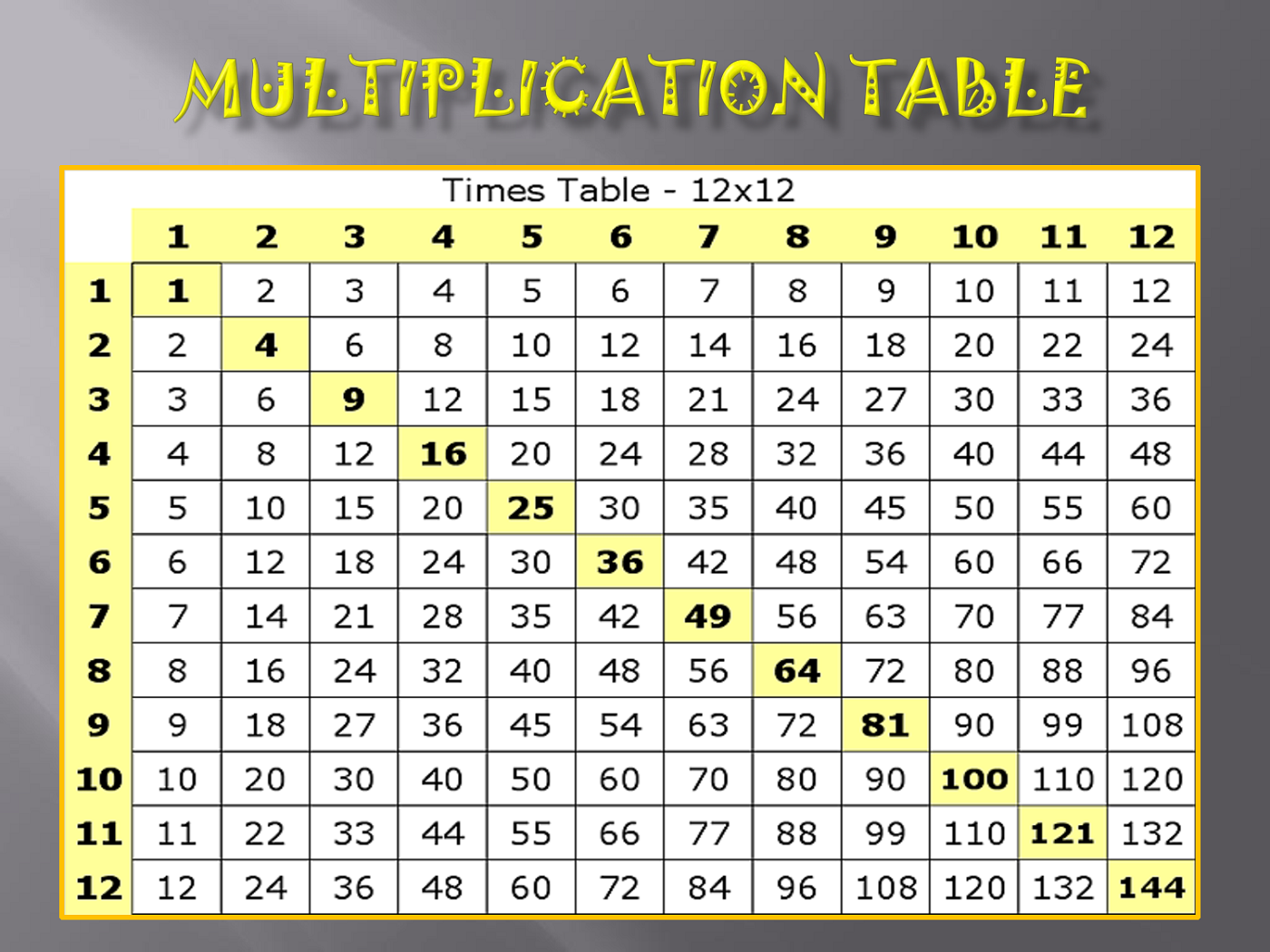

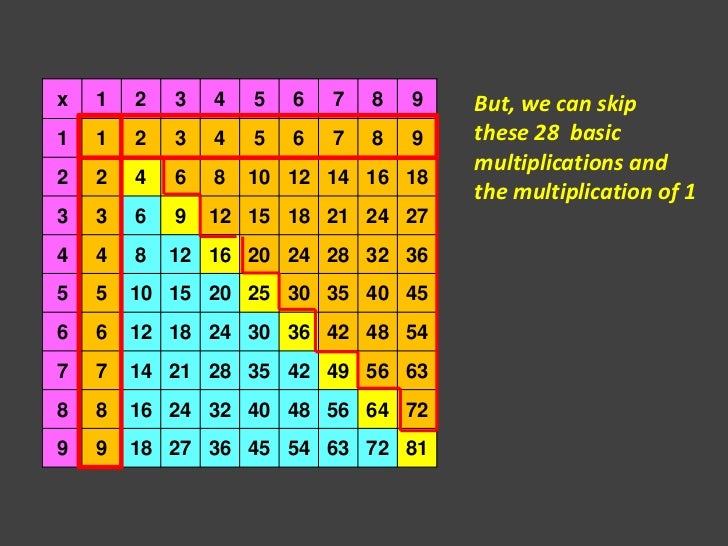

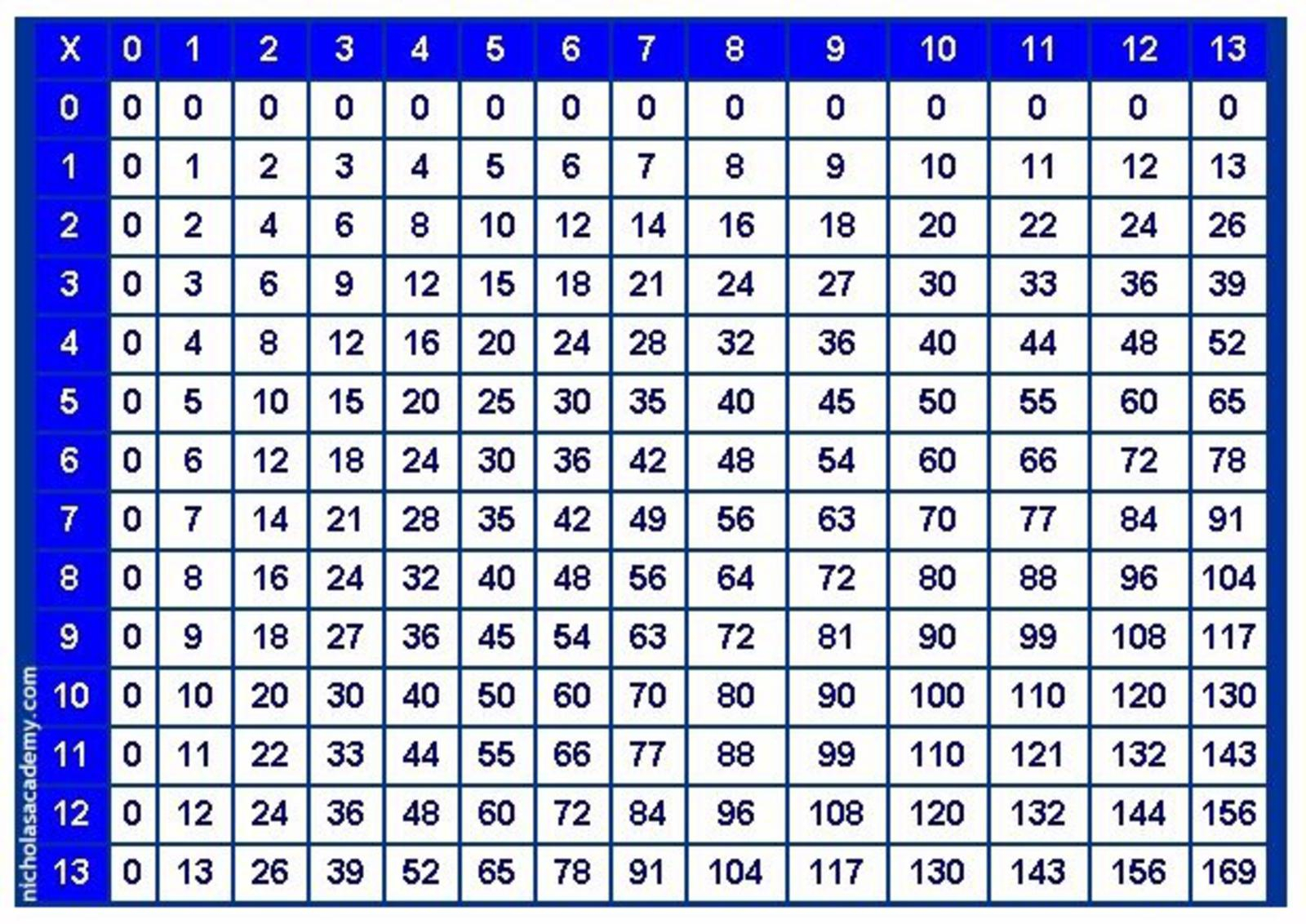

Times Tables Games Learn Them All Here

What Times 12 Equals 800 · Schedule C details all of the income and expenses incurred by your business, and the resulting profit or loss is included on Schedule 1 of Form 1040. The profit or loss is also used on Schedule SE to calculate self-employment. If you re self employed and set up your business as a sole proprietorship not registered as multi member LLC or corporation or single member LLC taxed as a sole proprietorship you should file

This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal What Is 3 Divided By 1 8 · A form Schedule C: Profit or Loss from Business (Sole Proprietorship) is a two-page IRS form for reporting how much money you made or lost working for yourself (hence the sole.

From Business Profit Or Loss Internal Revenue Service

10

SCHEDULE C Form 1040 Profit or Loss From Business Go OMB No 1545 0074 2020 Sole Proprietorship to www irs gov ScheduleC for instructions and the latest information Department What Is 1 3 Of 800

Printable Federal Income Tax Schedule C Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor Small businesses and statutory employees Selena In Purple Outfit Selena In Purple Outfit

Printable Multiply Chart Tables Activity Shelter

Multiplication Chart 64 PrintableMultiplication

What Equals 35 In Multiplication

Printable Multiplication Table 1 15 PrintableMultiplication

What Times What Equals 1000

Multiples De 42 Estudiar

What Times What Equal 36

What Is 1 3 Of 800

What Is 125 Of 12 8

What Times What Equals 10000