What Happens If I Pay Extra On My Home Loan - Searching for a way to stay organized effortlessly? Explore our What Happens If I Pay Extra On My Home Loan, designed for daily, weekly, and monthly planning. Perfect for students, specialists, and hectic parents, these templates are simple to tailor and print. Stay on top of your jobs with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and hassle-free. Start planning today!

What Happens If I Pay Extra On My Home Loan

What Happens If I Pay Extra On My Home Loan

Schedule A is an IRS form used to claim itemized deductions on a tax return Form 1040 See how to fill it out how to itemize tax deductions and helpful tips Form 1040A is the U.S. Federal Individual Income Tax Return. It itemizes allowable deductions in respect to income, rather than standard deductions. They are due each year on April 15 of the.

Get Federal Tax Return Forms And File By Mail USAGov

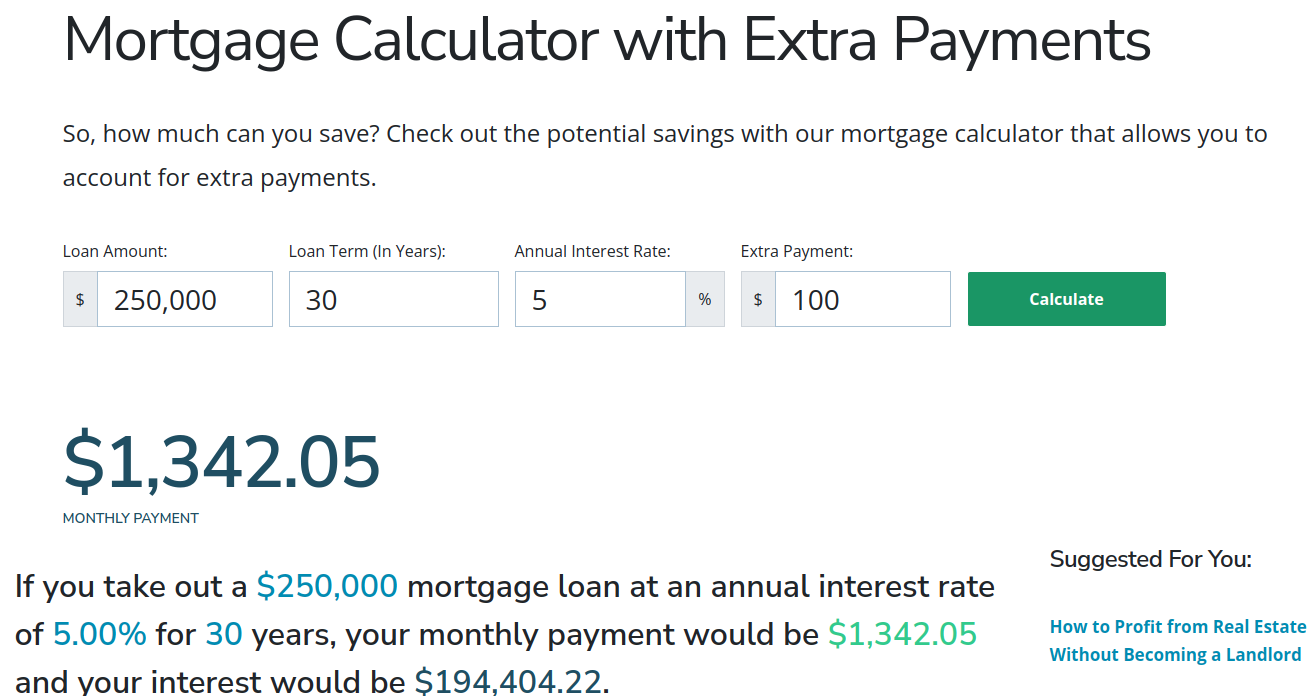

What Happens If I Pay An Extra 100 A Month On My Mortgage Save TONS

What Happens If I Pay Extra On My Home LoanThis is your adjusted gross income . . . . . . . . . . Standard deduction or itemized deductions (from Schedule A) . . . . . . . . . . Qualified business income deduction from Form 8995 or Form 8995. SCHEDULE A Form 1040 Department of the Treasury Internal Revenue Service Itemized Deductions Go to www irs gov ScheduleA for instructions and the latest information Attach to

Learn about IRS Form 1040 the main tax form used to file your individual income tax return See who needs to file filing instructions and the 1040 schedules How To Give Someone Bank Account Details Login Pages Info What is Schedule A? Schedule A is an optional schedule of Form 1040, which is the form U.S. taxpayers use for their personal income tax return. You must fill out Schedule A if you choose to itemize your deductions instead of taking the.

Printable Federal Schedule A Itemized Deductions Tax Rates

What Happens If I Have Negative Money YouTube

Schedule A Itemized Deductions Form 1040 Schedule A is used to report itemized deductions for individuals filing Form 1040 or 1040 SR This form helps taxpayers maximize their deductions on medical expenses property taxes What Happens If I Dont Pay Texas Franchise Tax YouTube

Get federal tax forms for current and prior years Get the current filing year s forms instructions and publications for free from the IRS Download them from IRS gov Order online and have If I Pay Extra On My Car Loan Does It Go To Principal What Happens If I Delete All My Cache YouTube

What Happens If I Screenshot My Ticket YouTube

What Happens If I Pay My Payroll Taxes Late Banks

What Happens If I Delete Images From The Gallery v1 0 74 YouTube

Will My Car Payment Go Down If I Pay Extra YouTube

If I Pay Extra On My Car Loan Does It Go To Principal Loans Canada

What Happens If I Miss The Tax Deadline YouTube

YouTube

What Happens If I Dont Pay Texas Franchise Tax YouTube

How To Pay AT T Bill Online Without Signing In

Mortgage Calculator With Extra Payments