Is Bi Monthly Mortgage Payments Worth It - Trying to find a way to stay organized easily? Explore our Is Bi Monthly Mortgage Payments Worth It, created for daily, weekly, and monthly preparation. Perfect for trainees, experts, and hectic parents, these templates are easy to tailor and print. Stay on top of your jobs with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and hassle-free. Start preparing today!

Is Bi Monthly Mortgage Payments Worth It

Is Bi Monthly Mortgage Payments Worth It

Maximize your business deductions and accurately calculate your profit or loss with Federal Form 1040 Schedule C · You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is typically for people who operate sole proprietorships or single-member LLCs.

How To Fill Out Your Schedule C Perfectly With

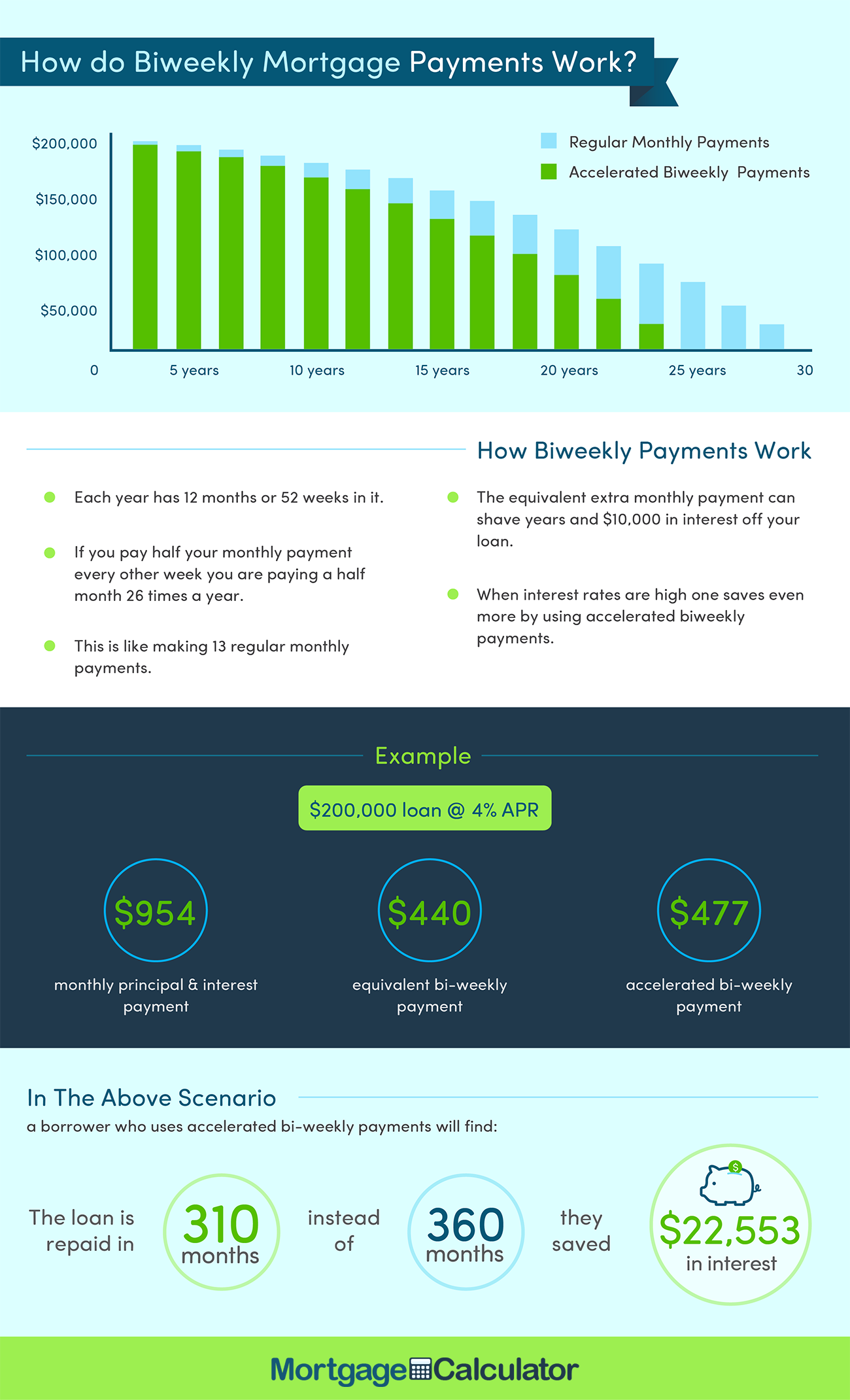

Bi Monthly Mortgage Payments VS Bi Weekly Mortgage Payments How To

Is Bi Monthly Mortgage Payments Worth It · Schedule C is for business owners to report their income for tax purposes. Complete the form, adding information and doing the calculations as you go. This process will give you a net income or loss amount for your business. A form Schedule C Profit or Loss from Business Sole Proprietorship is a two page IRS form for reporting how much money you made or lost working for yourself hence the sole proprietorship In other words it s where you report

Schedule C is a tax form for reporting income and expenses from a business or profession Learn who must file Schedule C what information to include and how to calculate 38 Mortgage Bi Weekly Payment Calculator TobySkaiste Schedule C: Profit or Loss from Business reports how much money you made or lost in a business you operated as a gig worker, freelancer, small business owner, or consultant in certain business structures.

Schedule C What It Is Who Has To File NerdWallet

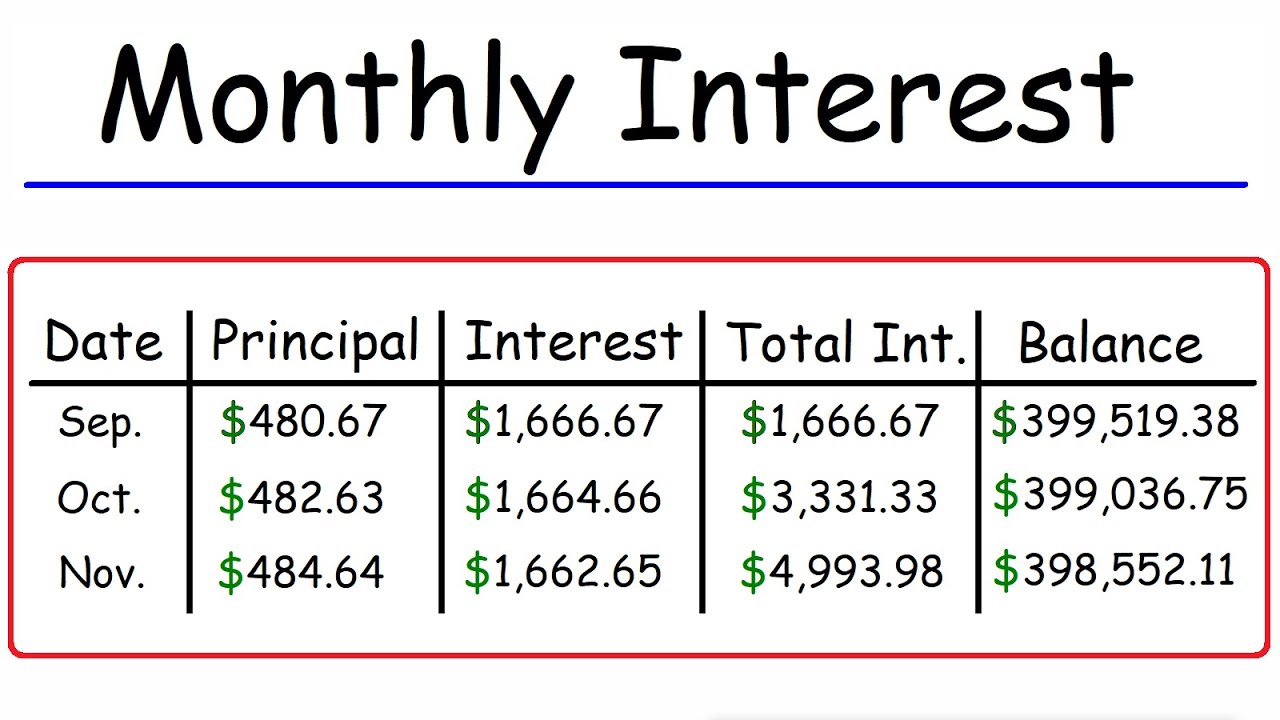

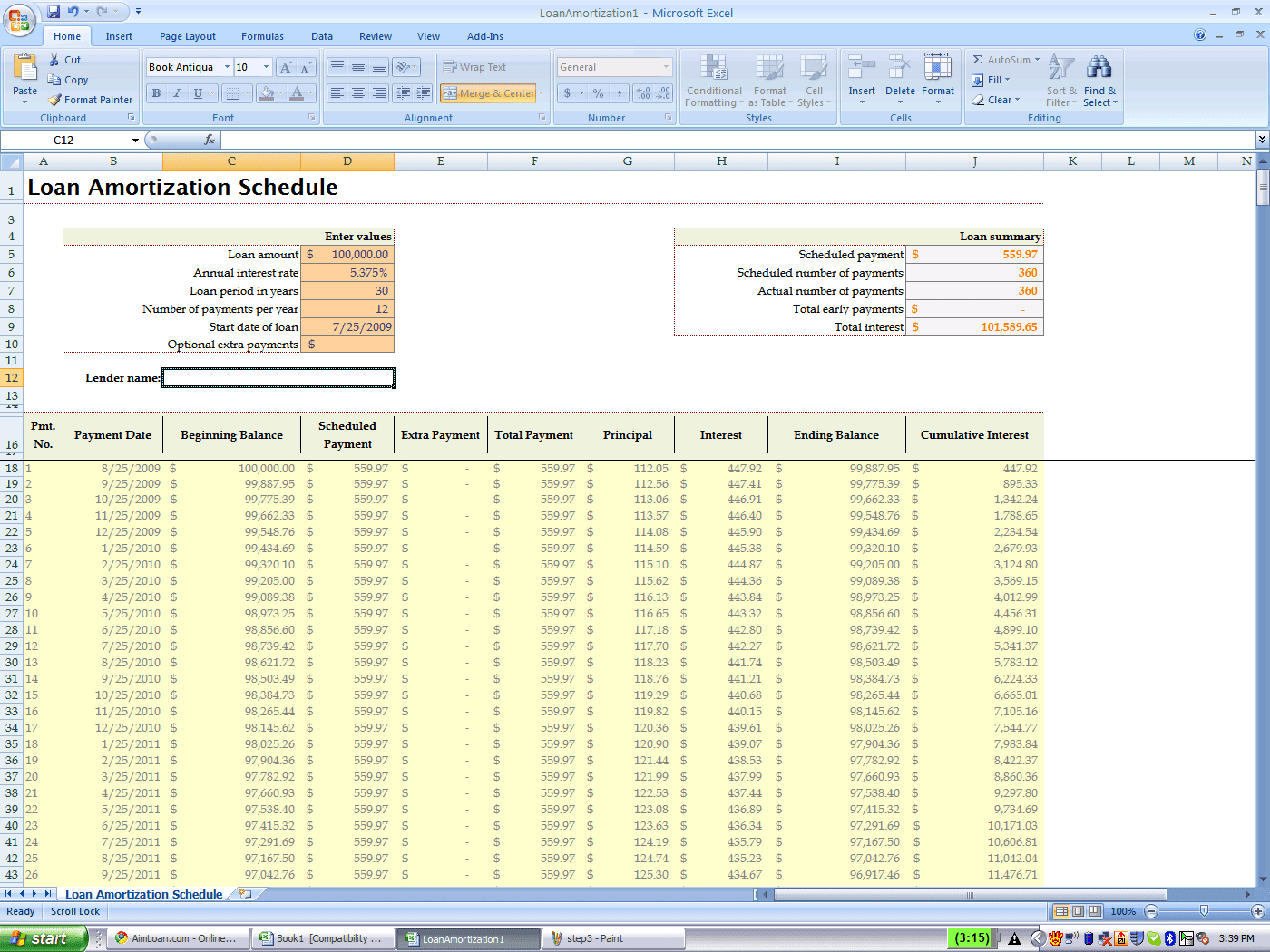

How To Calculate The Monthly Interest And Principal On A Mortgage Loan

A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor Known as a Profit or Loss From Business form it is used to provide information about Pay Periods Semi Monthly 2024 Lynn Nonnah

Anyone earning income outside of a W 2 such as freelancers gig workers and sole proprietors needs to fill out this form The guide provides step by step instructions on completing Schedule C including how to report income Mortgage Rates August 20 2024 Chart Gene Peggie Virginia Dhrm 2025 Pay And Holiday Calendar Lola Reese

Loan Payoff Deals Schedule 15

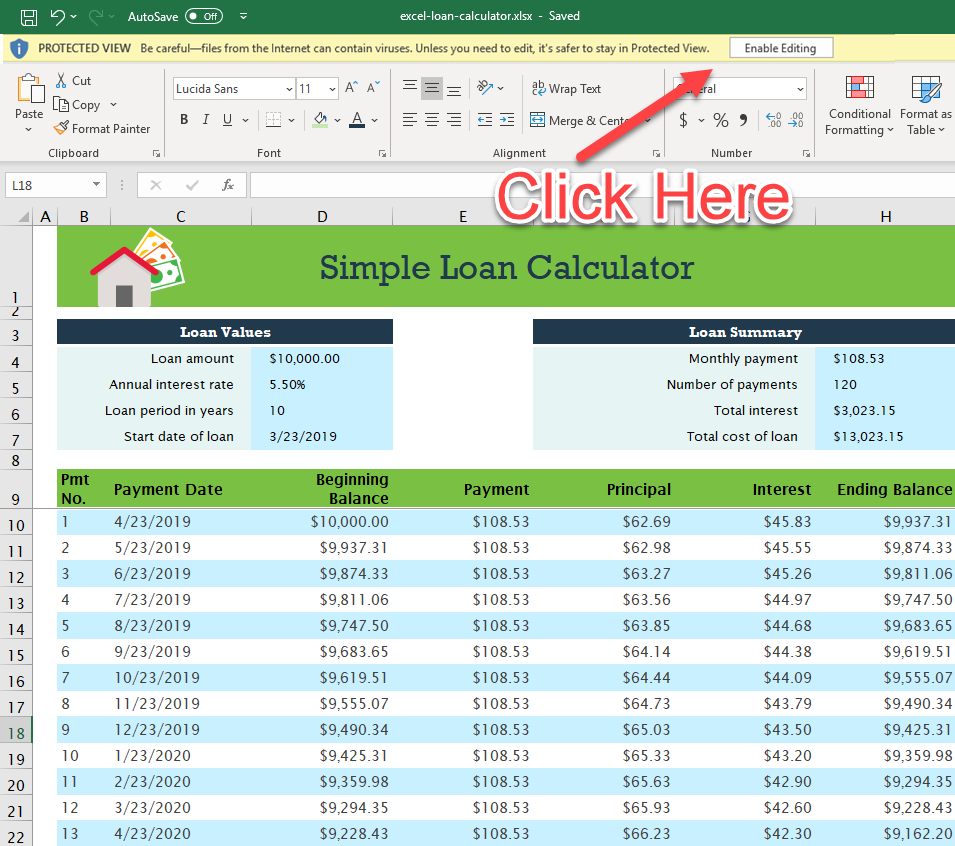

Download Microsoft Excel Mortgage Calculator Spreadsheet XLSX Excel

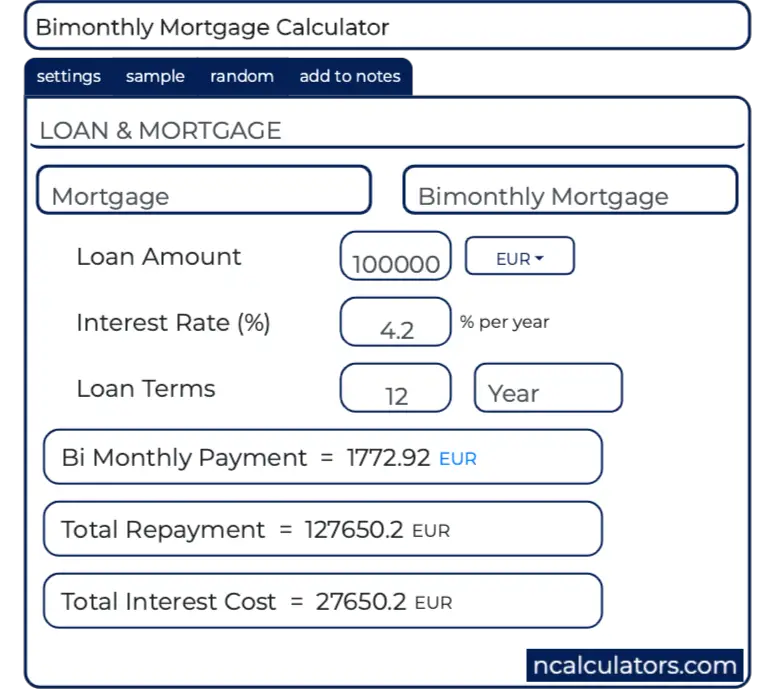

Bimonthly Mortgage Calculator

Bi weekly Loan Calculator Biweekly Payment Savings Calculator

Home Interest Rates 2025 Today Online Ruby Arwa

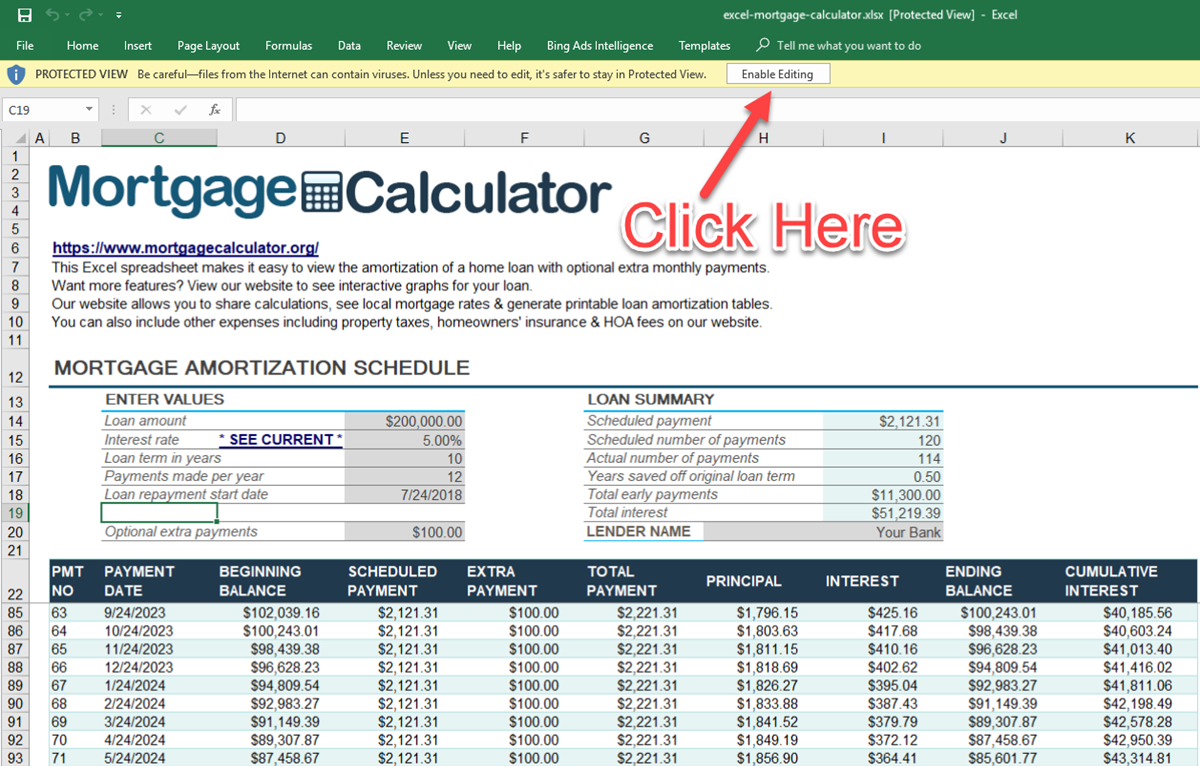

Mortgage Spreadsheet Template Excelxo

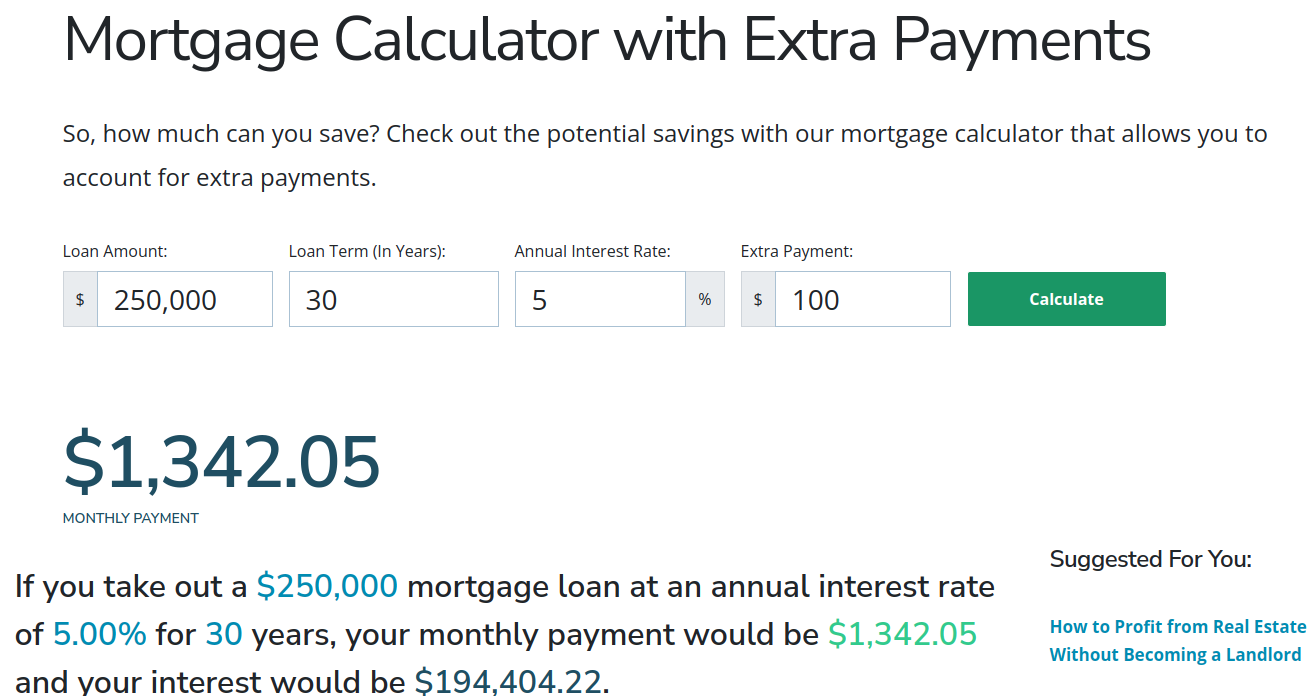

Mortgage Calculator With Extra Payments

Pay Periods Semi Monthly 2024 Lynn Nonnah

Bi Weekly Salary Job Comparison

How To Calculate Annuity Payments 8 Steps with Pictures