How To Write An Improper Fraction On A Number Line - Trying to find a way to remain arranged easily? Explore our How To Write An Improper Fraction On A Number Line, created for daily, weekly, and monthly preparation. Perfect for students, professionals, and busy parents, these templates are easy to personalize and print. Stay on top of your jobs with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and stress-free. Start planning today!

How To Write An Improper Fraction On A Number Line

How To Write An Improper Fraction On A Number Line

Download or print the 2023 Federal 1040 Schedule C Profit or Loss from Business Sole Proprietorship for FREE from the Federal Internal Revenue Service A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor. Known as a Profit or Loss From Business form, it is used to provide information about.

Tax Form 1040 Schedule C Calculator Profit Or Loss From Business

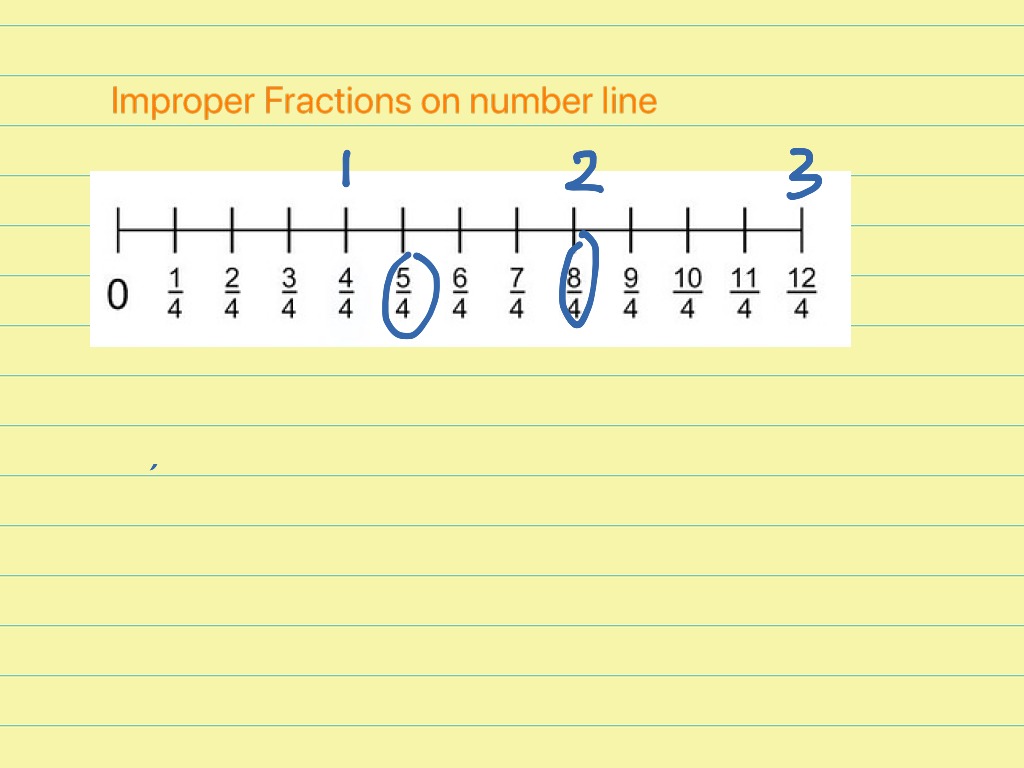

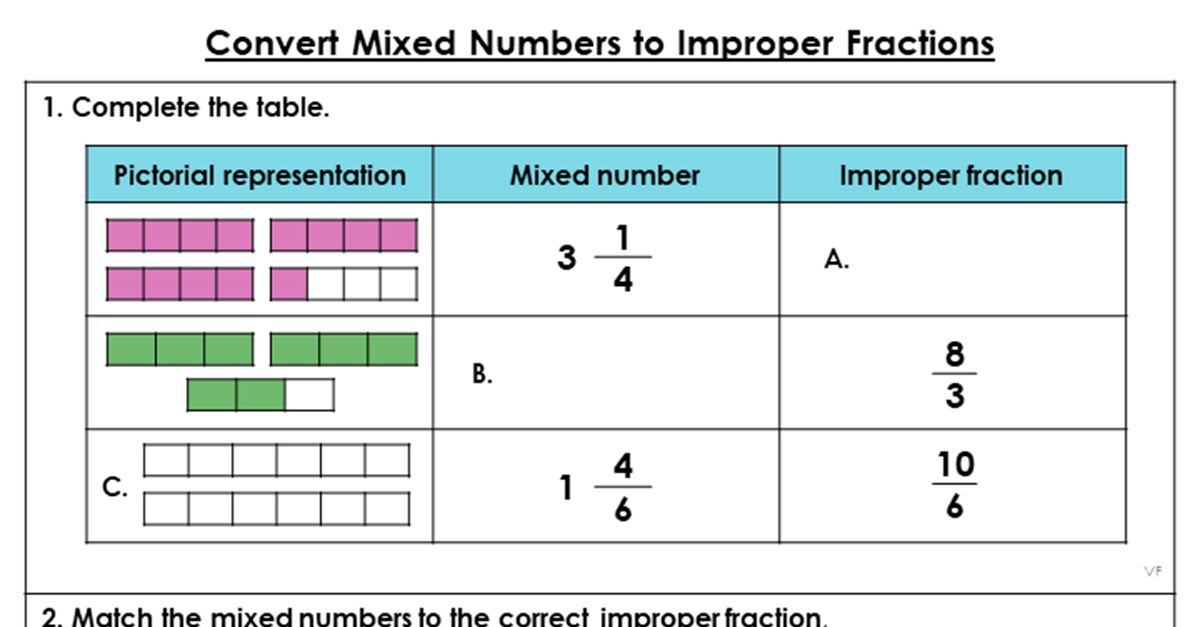

Improper Fractions On Number Line Math Elementary Math Fractions

How To Write An Improper Fraction On A Number LineDownload or print the 2023 Federal (Profit or Loss from Business (Sole Proprietorship)) (2023) and other income tax forms from the Federal Internal Revenue Service. Maximize your business deductions and accurately calculate your profit or loss with Federal Form 1040 Schedule C

SCHEDULE C Form 1040 Profit or Loss From Business Go OMB No 1545 0074 2020 Sole Proprietorship to www irs gov ScheduleC for instructions and the latest information Department Adding Mixed Fractions Printable Federal Income Tax Schedule C. Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor. Small businesses and statutory employees.

Schedule C Form 1040 Fillable Form amp PDF Sample FormSwift

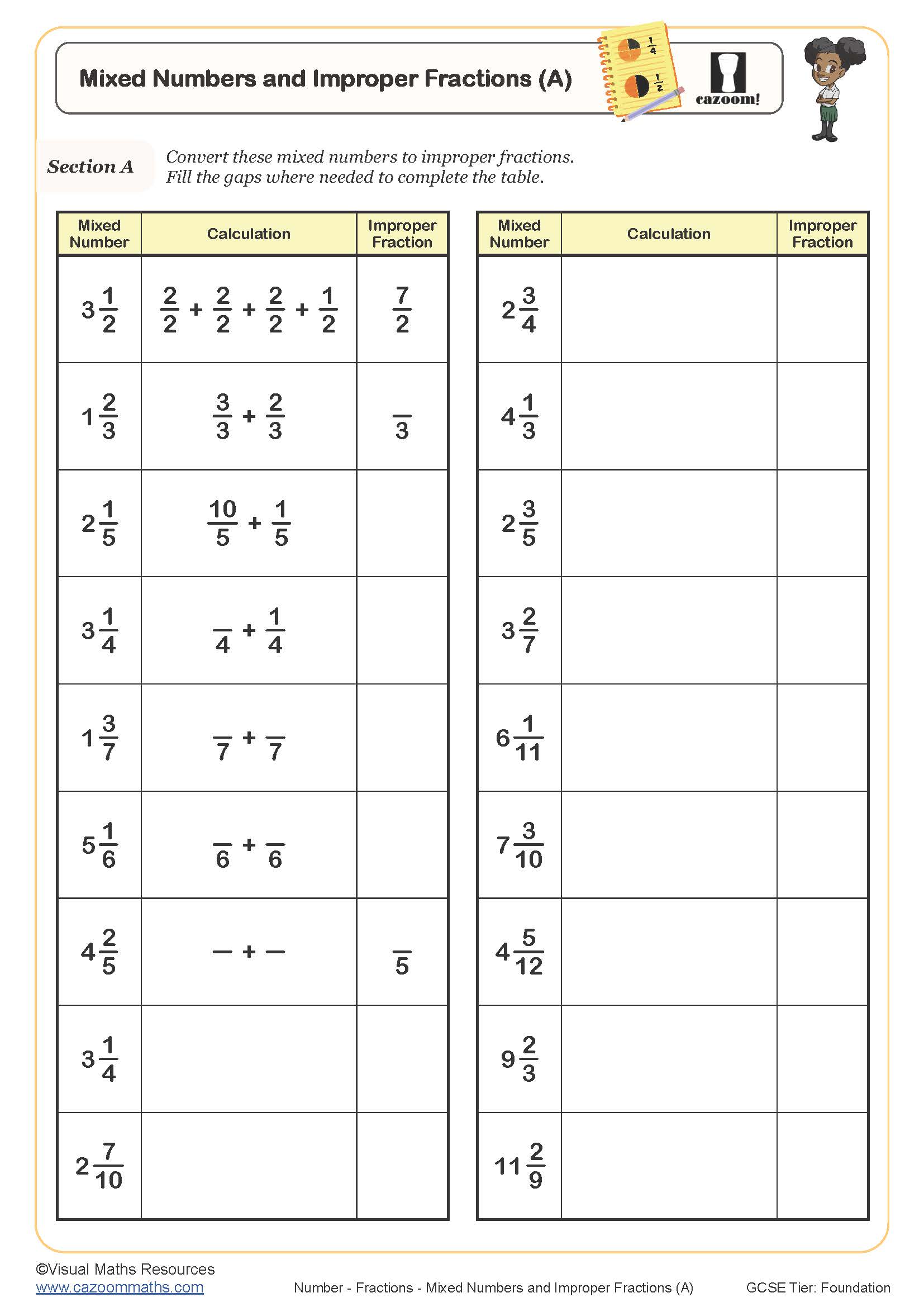

Worksheet On Changing Fractions Improper Fraction To A Whole Or

A form Schedule C Profit or Loss from Business Sole Proprietorship is a two page IRS form for reporting how much money you made or lost working for yourself hence the sole How To Reduce A Improper Fraction Heartpolicy6

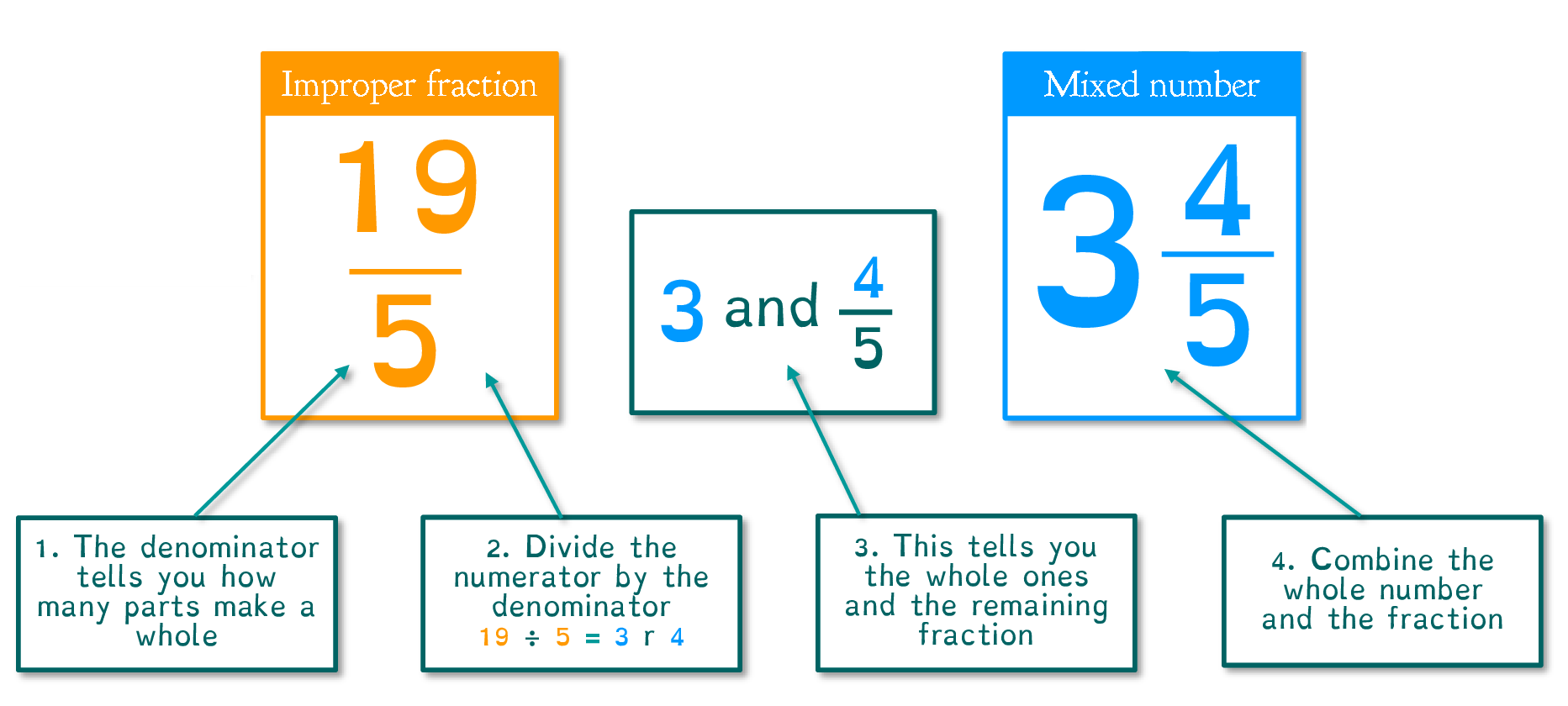

Form 1040 Schedule C Profit or Loss From Business Use Tax Form 1040 Schedule C Profit or Loss From Business as a stand alone tax form calculator to quickly calculate specific amounts for your Improper Fraction Examples Really Improper Fraction

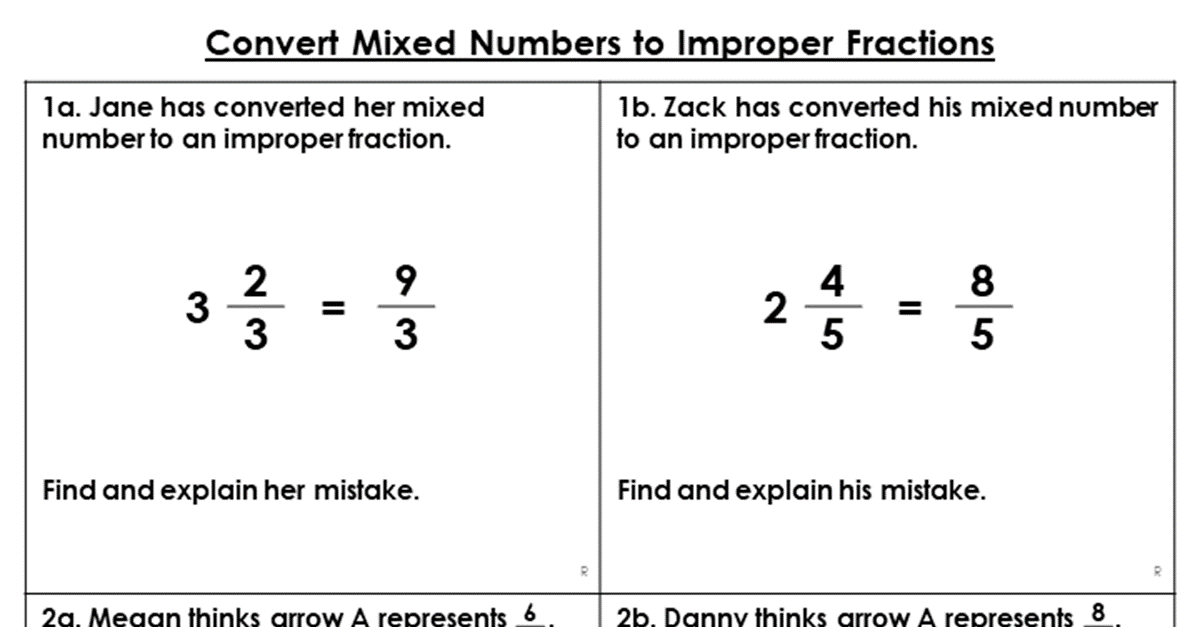

Mixed And Improper Fractions Worksheet Live Worksheets Worksheets

Grade 4 Math Worksheet Comparing Fractions And Mixed Numbers K5

Adding Mixed Numbers Worksheet

Equivalent Improper Fractions

Fractions General Educational Development GED LibGuides At

Fractions On Number Line Mixed Numbers And Improper Fractions

Improper Fractions Number Line

How To Reduce A Improper Fraction Heartpolicy6

Improper Fraction Models

Improper Fraction Models