How To Manage Autism Tantrums - Searching for a way to remain arranged easily? Explore our How To Manage Autism Tantrums, designed for daily, weekly, and monthly preparation. Perfect for trainees, specialists, and hectic parents, these templates are easy to tailor and print. Stay on top of your tasks with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and worry-free. Start planning today!

How To Manage Autism Tantrums

How To Manage Autism Tantrums

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The resulting profit or loss is typically Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if

Printable Federal Schedule C Profit Or Loss From Business Tax

Tim s Toddler Tantrum Story A Kids Picture Book About Toddler And

How To Manage Autism Tantrums · Schedule C details all of the income and expenses incurred by your business, and the resulting profit or loss is included on Schedule 1 of Form 1040. The profit or loss is also used on Schedule SE to calculate self-employment. If you re self employed and set up your business as a sole proprietorship not registered as multi member LLC or corporation or single member LLC taxed as a sole proprietorship you should file

This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal Are My Child s Tantrums Normal Learn From A Hopebridge BCBA · A form Schedule C: Profit or Loss from Business (Sole Proprietorship) is a two-page IRS form for reporting how much money you made or lost working for yourself (hence the sole.

From Business Profit Or Loss Internal Revenue Service

Fatigue After Sensory Meltdown Delibool

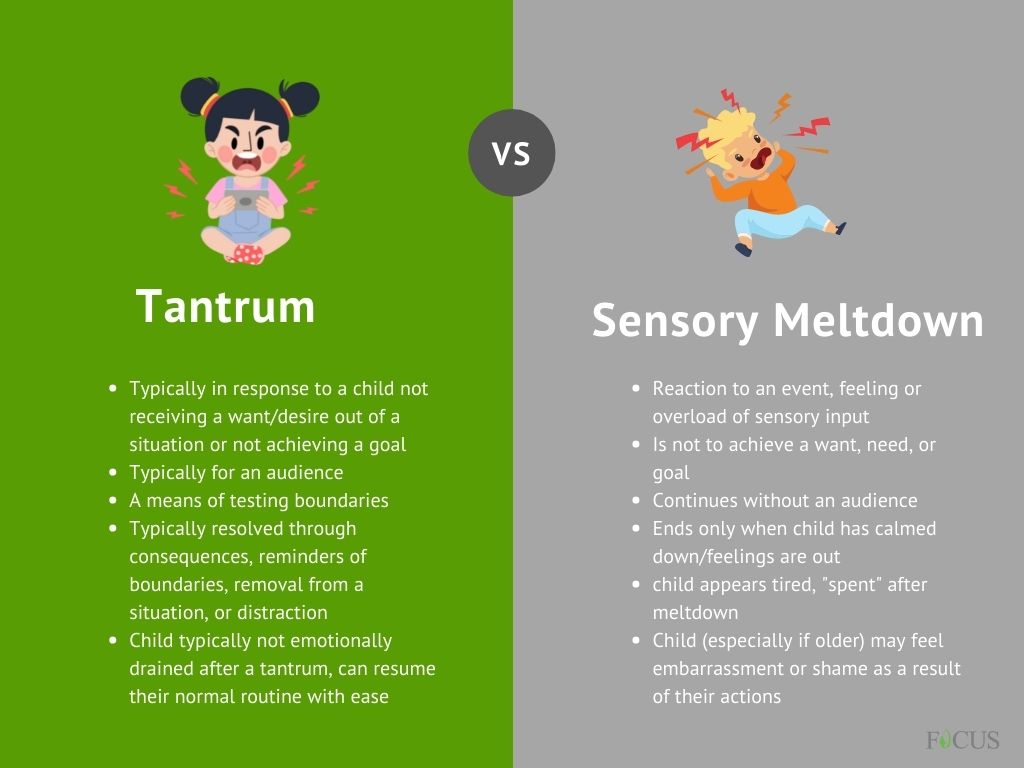

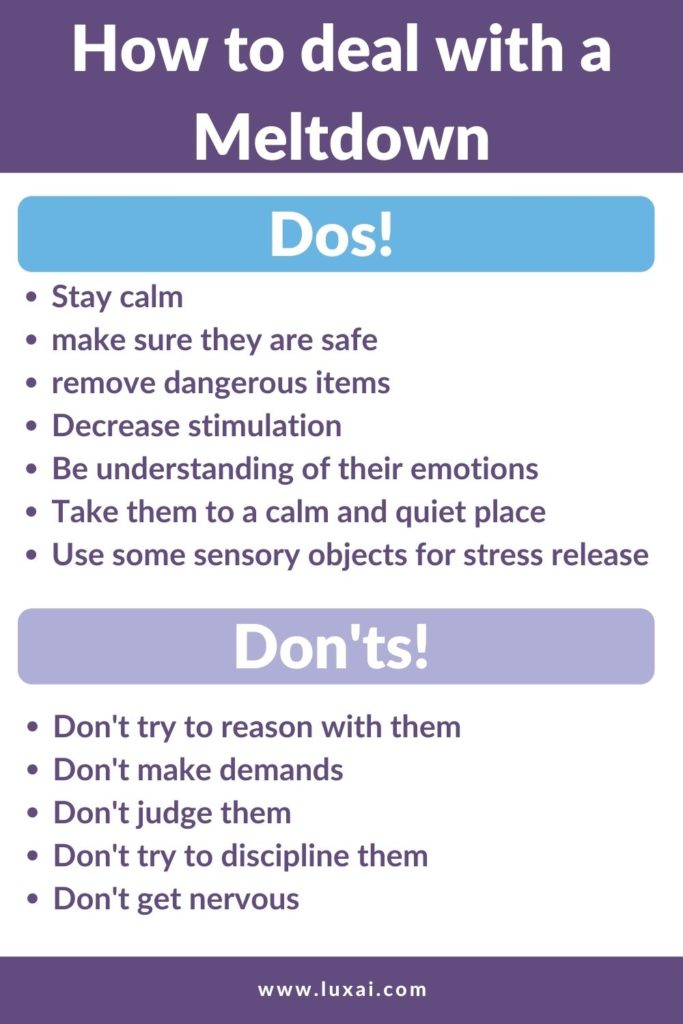

SCHEDULE C Form 1040 Profit or Loss From Business Go OMB No 1545 0074 2020 Sole Proprietorship to www irs gov ScheduleC for instructions and the latest information Department Tantrum Vs Autistic Meltdown What Is The Difference How To Deal With

Printable Federal Income Tax Schedule C Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor Small businesses and statutory employees Tantrum Vs Autistic Meltdown What Is The Difference How To Deal With Understanding The Three Levels Of Autism

:max_bytes(150000):strip_icc()/autism-coping-4686275-v5-0ebcd414a35a481282d891a9d69d4bb9.png)

Autism Coping Support And Living Well

Autism Awareness Articles And Resources Relias

Autistic Meltdown Adults Brolaunch

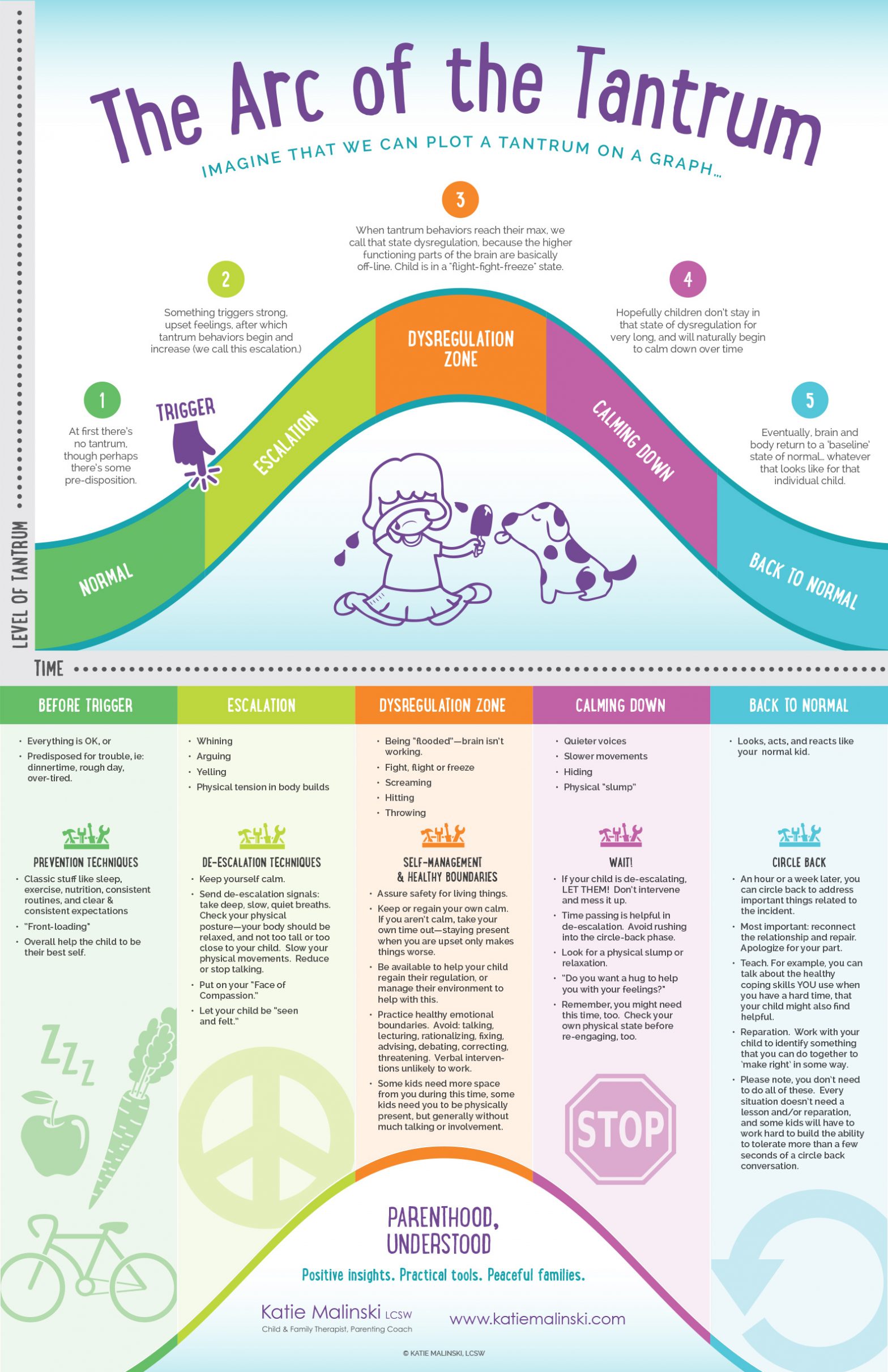

The Arc Of The Tantrum Resources Parenthood Understood

![]()

Shutdowns Are They Different From Meltdowns RDIconnect

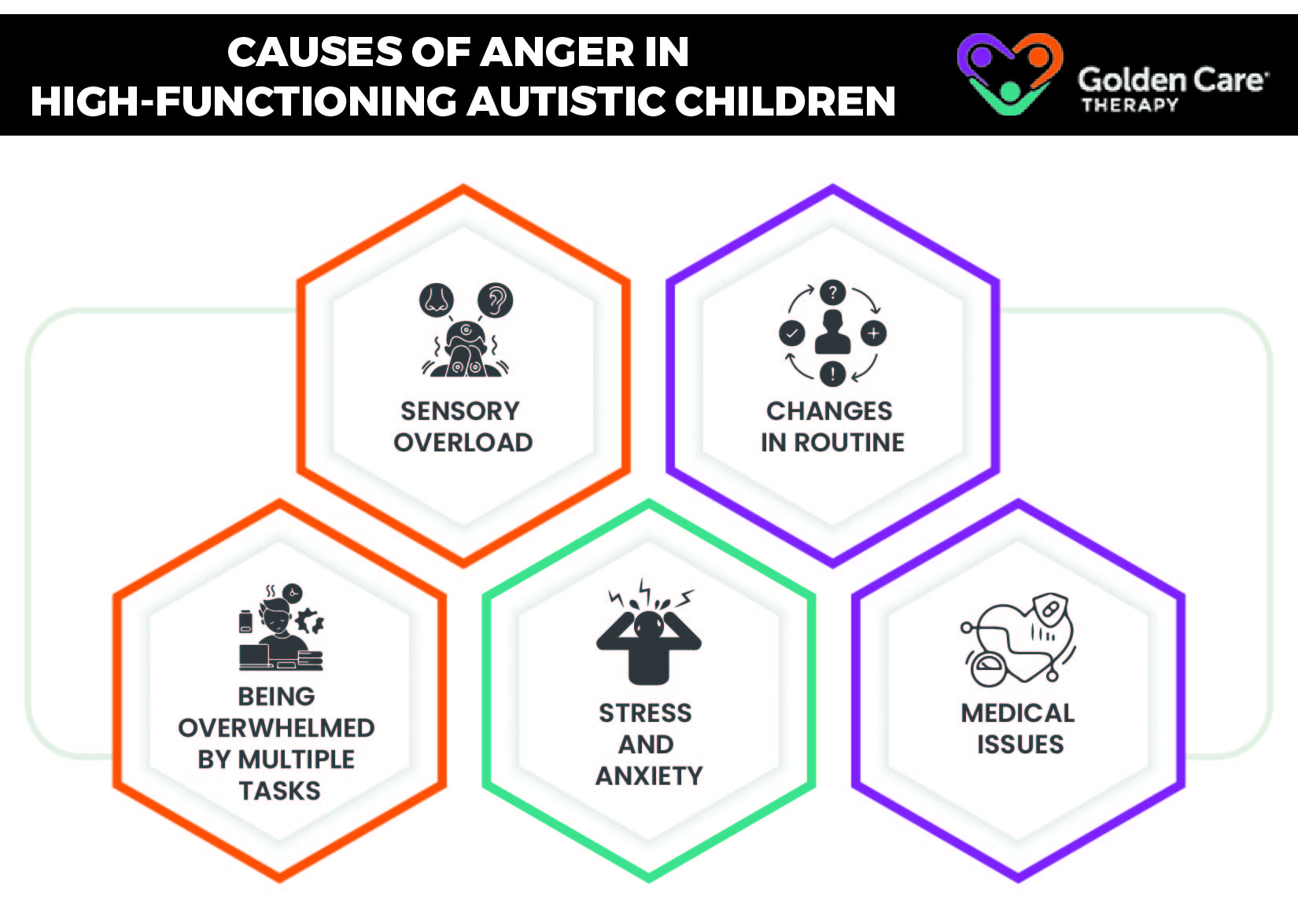

High Functioning Autism And Anger Golden Care Therapy

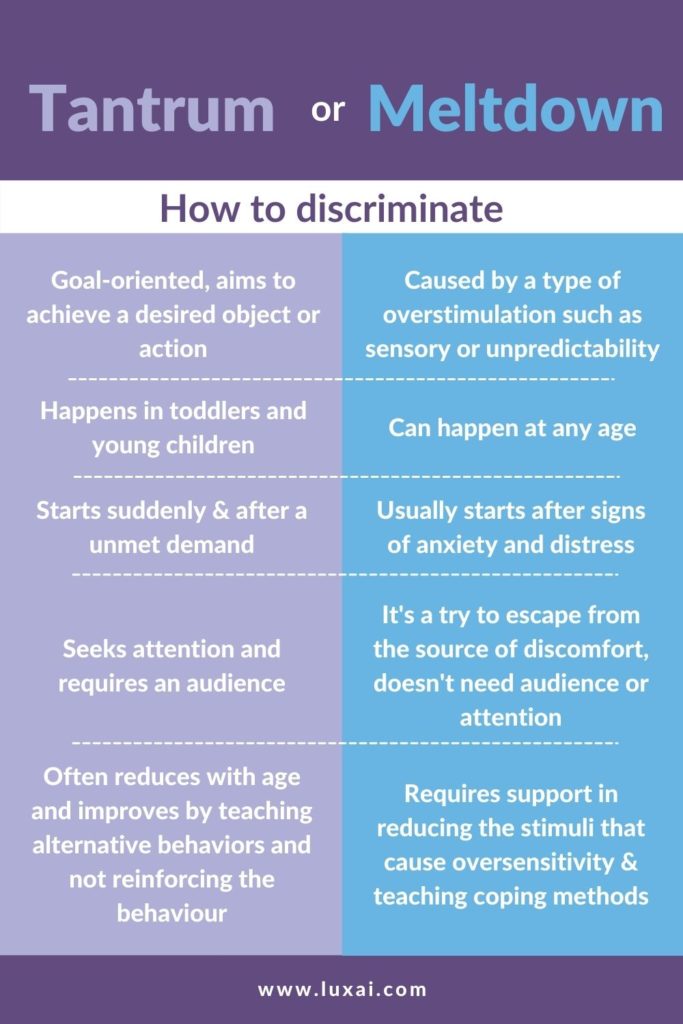

Tantrum Vs Autistic Meltdown What Is The Difference How To Deal With

Tantrum Vs Autistic Meltdown What Is The Difference How To Deal With

Temper Tantrums How To Handle Toddler Preschool Tantrums Child Stages

Autism Anxiety And Sensory Overload A Sensory Key Sensory Friendly