How To Enable Supplier Invoice Number In Tally Erp 9 - Searching for a way to stay organized easily? Explore our How To Enable Supplier Invoice Number In Tally Erp 9, created for daily, weekly, and monthly preparation. Perfect for students, professionals, and busy moms and dads, these templates are simple to tailor and print. Remain on top of your tasks with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and worry-free. Start preparing today!

How To Enable Supplier Invoice Number In Tally Erp 9

How To Enable Supplier Invoice Number In Tally Erp 9

Use this schedule to show your TAX LIABILITY for the quarter don t use it to show your deposits When you file this form with Form 941 or Form 941 SS don t change your tax liability by The IRS uses Schedule B to determine if you’ve deposited your federal employment tax liabilities on time. If you're a semiweekly schedule depositor and you don’t properly complete and file.

Federal 941 Schedule B Report Of Tax Liability For Semiweekly

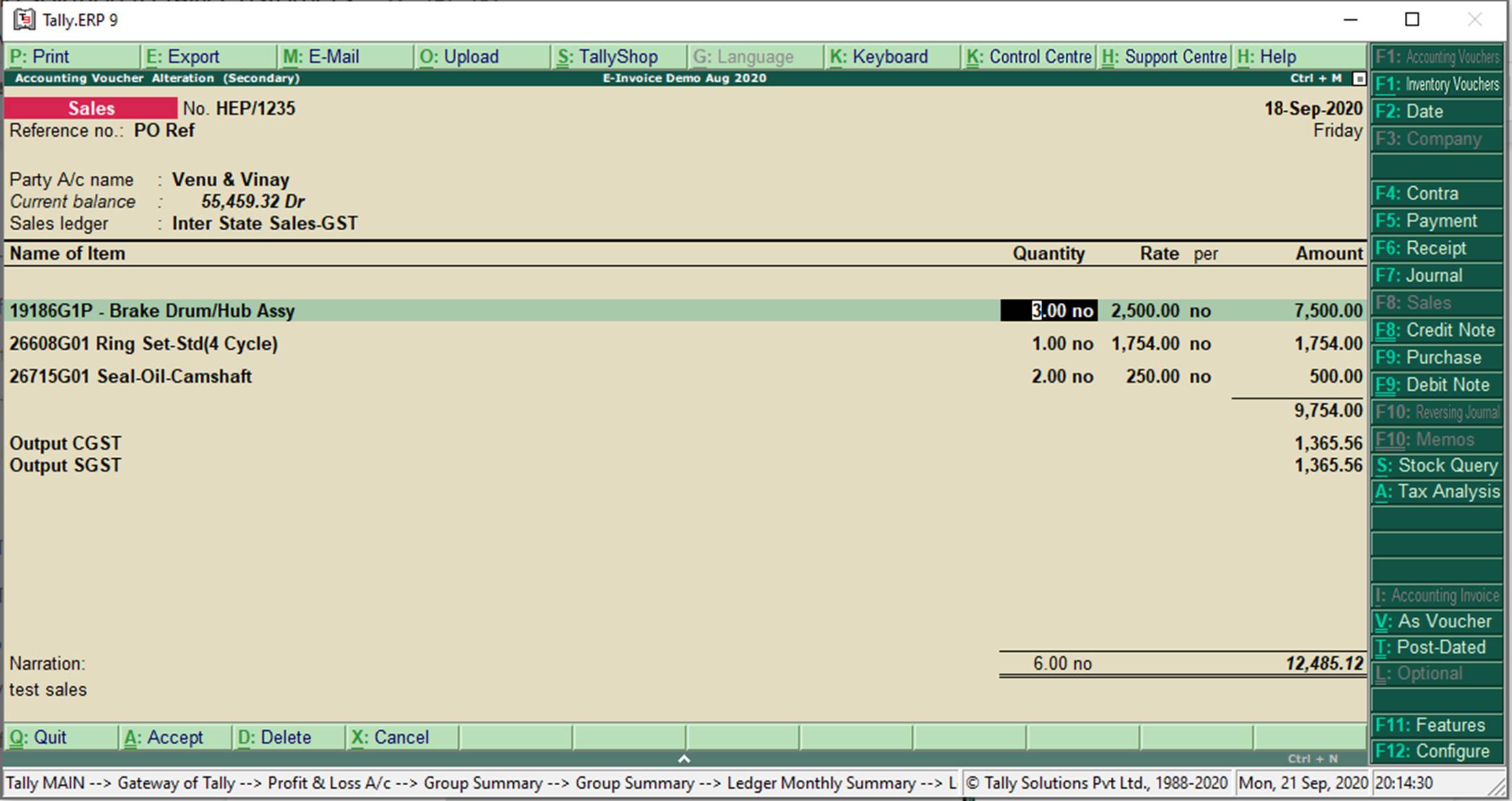

Tally Cllass tally tallyprime How To Make Basic Bill In Tally

How To Enable Supplier Invoice Number In Tally Erp 9This form is for income earned in tax year 2023, with tax returns due in April 2024. We will update this page with a new version of the form for 2025 as soon as it is made available by the. Complete Schedule B Form 941 Report of Tax Liability for Semiweekly Schedule Depositors and attach it to Form 941 Go to Part 3

What is Form 941 Schedule B When you pay your employees you are required to manage the applicable employee deductions and employer contributions for federal state and local payroll taxes Income tax Medicare Tally Prime Invoice Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Go to Part 3. . You MUST complete all three pages of Form 941 and.

Instructions For Schedule B Form 941 Rev June 2020

Debit Note And Credit Note In Tally Prime Tally Prime Credit Note

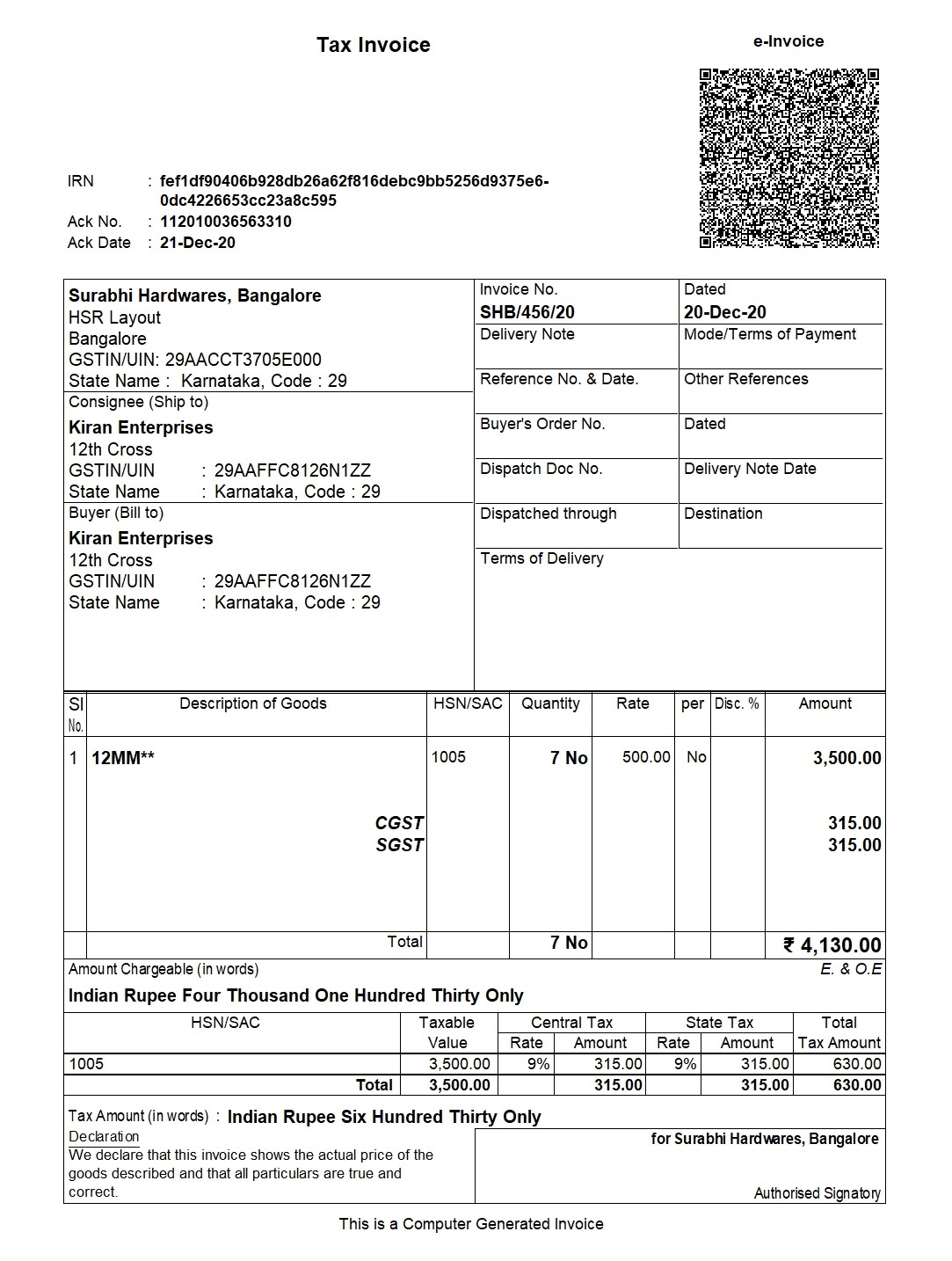

A Schedule B Form 941 is used by the Internal Revenue Service for tax filing and reporting purposes This form must be completed by a semiweekly schedule depositor who reported E Invoice Tally Integration With QR Code

We last updated the Report of Tax Liability for Semiweekly Schedule Depositors in January 2024 so this is the latest version of 941 Schedule B fully updated for tax year 2023 You can Tally ERP 9 Invoice Customization Format Tally Debit Note

How To Create Sales Invoice In Tally Prime How To Enter Sales Bill In

New GST Invoice Format TDL For Tally ERP 52 OFF

Advance Tally Prime Computer Institute

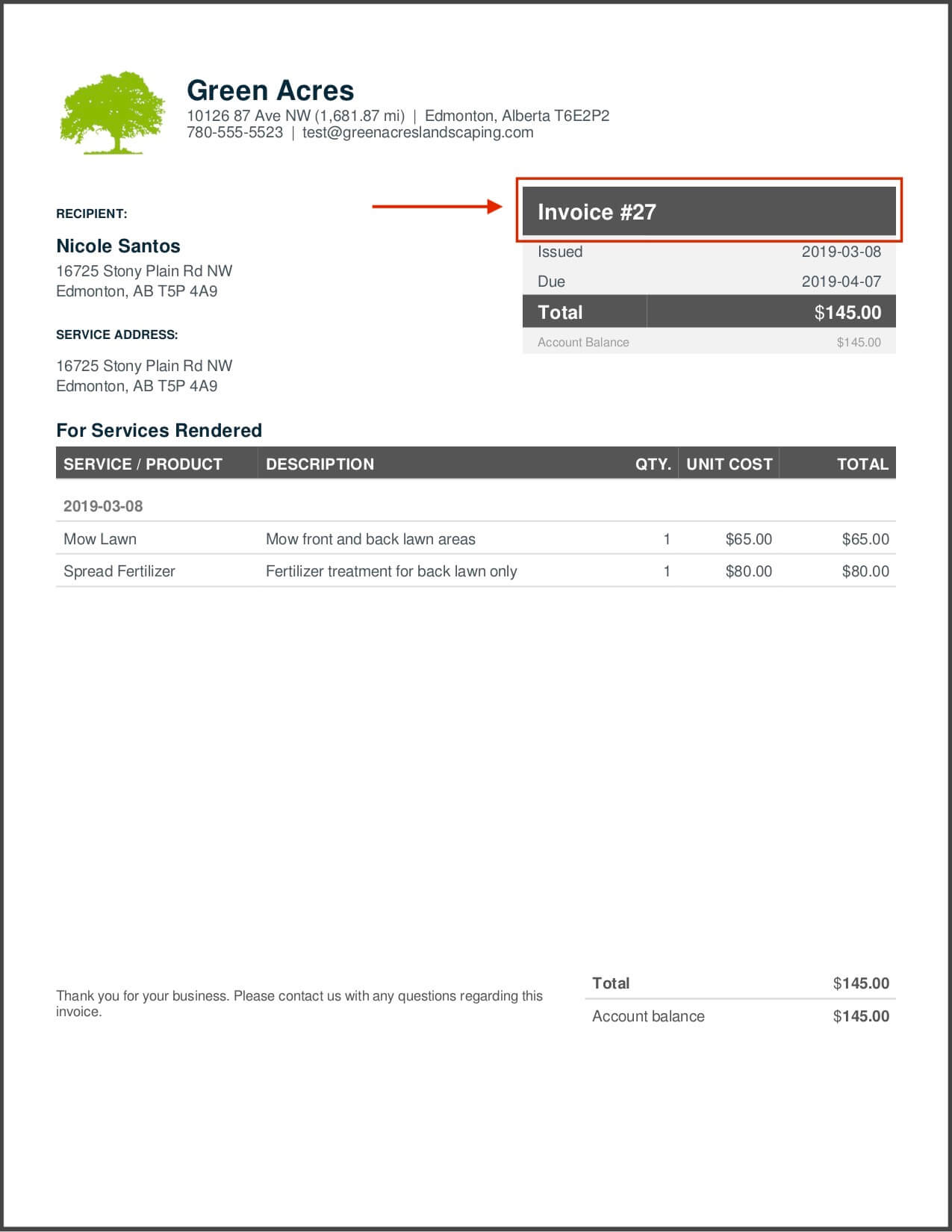

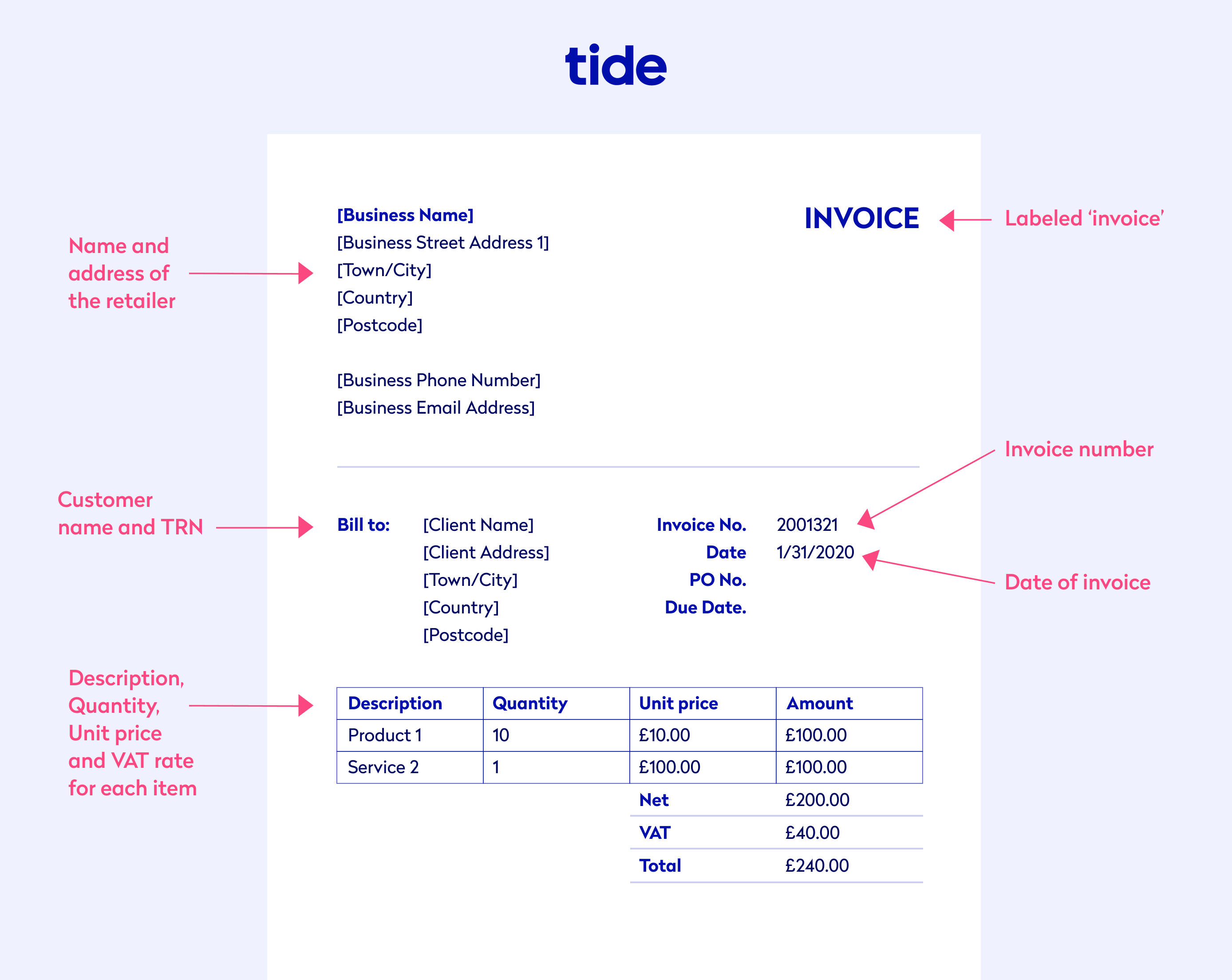

Invoice Number Definition Examples Best Practices 51 OFF

Invoice Diagram

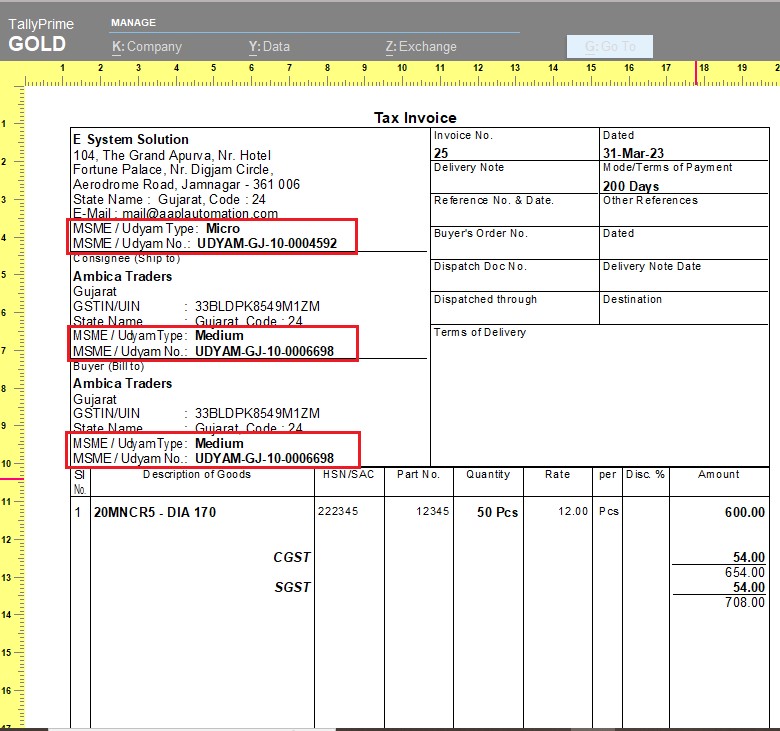

371 Print MSME Udyam Number In Invoice Reports

Vendor

E Invoice Tally Integration With QR Code

Sample Supplier Service Invoice Template Edit Fill Sign Online

Invoice 2025 23 Kay Sarajane