7 1 8 Hat In Cm - Trying to find a method to remain organized easily? Explore our 7 1 8 Hat In Cm, created for daily, weekly, and monthly planning. Perfect for students, specialists, and busy moms and dads, these templates are simple to tailor and print. Remain on top of your jobs with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and stress-free. Start preparing today!

7 1 8 Hat In Cm

7 1 8 Hat In Cm

Enter the totals directly on Schedule D line 8a you aren t required to report these transactions on Form 8949 see instructions You must check Box D E or F below This form is for income earned in tax year 2023, with tax returns due in April 2024. We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal government.

How To Fill Out A Schedule D Tax Worksheet Finance

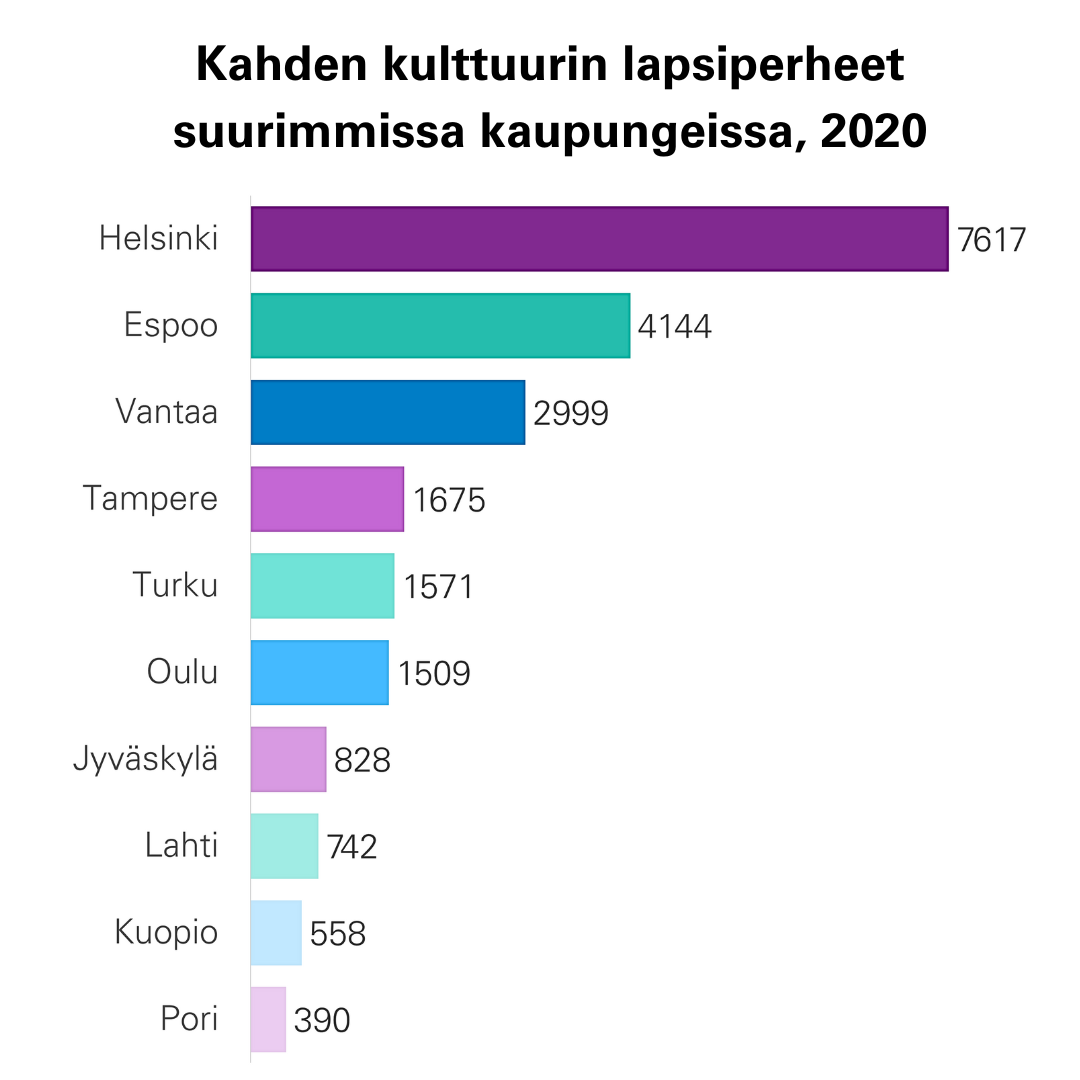

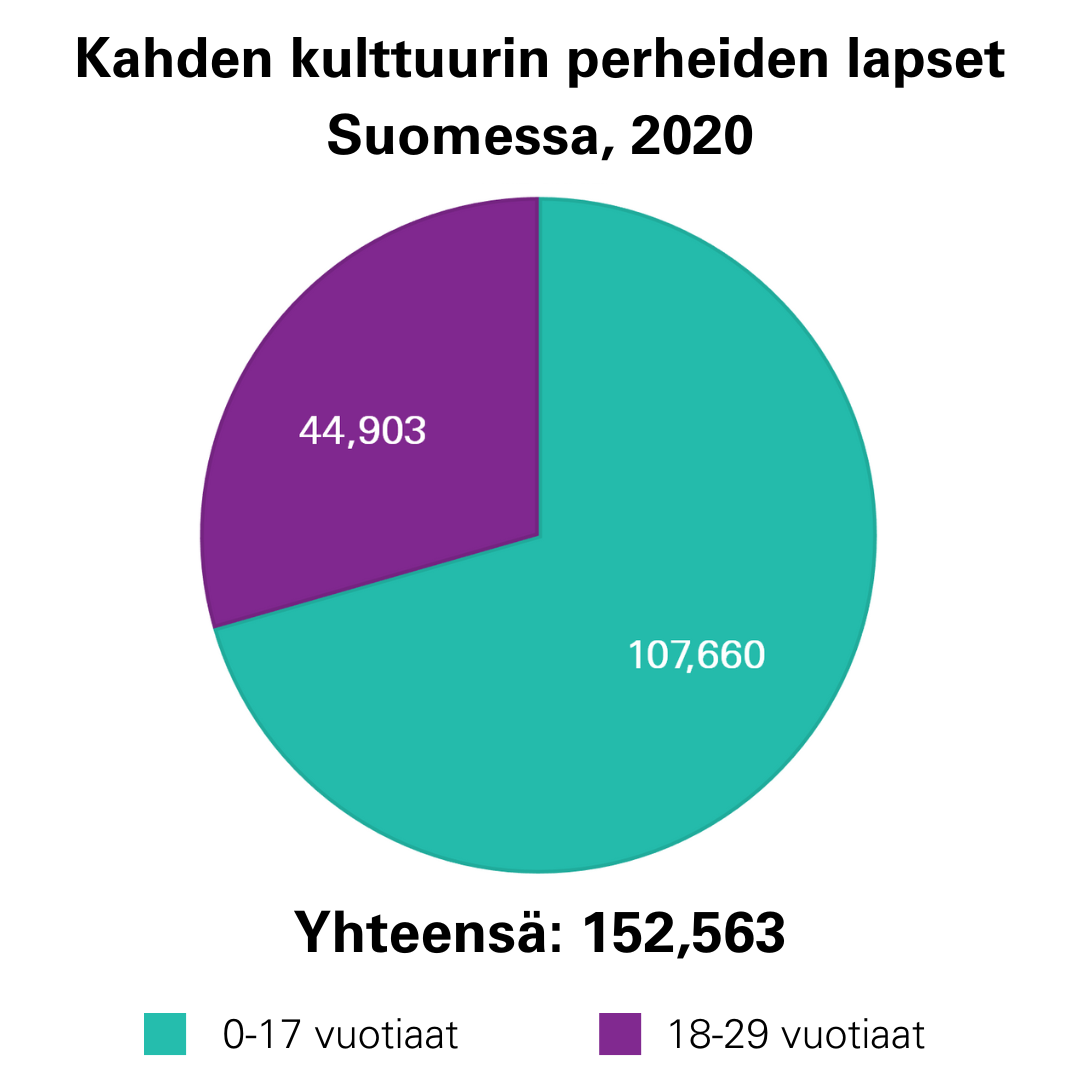

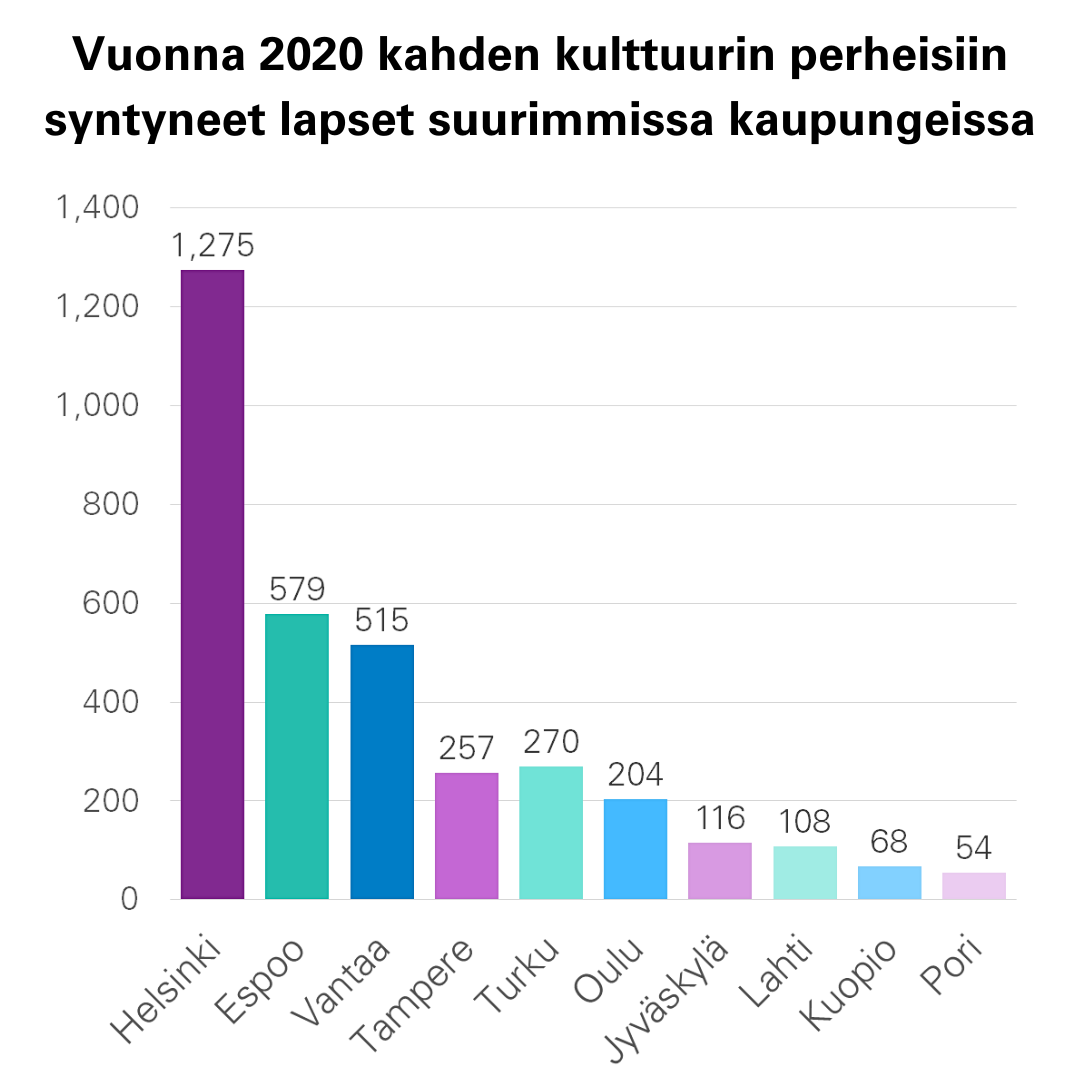

Kahden Kulttuurin Perheet Suomessa

7 1 8 Hat In CmPrintable Federal Income Tax Schedule D. You should use Schedule D to report: -Sale or exchange of a capital asset not reported elsewhere. -Gains from involuntary conversions of. Schedule D Form 1040 is a tax schedule from the IRS that attaches to the Form 1040 U S Individual Income Tax Return Form 1040 SR or Form 1040NR It

Up to 32cash back Schedule D is a form provided by the IRS to help taxpayers computer their capital gains or losses and the corresponding taxes due The calculations from Schedule RUFUZ 022 FROM RUFUZ WITH LOVE Lyrics And Tracklist Genius We last updated the Capital Gains and Losses in January 2024, so this is the latest version of 1040 (Schedule D), fully updated for tax year 2023. You can download or print current or past.

Printable 2023 Federal 1040 Schedule D Capital

Kahden Kulttuurin Perheet Suomessa

A Schedule D form is a supplemental form completed and sent in with your 1040 if you have capital gains or losses to report from the tax year You use the Capital Gains and Losses form to report certain types of sales exchanges gains Family Leave In Intercultural Families

IRS Schedule D is a worksheet that helps taxpayers figure capital gains and losses from their capital assets Schedule D is divided into three parts which taxpayers complete to figure The Alamo Lucchese Riyadh Air Fleet Details And History

Apple IPhone 12 Mini Magsafe

FAMILIA

OP L 410 TEMPER

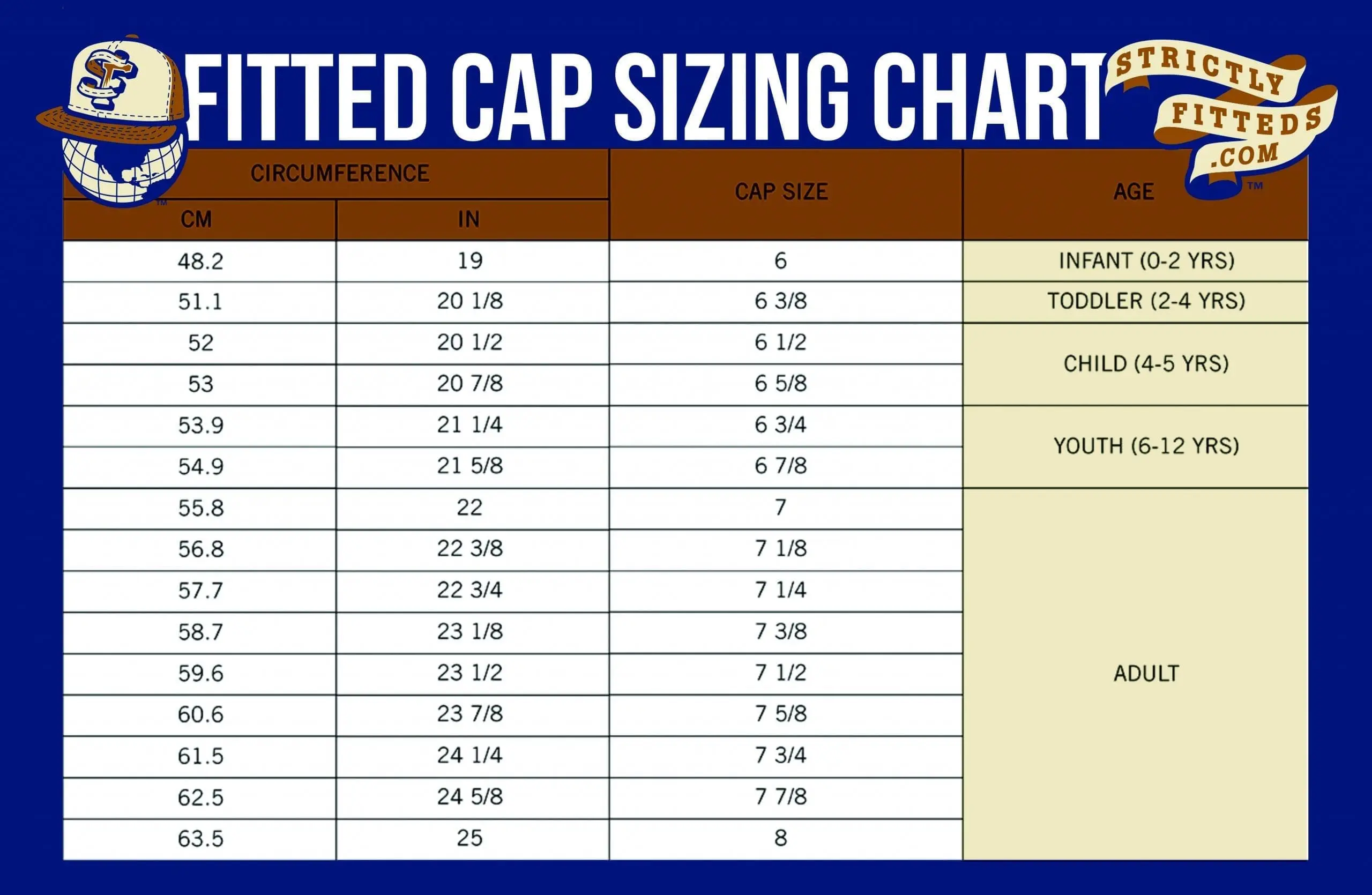

Fitted Baseball Cap Sizing Chart Strictly Fitteds

Pepper Gypsy Queens

New Era Sticker Ubicaciondepersonas cdmx gob mx

Family Leave In Intercultural Families

Pacific Northwest FlexFit Hat PNW Apparel

Adidas Originals Adicolor Sling Bag