52 Divided By 132 - Searching for a method to remain organized easily? Explore our 52 Divided By 132, created for daily, weekly, and monthly planning. Perfect for students, professionals, and busy parents, these templates are easy to customize and print. Remain on top of your tasks with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and hassle-free. Start preparing today!

52 Divided By 132

52 Divided By 132

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent · DoninGA. Level 15. The Schedule C is part of and included with your personal tax return, Form 1040, it cannot be downloaded separately. To access your current or prior year.

Schedule C Form Everything You Need To Know

Duplication Division

52 Divided By 132Maximize your business deductions and accurately calculate your profit or loss with Federal Form 1040 Schedule C. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to www irs gov ScheduleC for instructions and

View the Schedule C Form 1040 Instructions for Business Filers in our extensive collection of PDFs and resources Access the Schedule C Form 1040 Instructions for Business Filers now How To Do Division With Remainders · If you’re wondering how to fill out the Schedule C Form 1040, this easy-to-use tool will get your financial ducks in a row. We highly recommend using it before you attempt the official IRS form. You may also download the.

Is It Possible To Download A Copy Of Just The Schedule C Intuit

27 15 Simplified Form

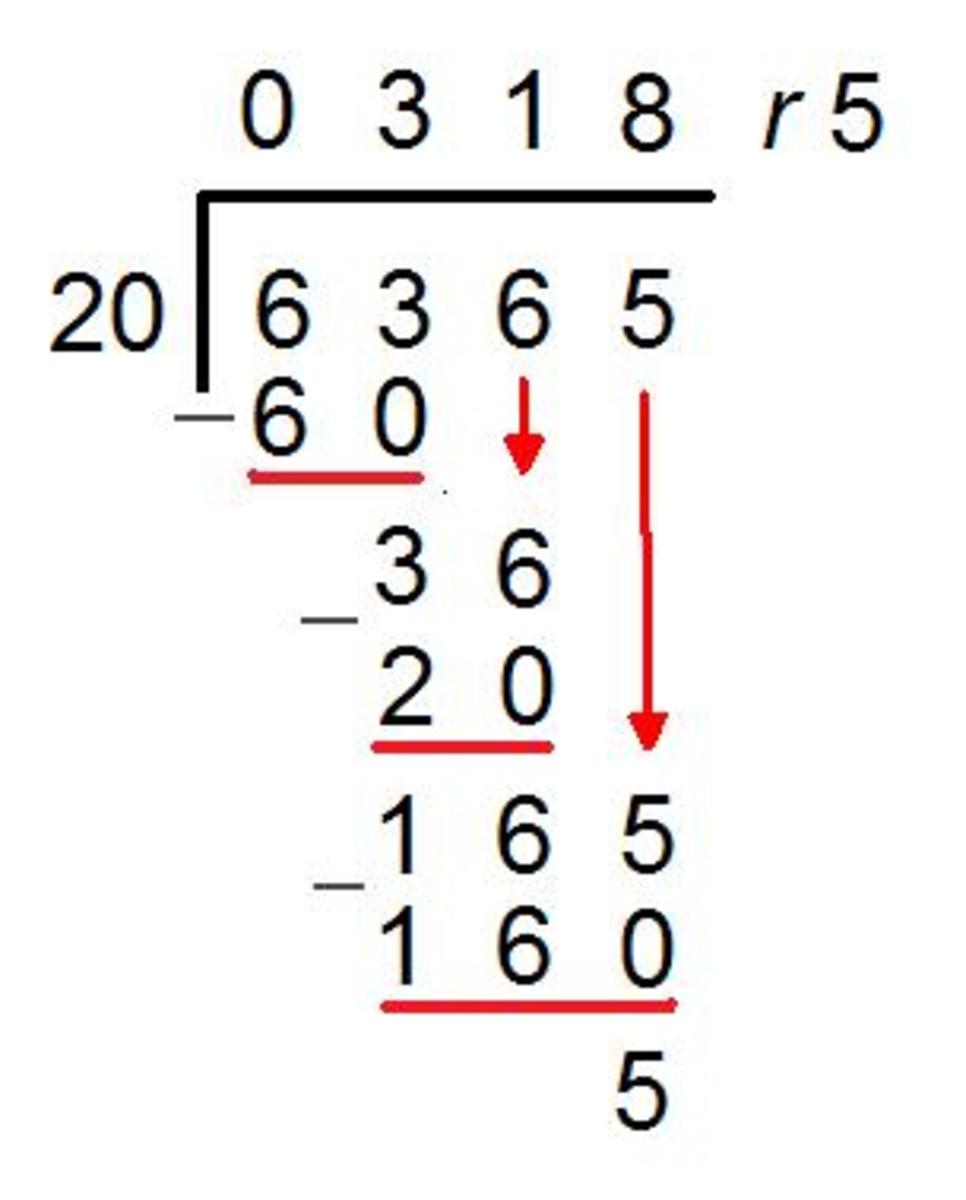

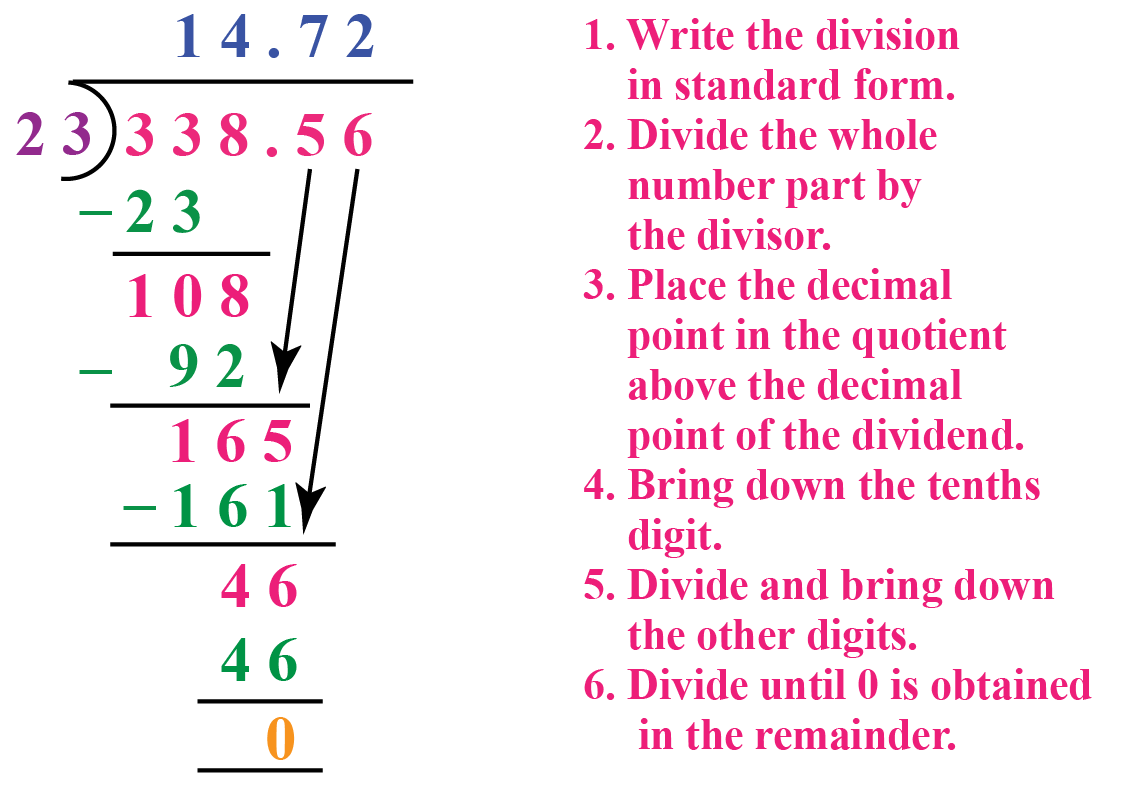

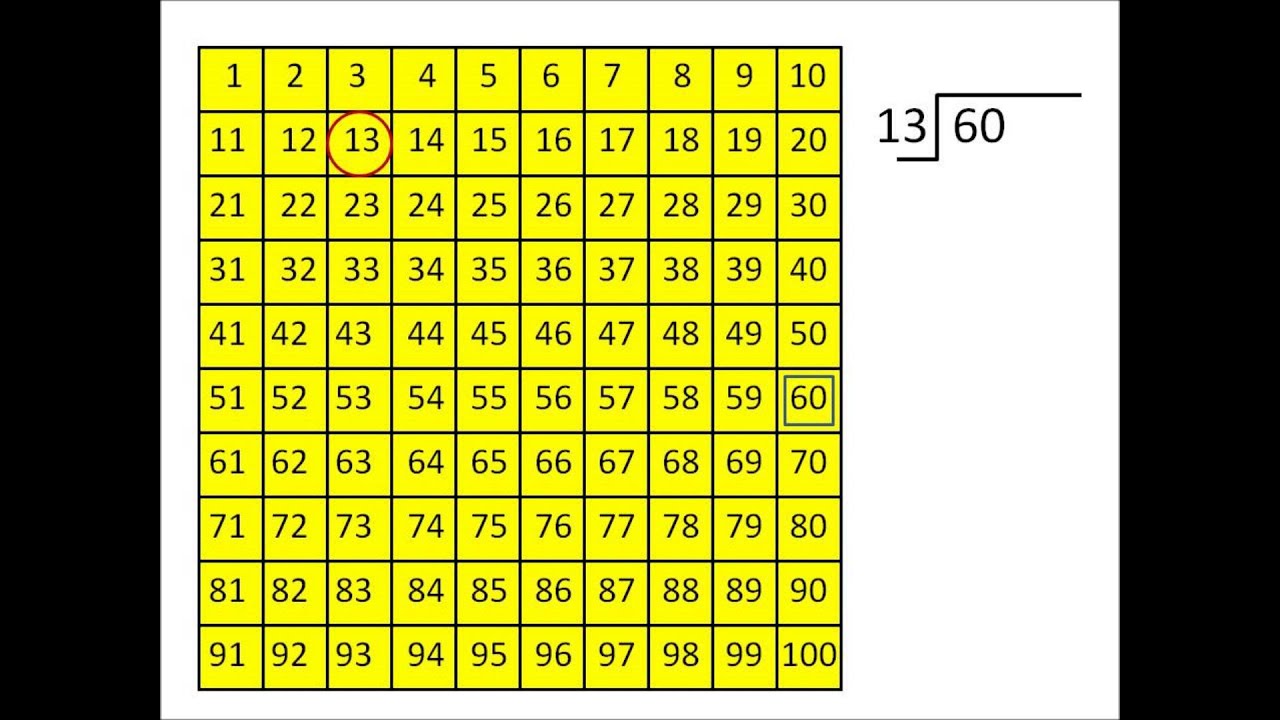

The IRS Schedule C Form 1040 provides profit or loss information for business proprietors Learn how to accurately complete this tax form for the 2024 tax year Essential guidelines for Long Division Decimals And Remainders

A form Schedule C Profit or Loss from Business Sole Proprietorship is a two page IRS form for reporting how much money you made or lost working for yourself hence the sole proprietorship In other words it s Times Table And Division What Is 3 Divided By 1 8

28 Divide 400

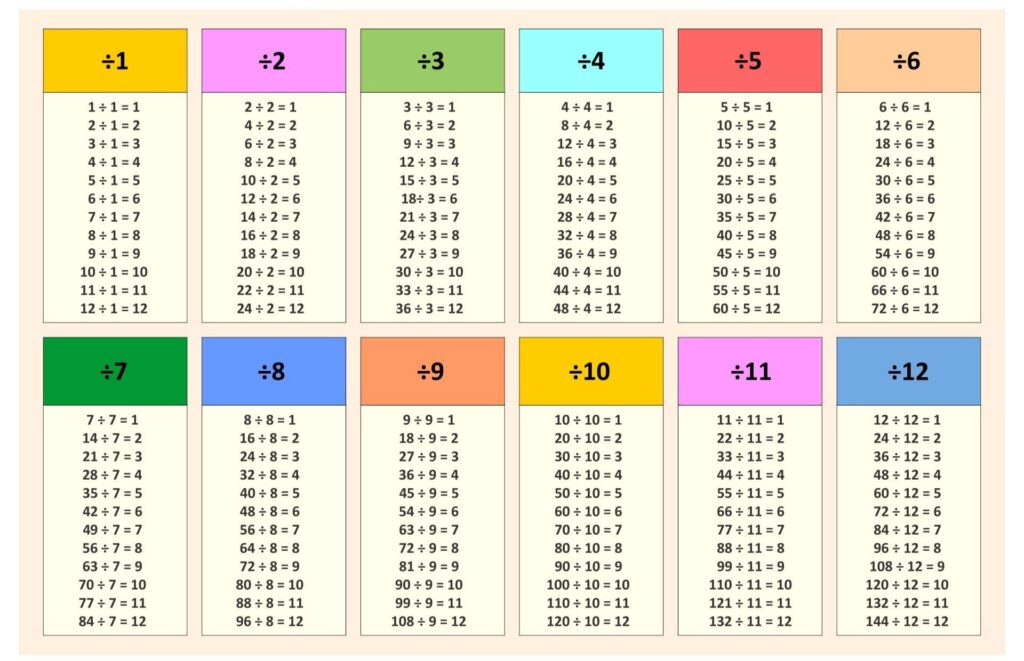

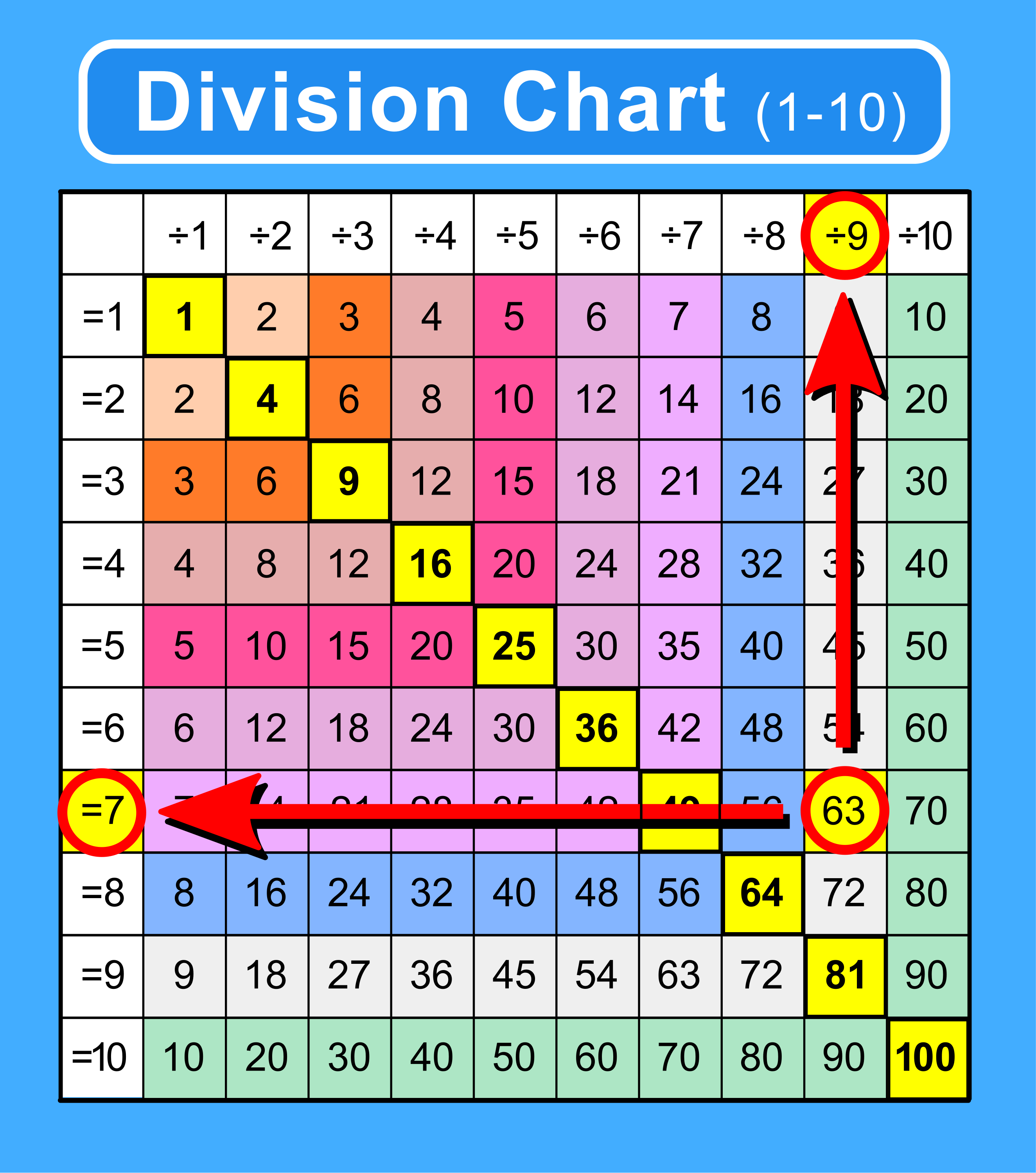

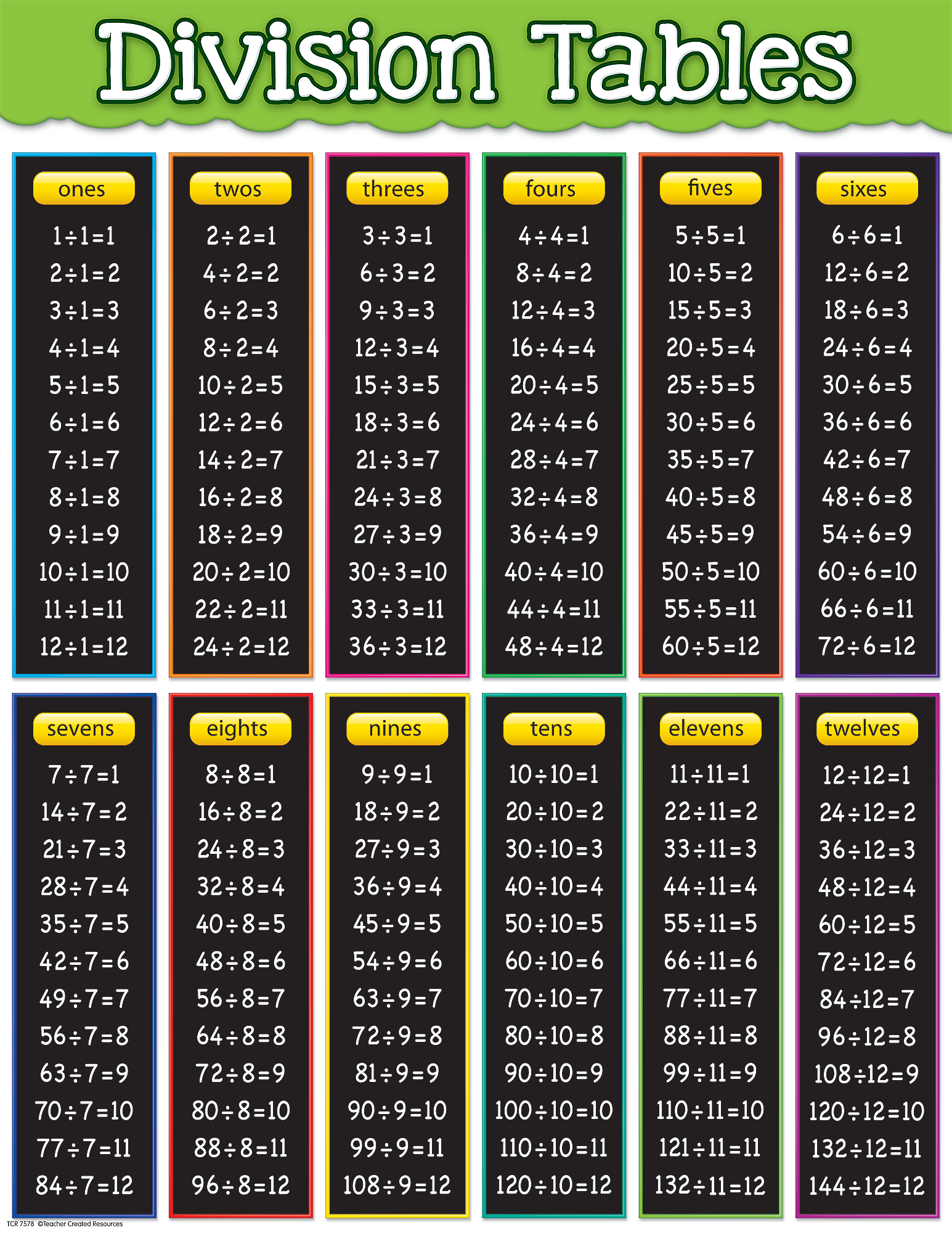

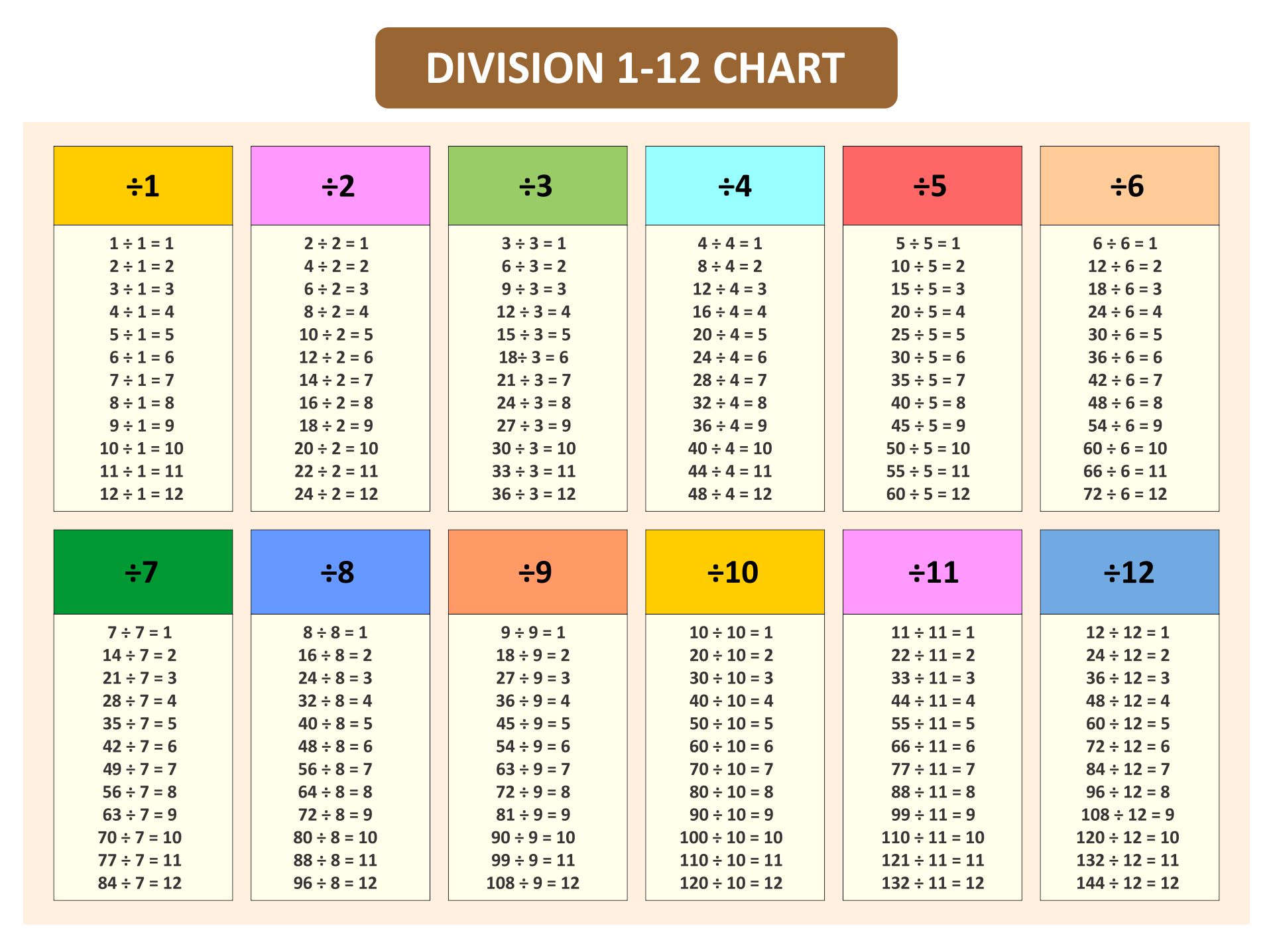

10 Division Table

400 Divided By 100

28 Divide By 30

Blank Division Chart

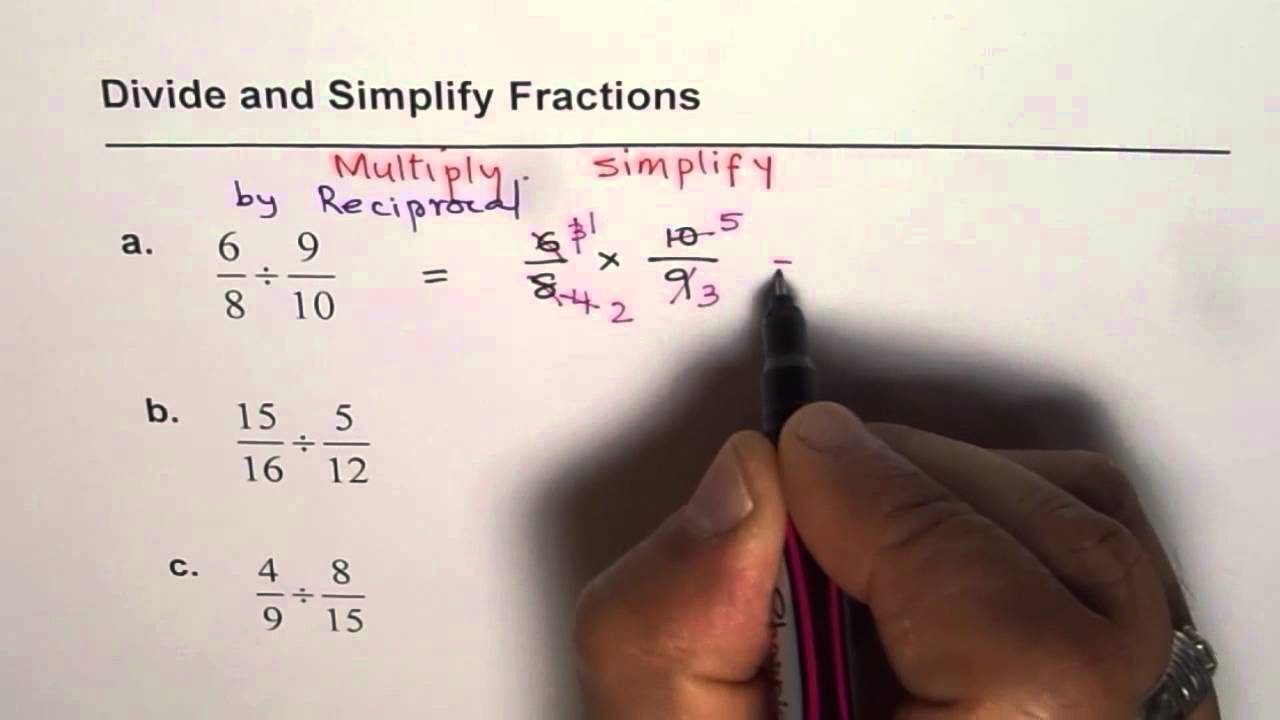

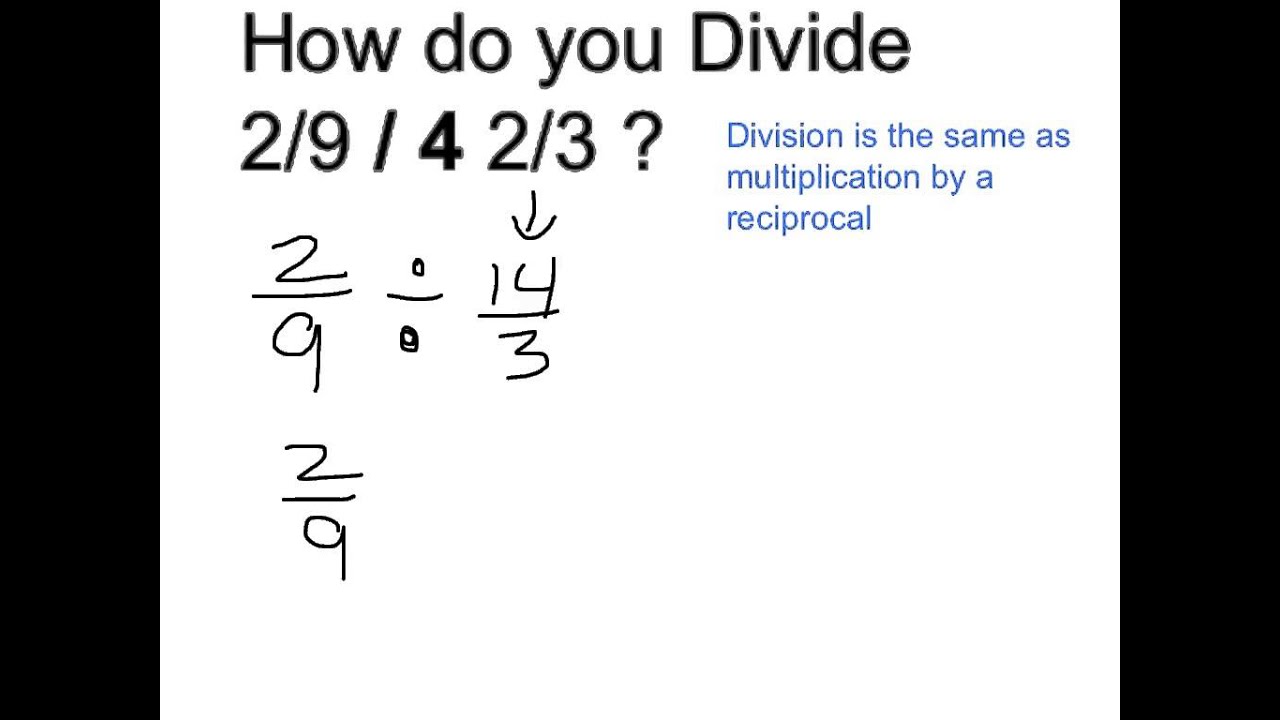

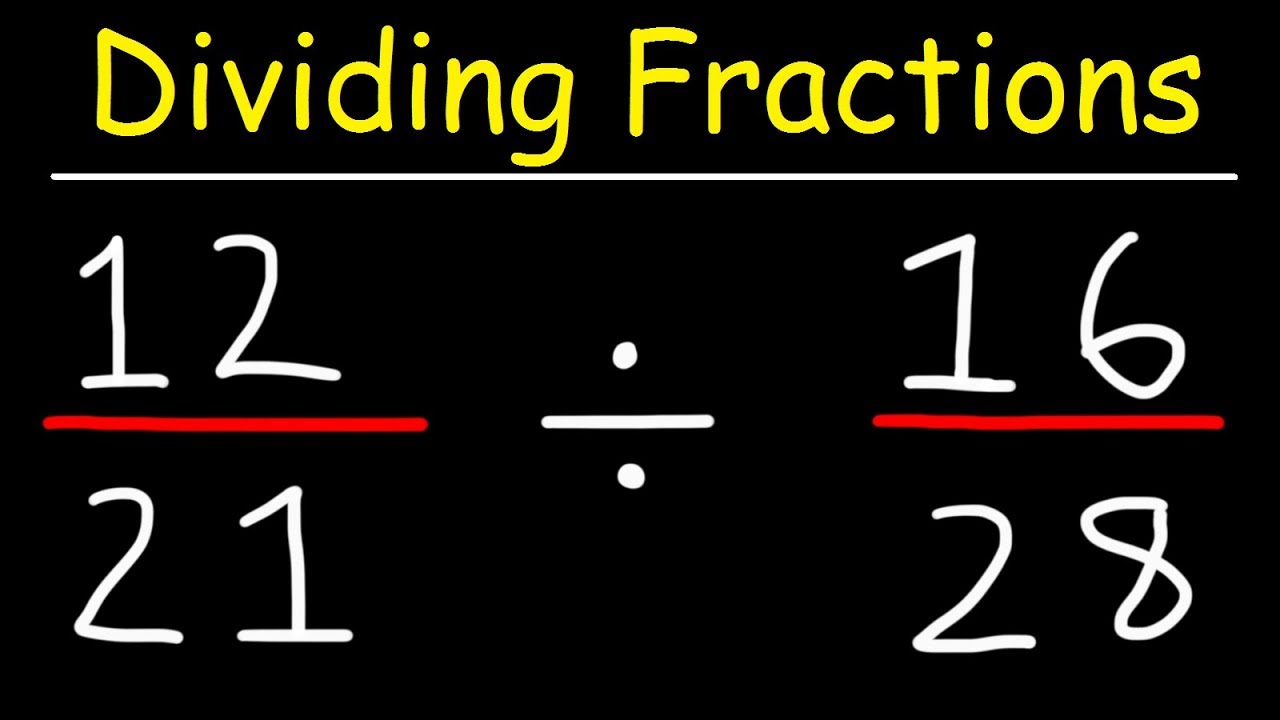

Divide Numbers By Fractions

Math Division Rules

Long Division Decimals And Remainders

Long Division Steps Printable

What Is 1000 Divided By 100