3z 1 3 4 4z 1 4 5z - Trying to find a way to remain arranged effortlessly? Explore our 3z 1 3 4 4z 1 4 5z, created for daily, weekly, and monthly planning. Perfect for trainees, specialists, and busy moms and dads, these templates are easy to customize and print. Stay on top of your jobs with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and trouble-free. Start preparing today!

3z 1 3 4 4z 1 4 5z

3z 1 3 4 4z 1 4 5z

Download a fillable PDF of Schedule C Form 1040 a supplemental form for sole proprietors to report their business income and expenses Learn how to complete each section of the form and Download or print the 2023 Federal (Profit or Loss from Business (Sole Proprietorship)) (2023) and other income tax forms from the Federal Internal Revenue Service.

2024 Schedule C Form 1040 Internal Revenue Service

2022 Ultra Standard Q2 Catalog International Version By

3z 1 3 4 4z 1 4 5zUse Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary. Schedule C Profit or Loss from Business reports how much money you made or lost in a business you operated as a gig worker freelancer small business owner or consultant in certain business

What Is a Schedule C Form Who Files a Schedule C What s on a Schedule C How Do I Fill Out a Schedule C How Do I Find My Net Profit or Loss Get Help With Your Self Solved Question 3 1 A x Y Z E R3 3x 2y Z 0 Chegg SCHEDULE C (Form 1040) Profit or Loss From Business Go OMB No. 1545-0074 2020 (Sole Proprietorship) to www.irs.gov/ScheduleC for instructions and the latest information. Department.

Printable 2023 Federal 1040 Schedule C Profit Or Loss From

Simplify 4 3z 1 2 2z 3 3 z 4 2z 7 Brainly in

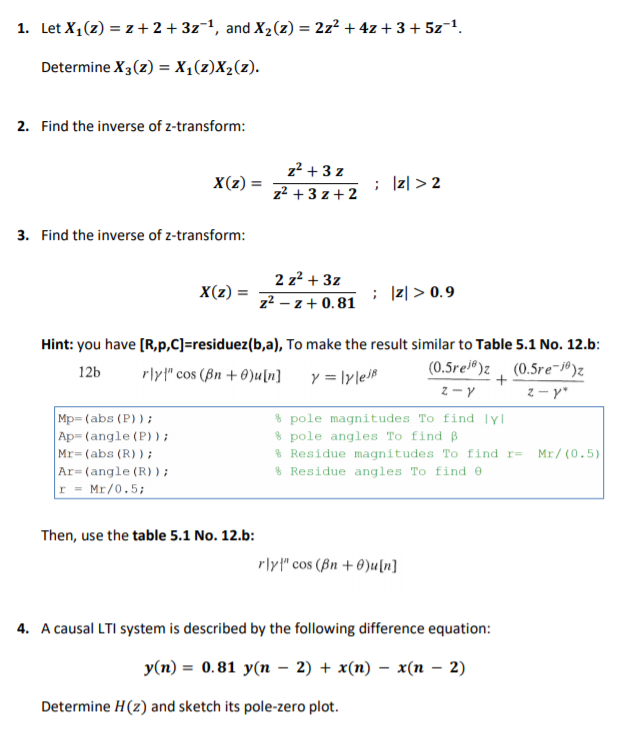

The IRS uses the information in the Schedule C tax form to calculate how much taxable profit you made and assess any taxes or refunds owing You can find the fillable form here IRS Schedule Solved Q 1 Find The Inverse Z Transform By Partial Fraction

SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service Profit or Loss From Business Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 1 2x 3y 4z 6 5x 3y Z 11 Z 1 3 2x Y Chegg Solved Use The System Of Equations X 2y 3z 4 Y 5z Chegg

3z 1 3 4 4z 1 4 5z Solve And Get Brain List With 100 Points Brainly in

X 5y 4z 3 1 2x 2y 3z 4 2 4x 2y Z 9 3

Solve 2x 2y 5z 3w 0 4x y z w 0 3x 2y 3z 4w 0 X 3y 7y 6w 0

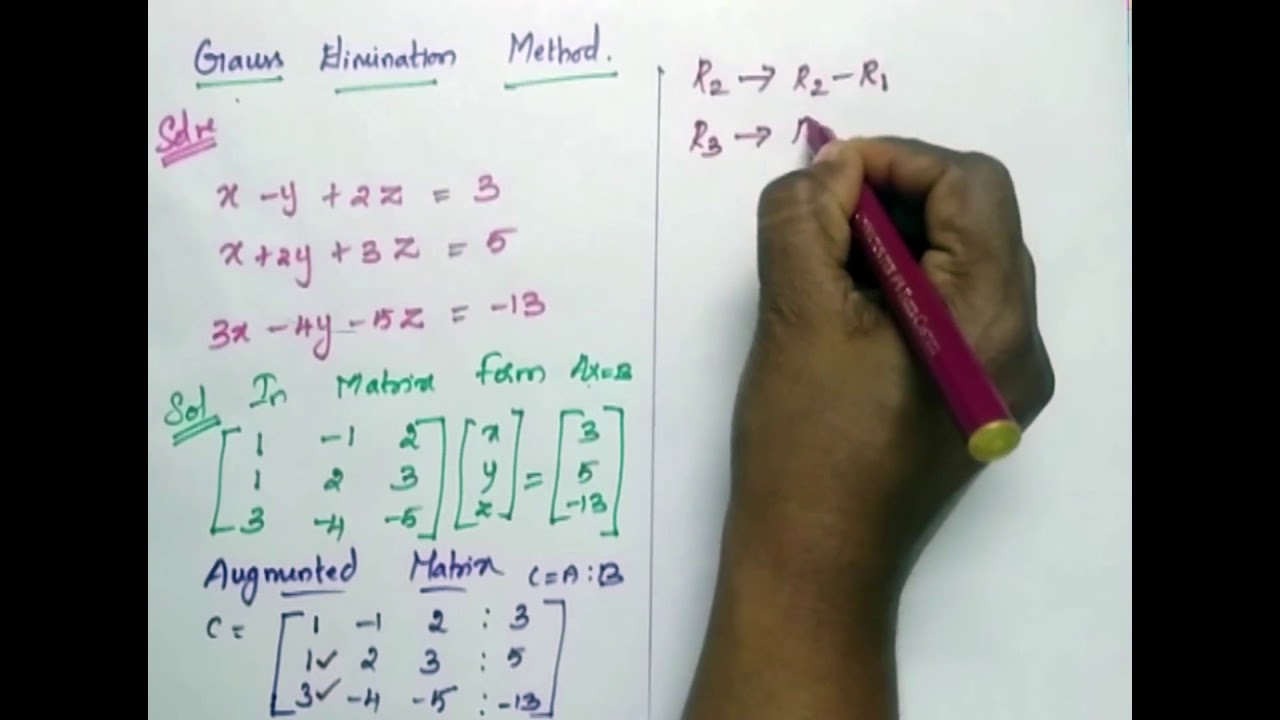

Gauss Elimination Method X y 2z 3 X 2y 3z 5 3x 4y 5z 13 YouTube

Using Matrices Solve The Following System Of Equations 2x 3y 3z

3 2y 5z 38 1 2 4y z 7 2 7 3y 4z 5 3 Brainly lat

InverseZtransform Using Partial Fraction Method Find The Inverse

Solved Q 1 Find The Inverse Z Transform By Partial Fraction

Solved 1 Let X1 z 2 2 3z 1 And X2 2 2z2 4z Chegg

If Z 2 3i Then Z 2 4z 13