3003 Vs 5052 Vs 6061 - Trying to find a method to stay arranged easily? Explore our 3003 Vs 5052 Vs 6061, created for daily, weekly, and monthly preparation. Perfect for trainees, specialists, and busy parents, these templates are easy to customize and print. Stay on top of your jobs with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and stress-free. Start preparing today!

3003 Vs 5052 Vs 6061

3003 Vs 5052 Vs 6061

Schedule C Worksheet for Self Employed Businesses and or Independent Contractors IRS requires we have on file to support all Schedule C s Printable Federal Income Tax Schedule C. Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor. Small businesses and statutory employees.

Free Download Schedule C Excel Worksheet For Sole

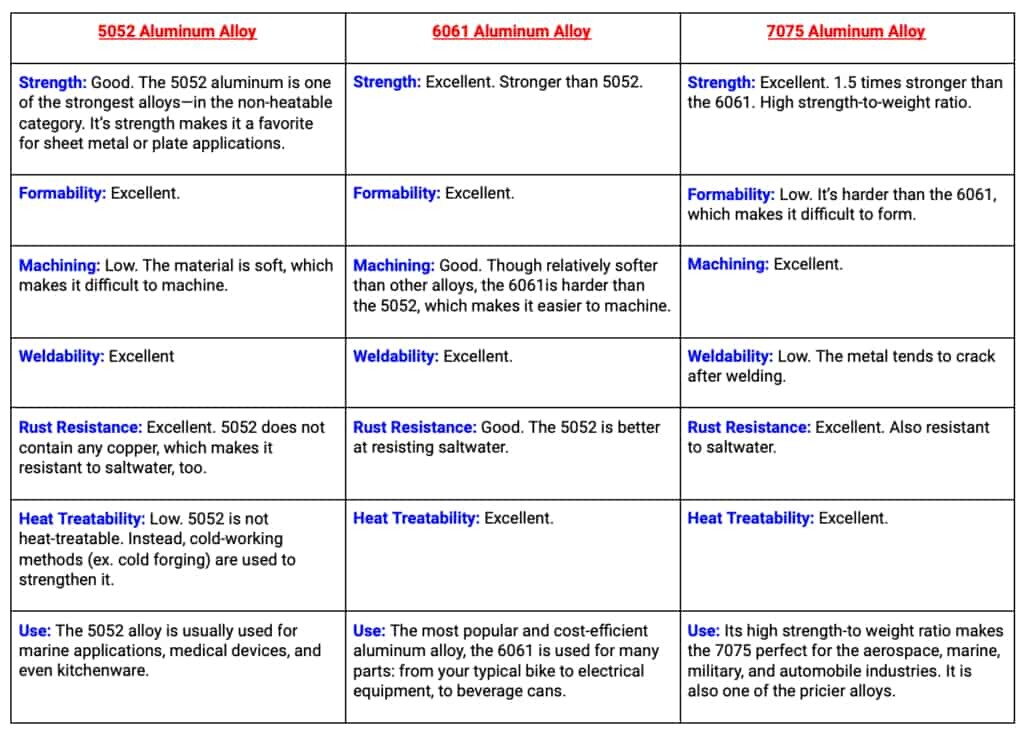

5052 Vs 6061 Aluminum What Is The Difference DEK 53 OFF

3003 Vs 5052 Vs 6061 · Schedule C details all of the income and expenses incurred by your business, and the resulting profit or loss is included on Schedule 1 of Form 1040. The profit or loss is also used on Schedule SE to calculate self-employment. Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent

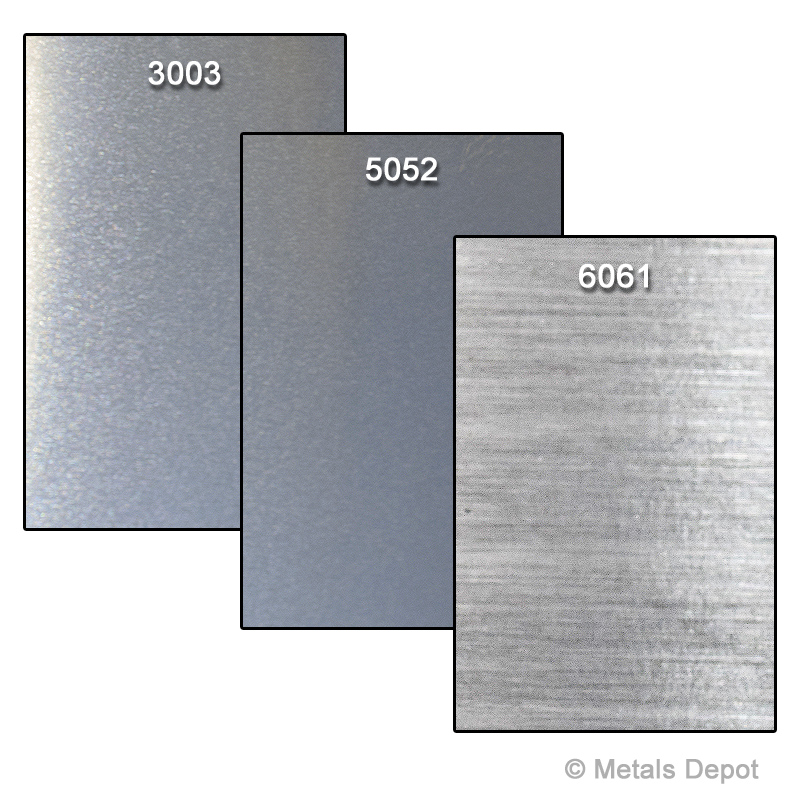

Try Bench The IRS uses the information in the Schedule C tax form to calculate how much taxable profit you made and assess any taxes or refunds owing You can find the fillable form here IRS What Is The Difference Between 5052 And 3003 Aluminum Sheet Haomei Self-Employed Business Expenses (Schedule C) Worksheet. 1. ess Expenses (Schedu. businesses or farms. Use separate sheet for each type of business. . a separate worksheet for e. Name & type.

Printable Federal Schedule C Profit Or Loss From Business Tax

Identifying Aluminum 5052 6061 Similarities And Differences 46 OFF

Our Schedule C Tax Preparation Checklist for Self Employed Tax Filers will help you determine what paperwork is needed and what you can deduct Feasibly Of Aluminum Alloys 5052 6061 Possibly Type II Anodizing In

If you re wondering how to fill out the Schedule C Form 1040 this easy to use tool will get your financial ducks in a row We highly recommend using it before you attempt the official IRS form You may also download the 2023 Feasibly Of Aluminum Alloys 5052 6061 Possibly Type II Anodizing In 6061 High Precision Cast Aluminum Plate

5052 Vs 6061 Perbandingan Paduan Aluminium Kekuatan 60 OFF

Aluminum Sheet 6061 T6 5052 H32 3105 H14 3003 H14 60 OFF

6061 T6

3003 Or 5052 Aluminium All MetalShaping

What Is The Difference Between 3003 Aluminum Vs 5052 58 OFF

5052 Vs 6061 Aluminum Emtek Processed Alloys Inc Emtek Processed

MetalsDepot Buy Aluminum Sheet Online

Feasibly Of Aluminum Alloys 5052 6061 Possibly Type II Anodizing In

5052 Aluminum Vs 6061 The Complete Difference

Pure Aluminum Element