3 8 12 If And Only If 5x4 25 - Searching for a way to stay arranged effortlessly? Explore our 3 8 12 If And Only If 5x4 25, created for daily, weekly, and monthly preparation. Perfect for trainees, experts, and hectic moms and dads, these templates are easy to personalize and print. Stay on top of your jobs with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and hassle-free. Start preparing today!

3 8 12 If And Only If 5x4 25

3 8 12 If And Only If 5x4 25

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The resulting profit or loss is typically Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if

Printable Federal Schedule C Profit Or Loss From Business Tax

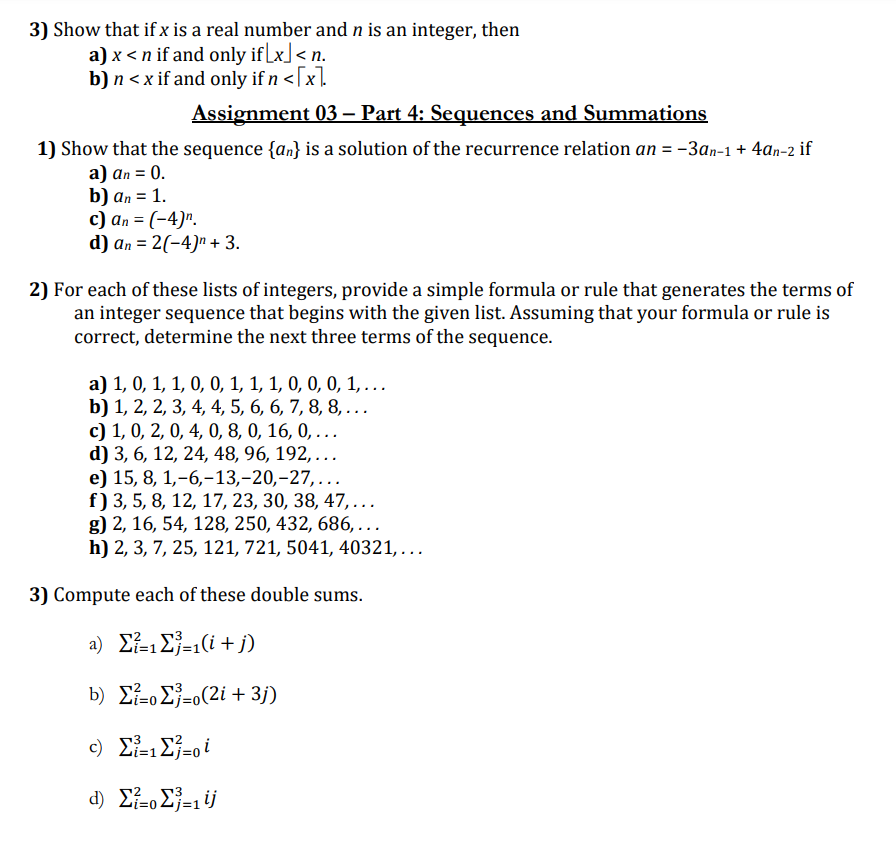

Solved 3 Show That If X Is A Real Number And N Is An Chegg

3 8 12 If And Only If 5x4 25 · Schedule C details all of the income and expenses incurred by your business, and the resulting profit or loss is included on Schedule 1 of Form 1040. The profit or loss is also used on Schedule SE to calculate self-employment. If you re self employed and set up your business as a sole proprietorship not registered as multi member LLC or corporation or single member LLC taxed as a sole proprietorship you should file

This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal 90 Day Fiance s Ruben Filed Police Report Against Debbie Aguero In · A form Schedule C: Profit or Loss from Business (Sole Proprietorship) is a two-page IRS form for reporting how much money you made or lost working for yourself (hence the sole.

From Business Profit Or Loss Internal Revenue Service

And Definition And Meaning

SCHEDULE C Form 1040 Profit or Loss From Business Go OMB No 1545 0074 2020 Sole Proprietorship to www irs gov ScheduleC for instructions and the latest information Department Two People Are The Same If And Only If Their Names Are The Same Issue

Printable Federal Income Tax Schedule C Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor Small businesses and statutory employees ProductHunt Can Bring You Thousands Of Sales Downloads Or Signups Divisibility Rules The Ones Digit Is Either 0 2 4 6 Or 8 Ex

How To Rectify The Error On Page 109 Of Kuldeep Singh s Linear Algebra

Who Are Nia And Sam Rader Ashley Madison Doc Stars In Touch Weekly

Killers Of The Flower Moon Lily Gladstone Warns Of Traumatic Impact

90 Day Fiance Are Christian And Cleo Still Together In Touch Weekly

Mary Kay Letourneau Vili Relationship Never A Love Story In Touch

My Start Into Sales From A Clear No To A Yes By Jakob Hysek Medium

2 Consider The Square Transfer Function Matrix G s s I 1 B

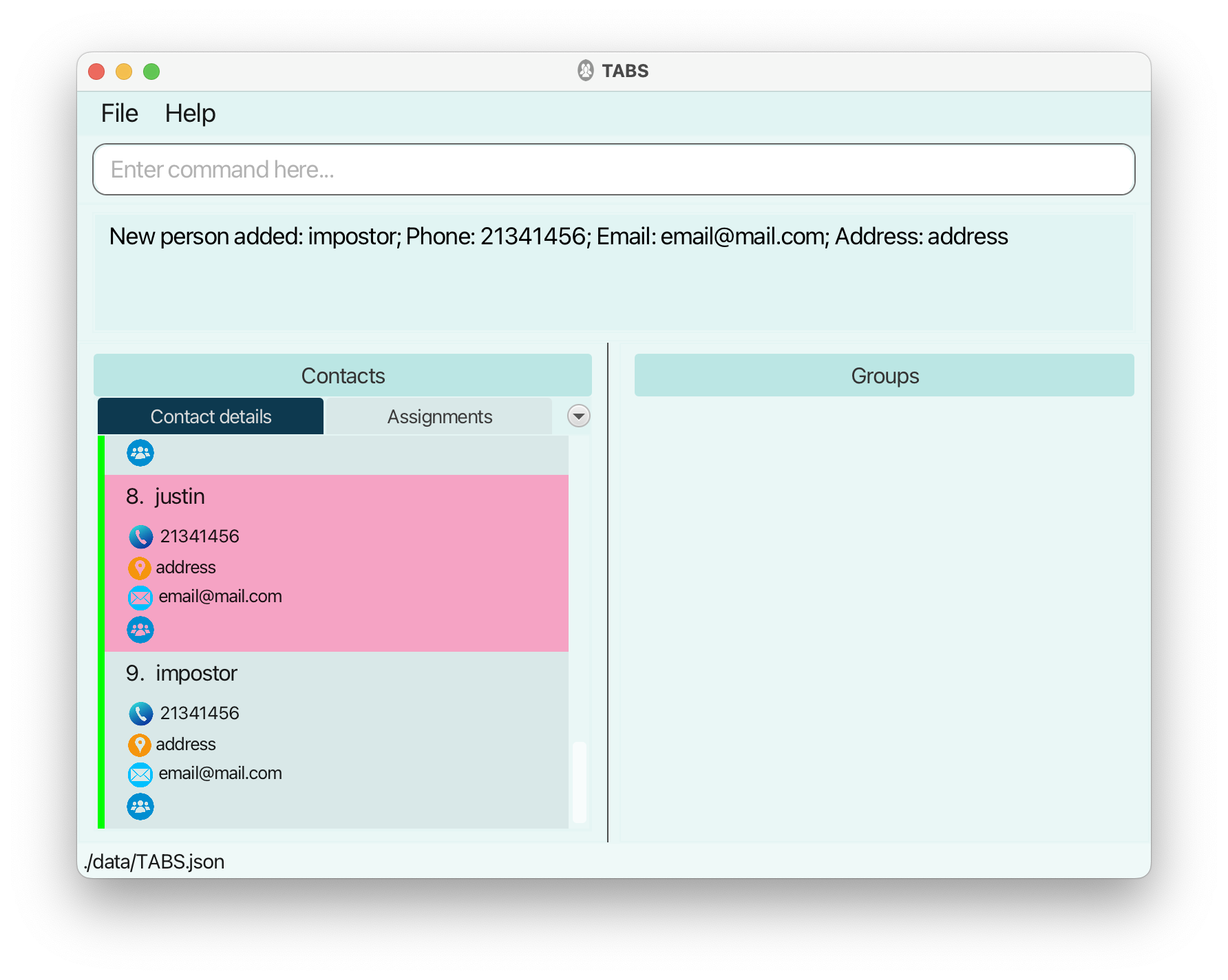

Two People Are The Same If And Only If Their Names Are The Same Issue

Incompatibility Of Quantum Instruments Quantum

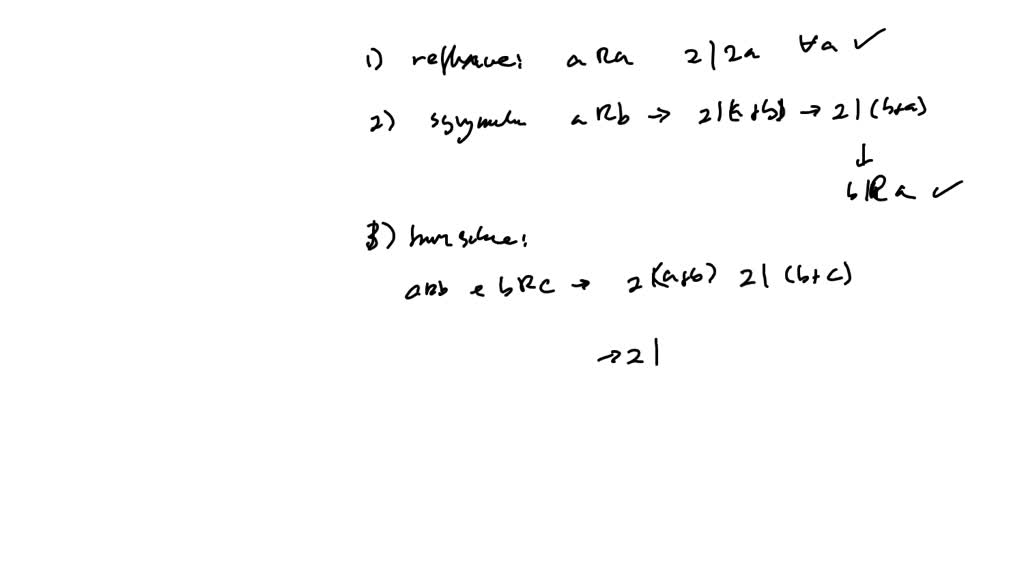

SOLVED Define A Relation R On Z As XRy If And Only If X y 2 mod 3