3 10 Divided By 5 9 As A Fraction - Searching for a method to remain arranged effortlessly? Explore our 3 10 Divided By 5 9 As A Fraction, created for daily, weekly, and monthly preparation. Perfect for students, professionals, and hectic moms and dads, these templates are simple to customize and print. Remain on top of your tasks with ease!

Download your ideal schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and worry-free. Start planning today!

3 10 Divided By 5 9 As A Fraction

3 10 Divided By 5 9 As A Fraction

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary The 2023 Form 1040 Schedule C is a supplemental form used in conjunction with the Form 1040 to report the profit or loss from a sole proprietorship business. This schedule is used by self.

Federal 1040 Schedule C Profit Or Loss From Business Sole

25 5 25 5 25 Divided By 5 25 5 Simplified Form YouTube

3 10 Divided By 5 9 As A Fraction · A form Schedule C: Profit or Loss from Business (Sole Proprietorship) is a two-page IRS form for reporting how much money you made or lost working for yourself (hence the sole. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to www irs gov ScheduleC for instructions and

Definition Schedule C is the IRS form small business owners use to calculate the profit or loss from their business That amount from Schedule C is then entered on the owner s 28 Divide By 4 · IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C.

2023 1040 Schedule C Profit Or Loss From Business E File

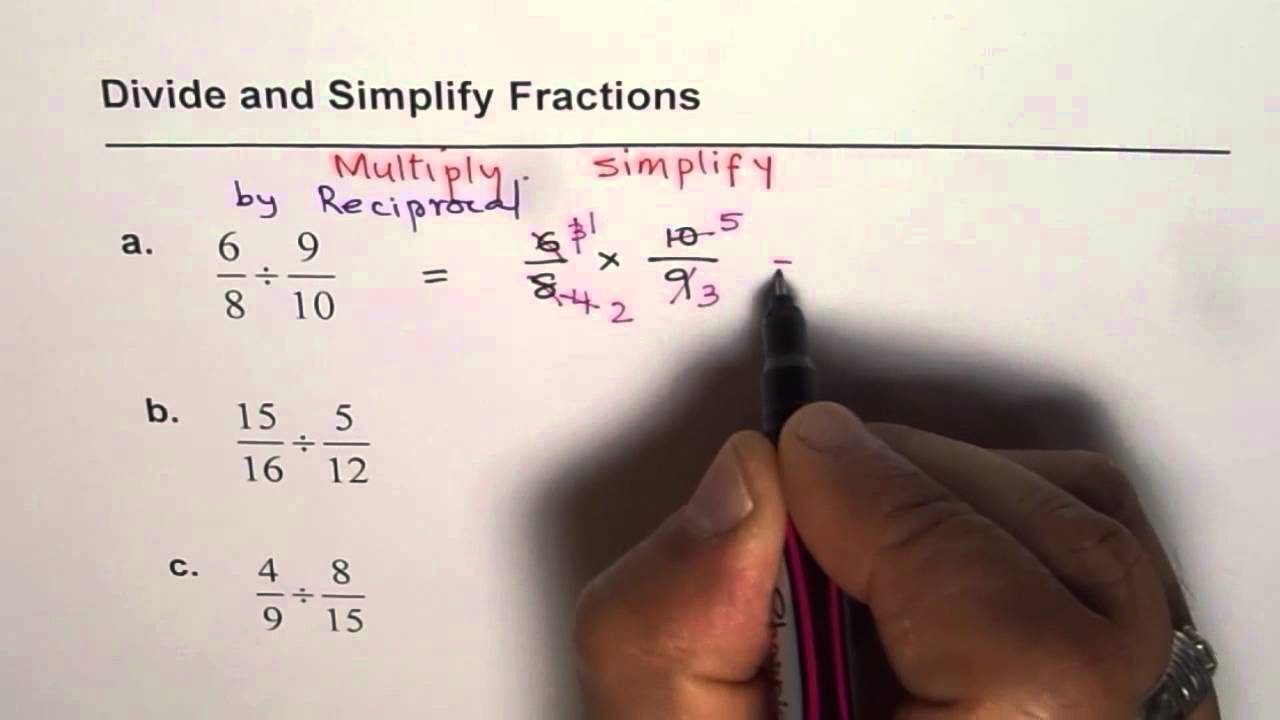

Division With Remainders As Fractions YouTube

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if 10 Divided By 1 2

Download or print the 2023 Federal 1040 Schedule C Profit or Loss from Business Sole Proprietorship for FREE from the Federal Internal Revenue Service 4 6 Divided By 1 2 6 Divided By 100

15 Divided By 23

15 Divided By 23

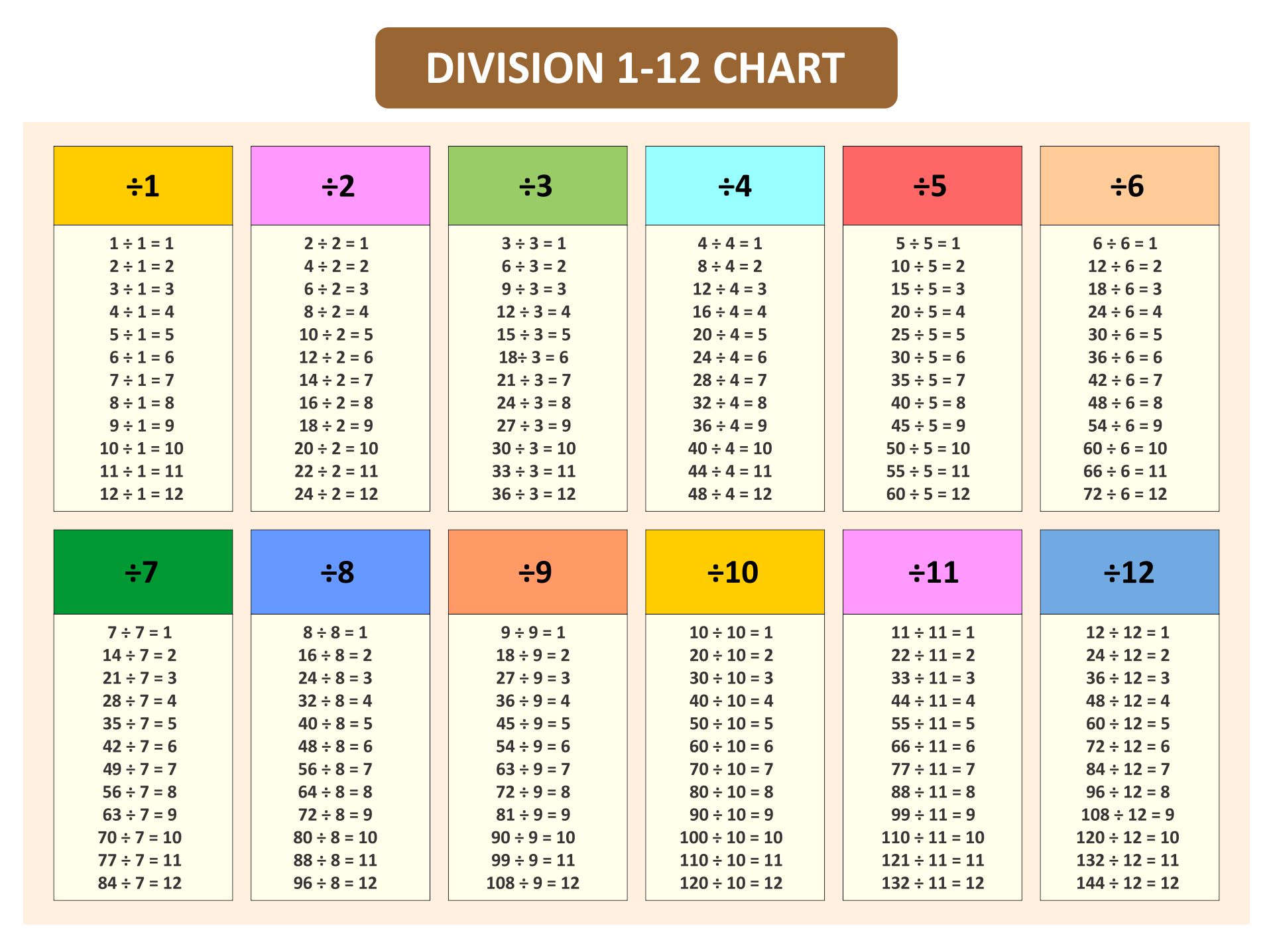

Two Division Tables

Division Chart Printable

.png)

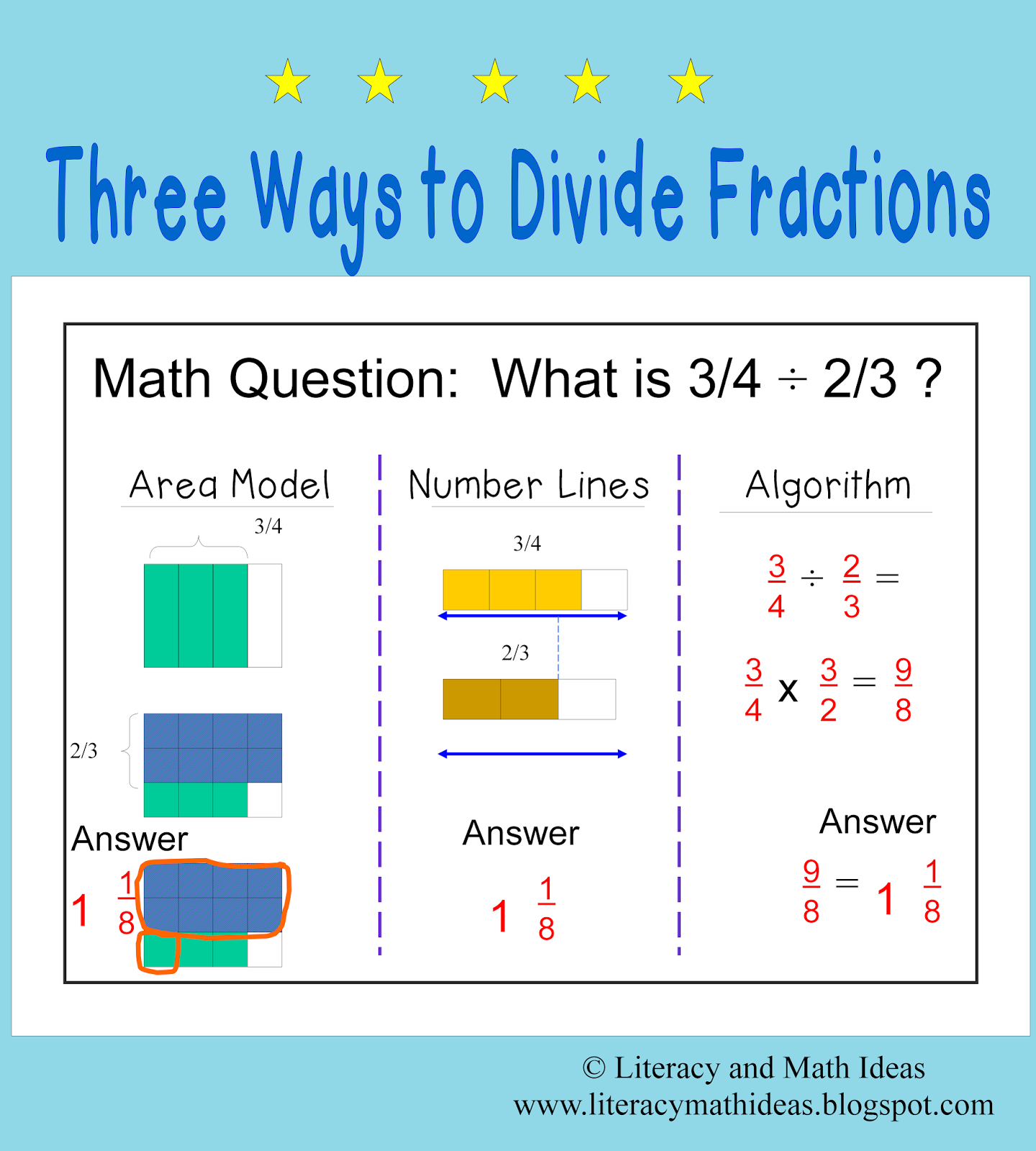

Area And Fractions

10 Divided By 12

28 Divide By 30

10 Divided By 1 2

What Is 100 Divided By 7

1 4 Divided By 3