200 Is 45 Percent Of What Number - Looking for a method to stay organized easily? Explore our 200 Is 45 Percent Of What Number, created for daily, weekly, and monthly preparation. Perfect for students, professionals, and busy moms and dads, these templates are simple to tailor and print. Stay on top of your tasks with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you efficient and hassle-free. Start preparing today!

200 Is 45 Percent Of What Number

200 Is 45 Percent Of What Number

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity Download or print the 2023 Federal 1040 (Schedule C) (Profit or Loss from Business (Sole Proprietorship)) for FREE from the Federal Internal Revenue Service.

What Is Schedule C Form 1040 H amp R Block

Calculating The Percent Of Slope YouTube

200 Is 45 Percent Of What NumberMaximize your business deductions and accurately calculate your profit or loss with Federal Form 1040 Schedule C. Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file

Sole owner of an LLC Business owner with your spouse In a nutshell if you earn income that isn t reported on a W 2 you don t have a business partner and your business isn t incorporated or treated as a corporation for tax purposes Schedule C is for you What Is 20 Percent Of 200 Calculatio · IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is.

Federal 1040 Schedule C Profit Or Loss From Business Sole

Honest Advice About Body Fat Percentages Real Examples Included YouTube

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if Facebook

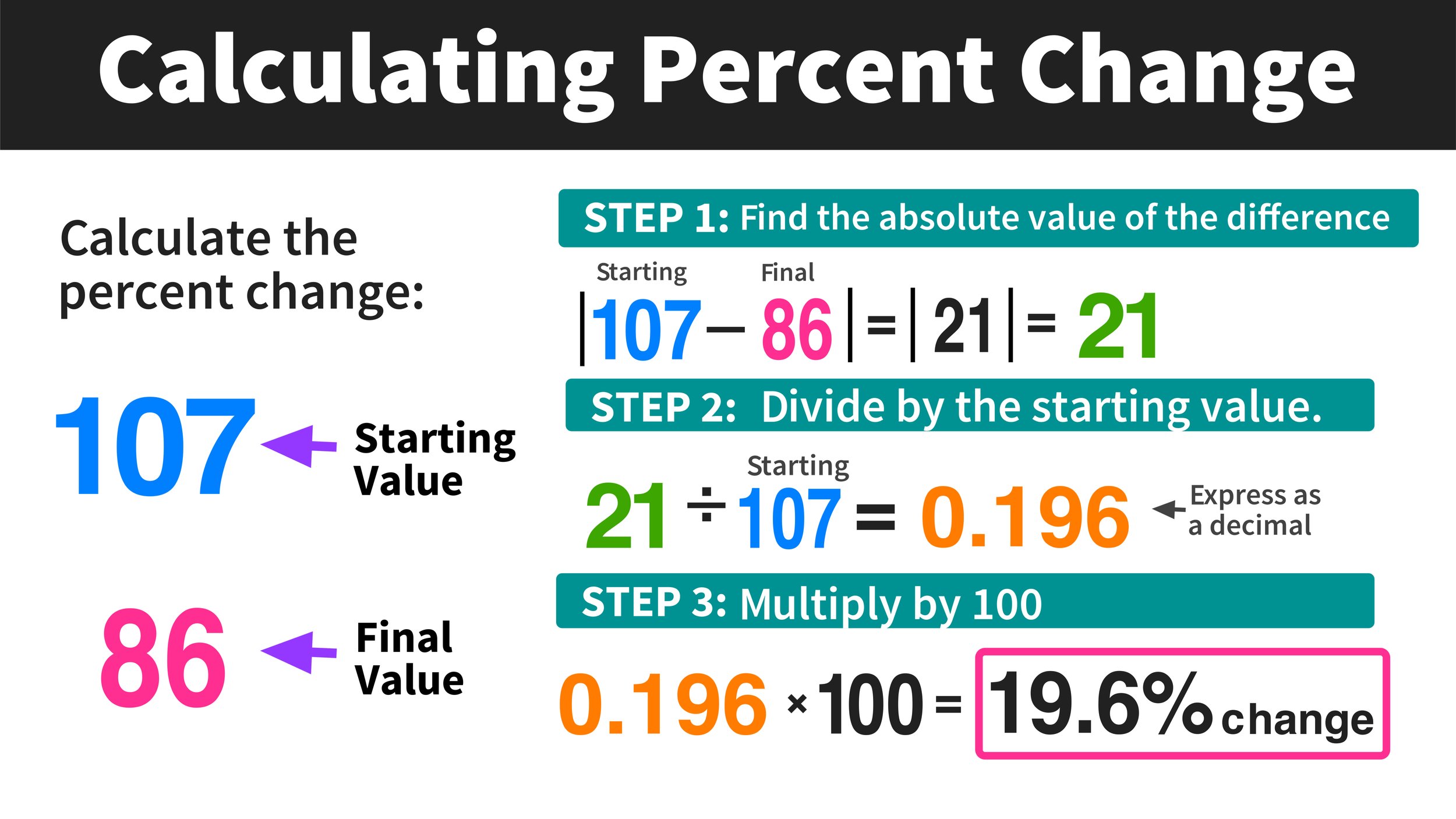

You can find and download all versions of Schedule C on the IRS website You can also use H R Block Online to access Schedule C and complete your tax return Or if you work with a tax preparer they will help you access and complete Schedule C What Is A Percent Of A Number Worksheets Library Percent Change Calculator Mashup Math

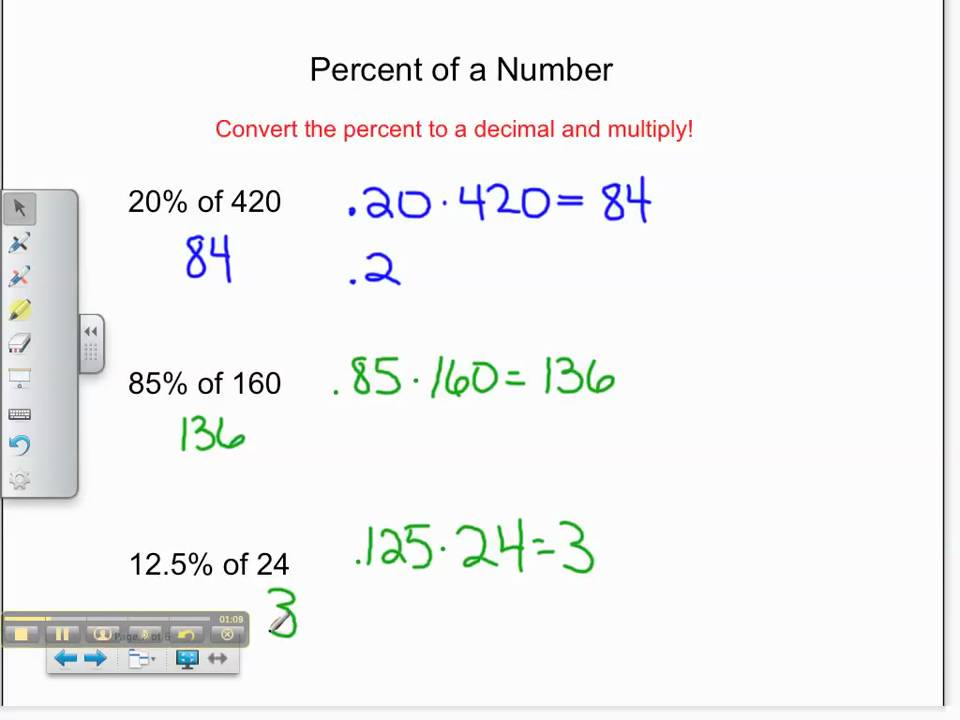

Finding Percent Of A Number YouTube

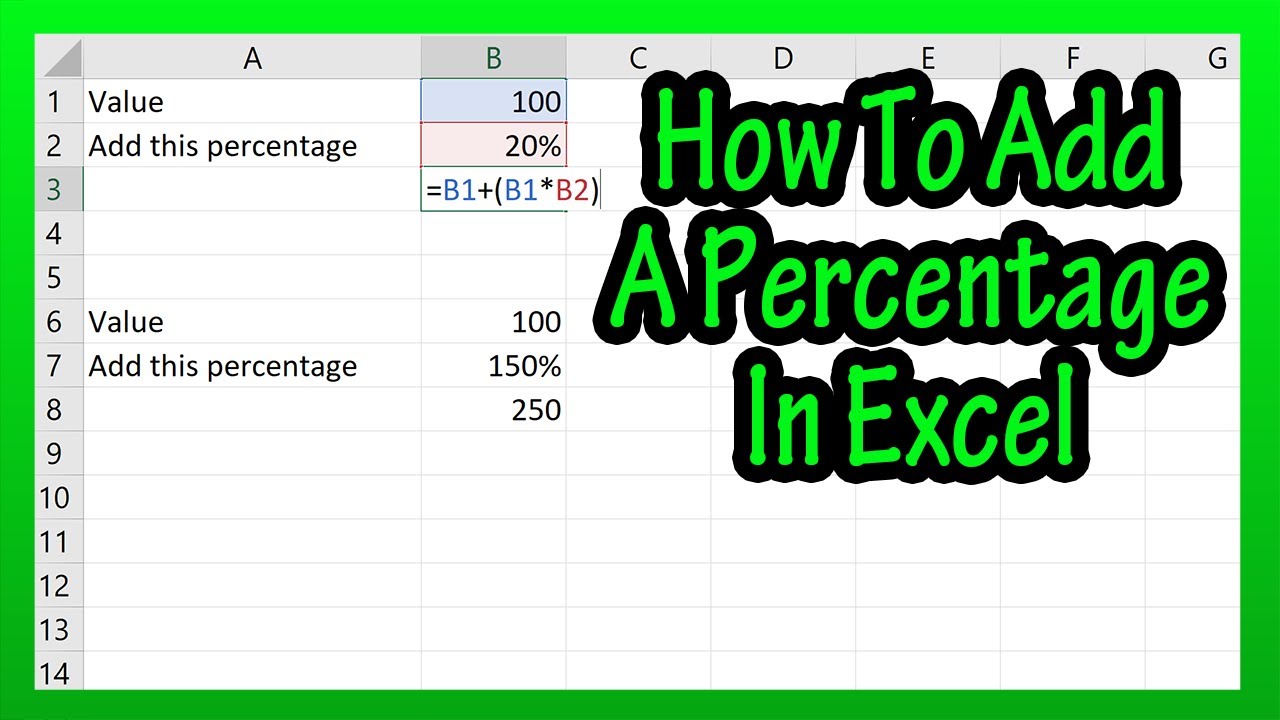

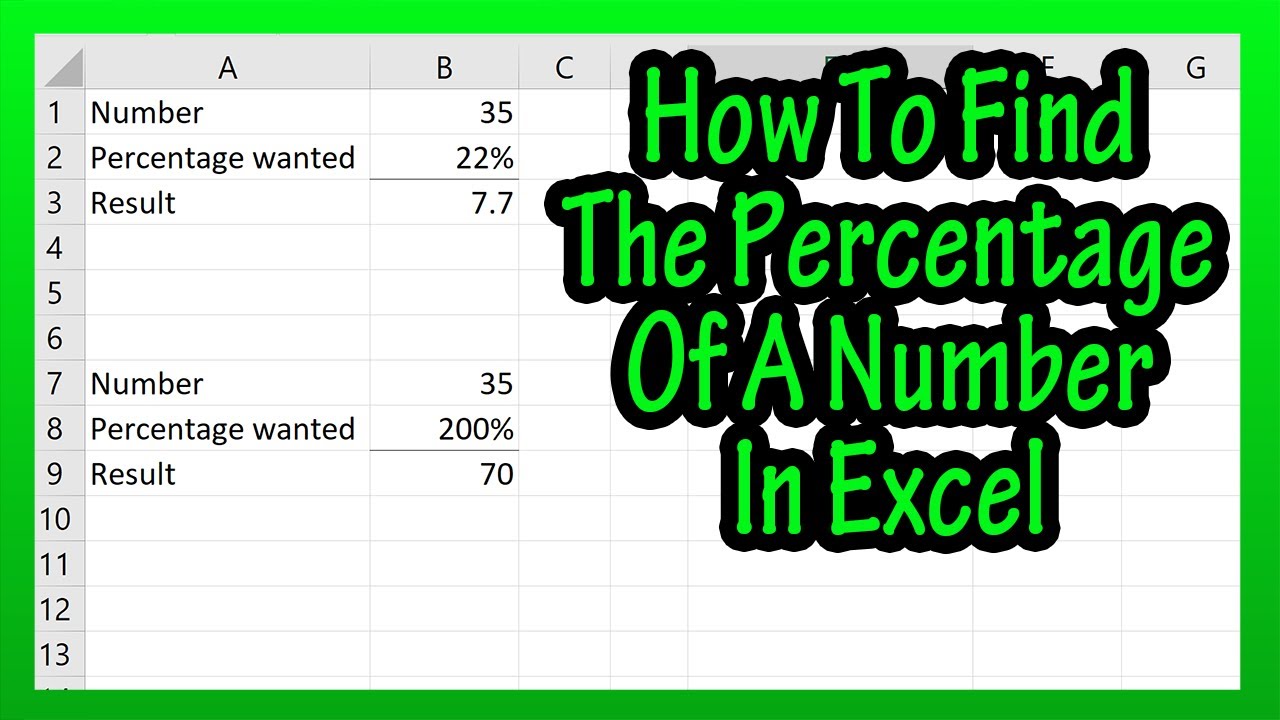

How To Calculate Or Find The Percent Percentage Of A Number In Excel

What Is 40 Percent Of 200 QnA Explained YouTube

How To Find 30 Percent Of A Number 30 Percent Of What Number Is 60 30

Percentage Formula How To Calculate Examples And FAQs 44 OFF

Keskiverto Nainen Painaa 70 Kiloa Suomi24 Keskustelut

Vanshika 11 NUTRITIONIST LIFESTYLE FITNESS COACH Did You Just Say