2 605 Divided By 12 - Trying to find a method to stay organized effortlessly? Explore our 2 605 Divided By 12, designed for daily, weekly, and monthly preparation. Perfect for trainees, experts, and hectic moms and dads, these templates are simple to personalize and print. Remain on top of your tasks with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and hassle-free. Start preparing today!

2 605 Divided By 12

2 605 Divided By 12

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The resulting profit or loss is typically Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if

Printable Federal Schedule C Profit Or Loss From Business Tax

32 Divided By 4 32 4 YouTube

2 605 Divided By 12 · Schedule C details all of the income and expenses incurred by your business, and the resulting profit or loss is included on Schedule 1 of Form 1040. The profit or loss is also used on Schedule SE to calculate self-employment. If you re self employed and set up your business as a sole proprietorship not registered as multi member LLC or corporation or single member LLC taxed as a sole proprietorship you should file

This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal Divided Kingdom Of Northern Israel And Judah Map · A form Schedule C: Profit or Loss from Business (Sole Proprietorship) is a two-page IRS form for reporting how much money you made or lost working for yourself (hence the sole.

From Business Profit Or Loss Internal Revenue Service

6 Divided By 1 2 Six Divided By One Half YouTube

SCHEDULE C Form 1040 Profit or Loss From Business Go OMB No 1545 0074 2020 Sole Proprietorship to www irs gov ScheduleC for instructions and the latest information Department Kings Of Israel Judah Truthunedited

Printable Federal Income Tax Schedule C Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor Small businesses and statutory employees 216 Divided By 12 Picture Method Brainly Hardwood Lumber In Opelika AL Bowtie Woodworks

How To Divide A Circle Into 8 Equal Parts YouTube

65 Divided By 5 65 5 Value 65 5 Value YouTube

Find The Quotient And Remainder When Dividing Numbers YouTube

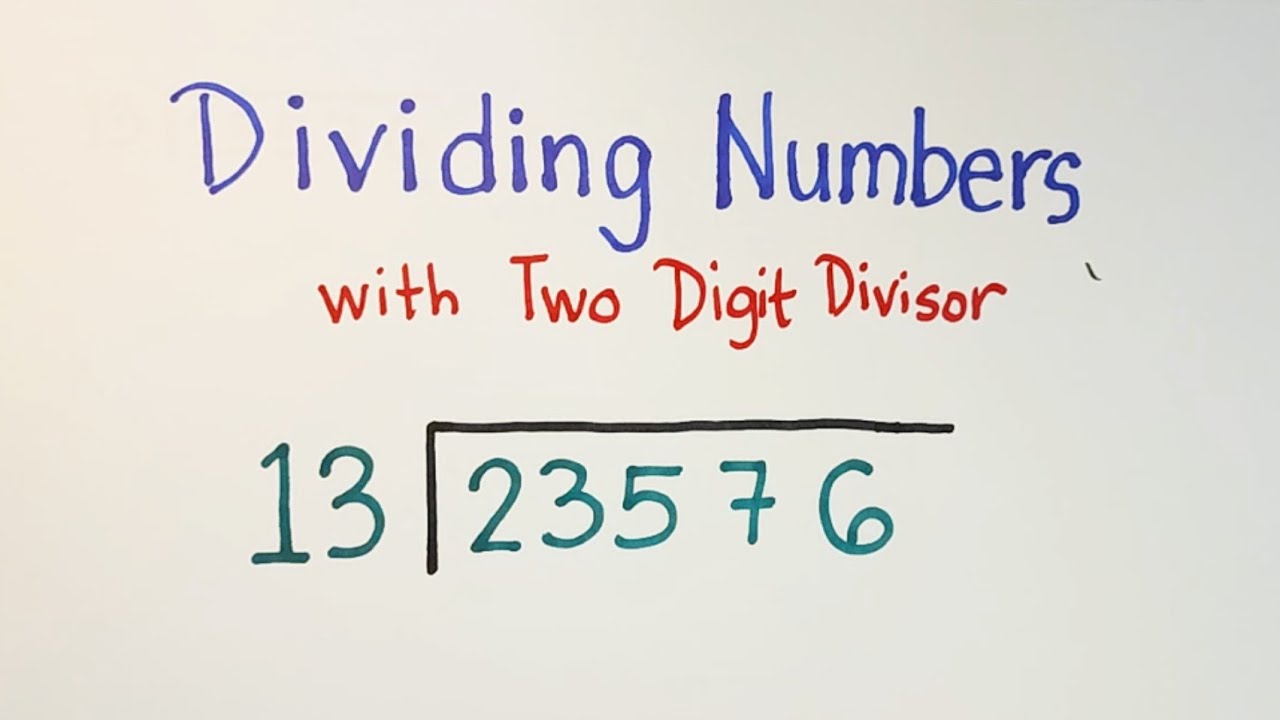

How To Divide Numbers With Two Digit Divisor Long Division Of Numbers

Fraction Pie Divided Into Twelfths ClipArt ETC

Therefore The Least Number Which When Divided By 12 15 18 And 24

Find The Smallest Number Which when Divided By 28 32 Leave Remainder

Kings Of Israel Judah Truthunedited

Which Answer Choice Correctly Illustrates The Quotient As A Fraction In

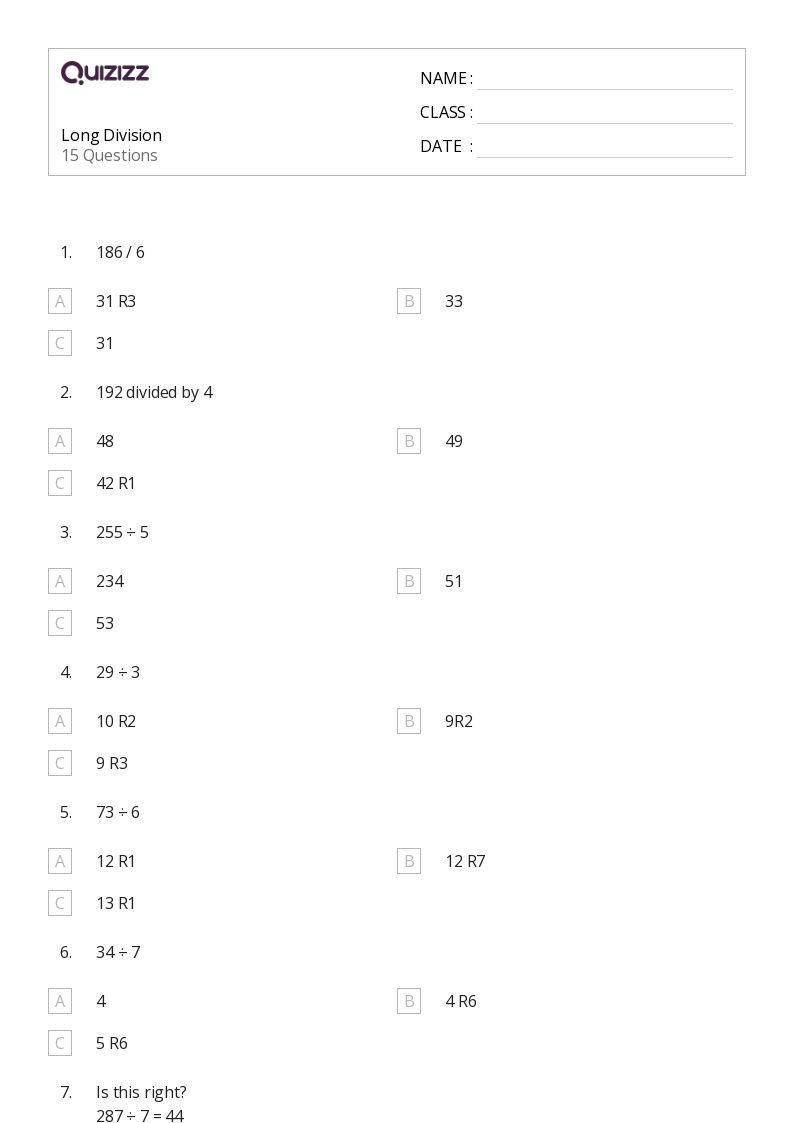

50 Long Division Worksheets On Quizizz Free Printable