152 Divided By 164 - Looking for a method to remain arranged effortlessly? Explore our 152 Divided By 164, created for daily, weekly, and monthly planning. Perfect for trainees, experts, and busy moms and dads, these templates are simple to personalize and print. Stay on top of your tasks with ease!

Download your perfect schedule now and take control of your time. Whether it's work, school, or home, our templates keep you productive and stress-free. Start planning today!

152 Divided By 164

152 Divided By 164

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity Download or print the 2023 Federal (Profit or Loss from Business (Sole Proprietorship)) (2023) and other income tax forms from the Federal Internal Revenue Service.

Federal 1040 Schedule C Profit Or Loss From Business Sole

Half Brain Half Heart With Flowers Coloring Book Art Line Art

152 Divided By 164 · Was this page helpful? To complete Schedule C for your small business taxes, you'll need your business income, costs of goods sold, and more. Attach Schedule C to your Form 1040 tax return. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to www irs gov ScheduleC for instructions and the latest information Attach to Form 1040 1040 SR 1040 NR or 1041 partnerships must generally file Form 1065 OMB No 1545 0074 2021 Attachment Sequence No 09

Form 1040 Schedule C Profit or Loss From Business Use Tax Form 1040 Schedule C Profit or Loss From Business as a stand alone tax form calculator to quickly calculate specific amounts for your 2024 tax return How To Divide Decimals Easily And Correctly fastandeasymaths math · If you’re wondering how to fill out the Schedule C Form 1040, this easy-to-use tool will get your financial ducks in a row. We highly recommend using it before you attempt the official IRS form. You may also download the 2023 Schedule C Worksheet and record your 2023 income and expenses as the year progresses. here's the worksheet (free download)

Federal Profit Or Loss From Business Sole Proprietorship

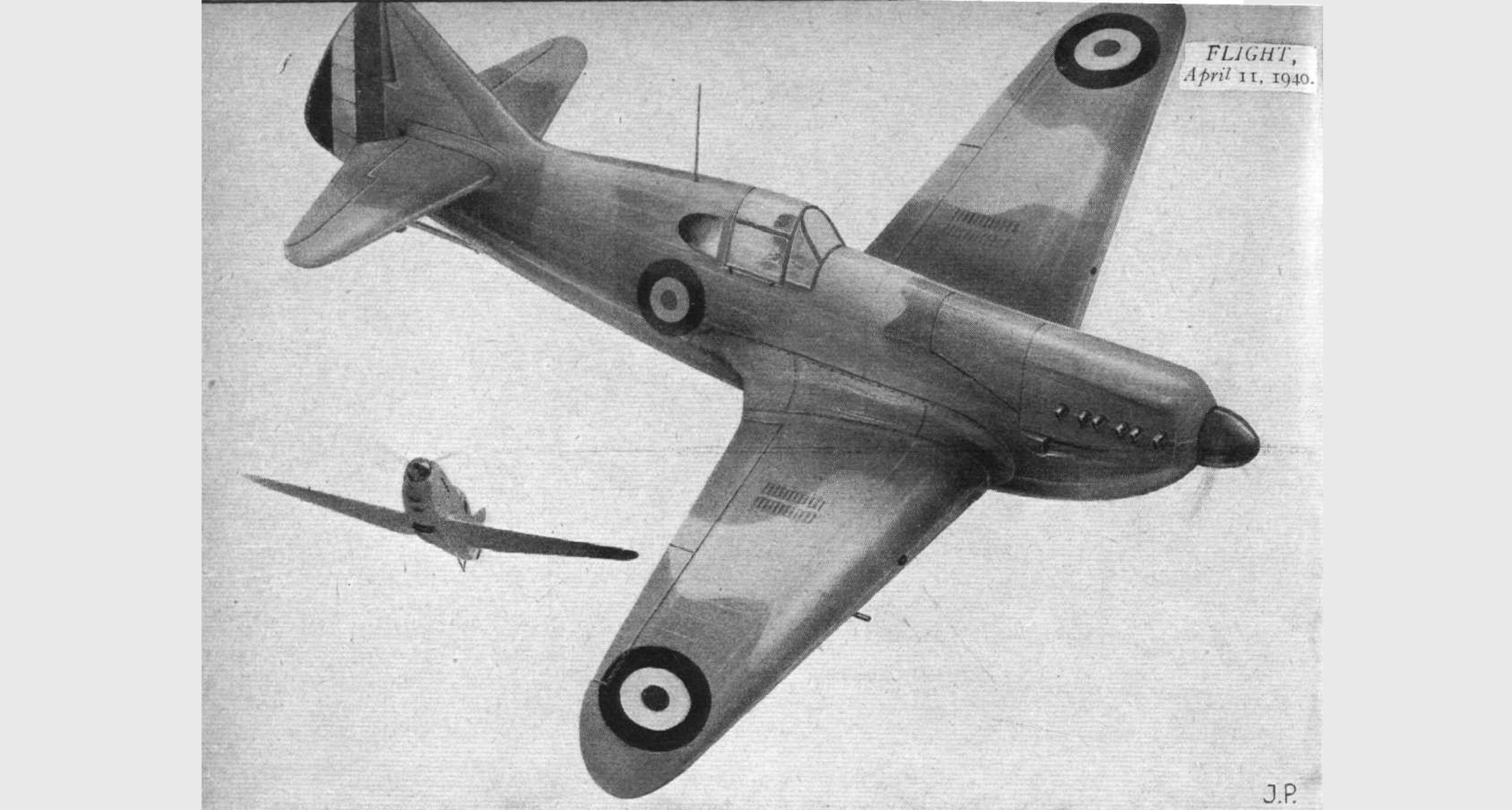

bb164a Hex Color Palette

If you re self employed and set up your business as a sole proprietorship not registered as multi member LLC or corporation or single member LLC taxed as a sole proprietorship you should file Schedule C with your Form 1040 to report the profit or loss for your business 1940

Download or print the 2023 Federal 1040 Schedule C Profit or Loss from Business Sole Proprietorship for FREE from the Federal Internal Revenue Service 1940 1940

S P RA M T THANH G M HUY N THO I S P RA M T THANH G M HUY N

Hunter Greene Candy

D y C B c Style By Pnj Feminine 0000y000090

B ng Tai B c nh Style By Pnj Sexy Ztxmw000031

D y C V ng 18k nh Citrine Pnj Ctxmy000023

D y C B c nh Style By Pnj Sexy Xm00w060015

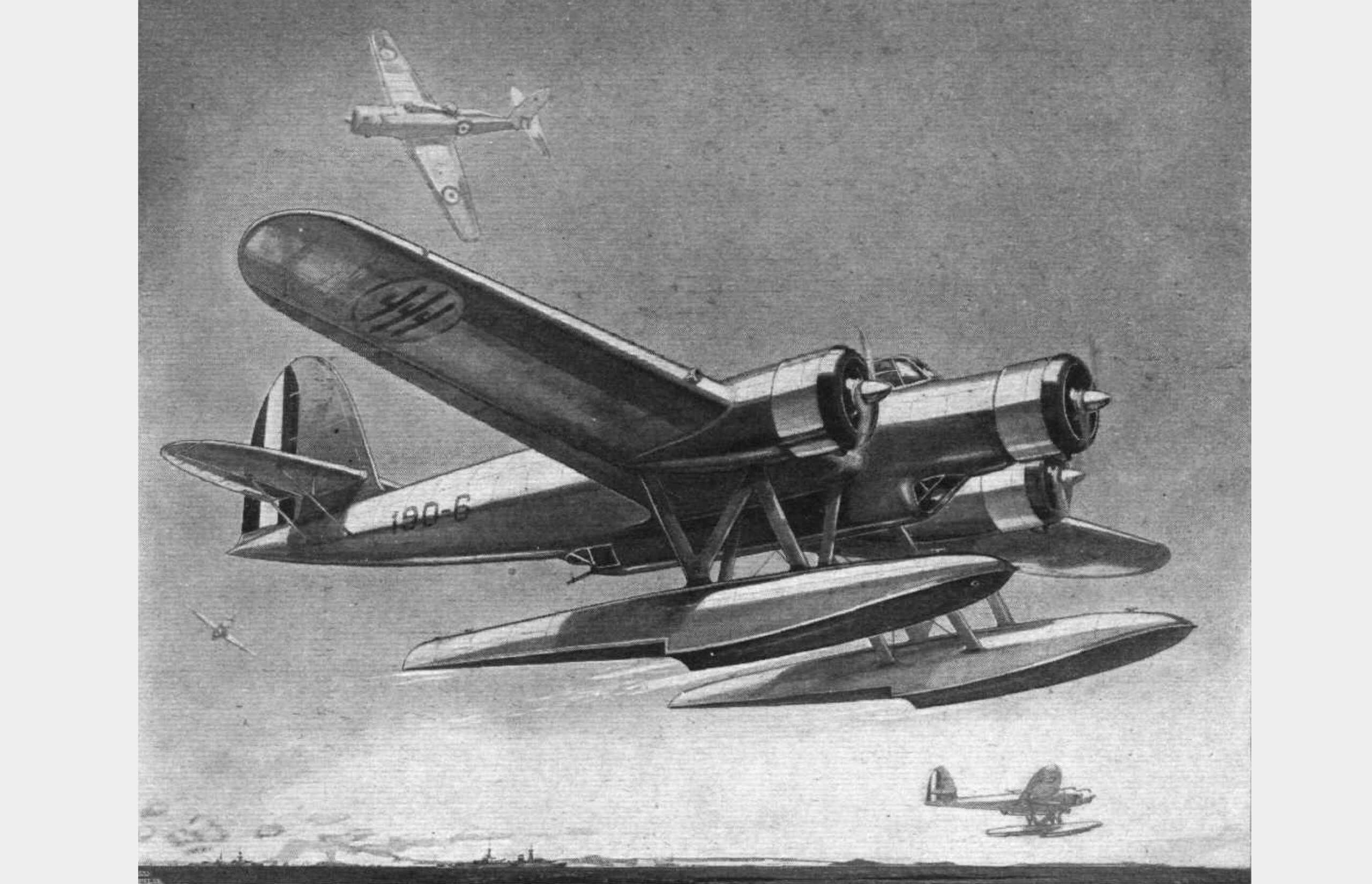

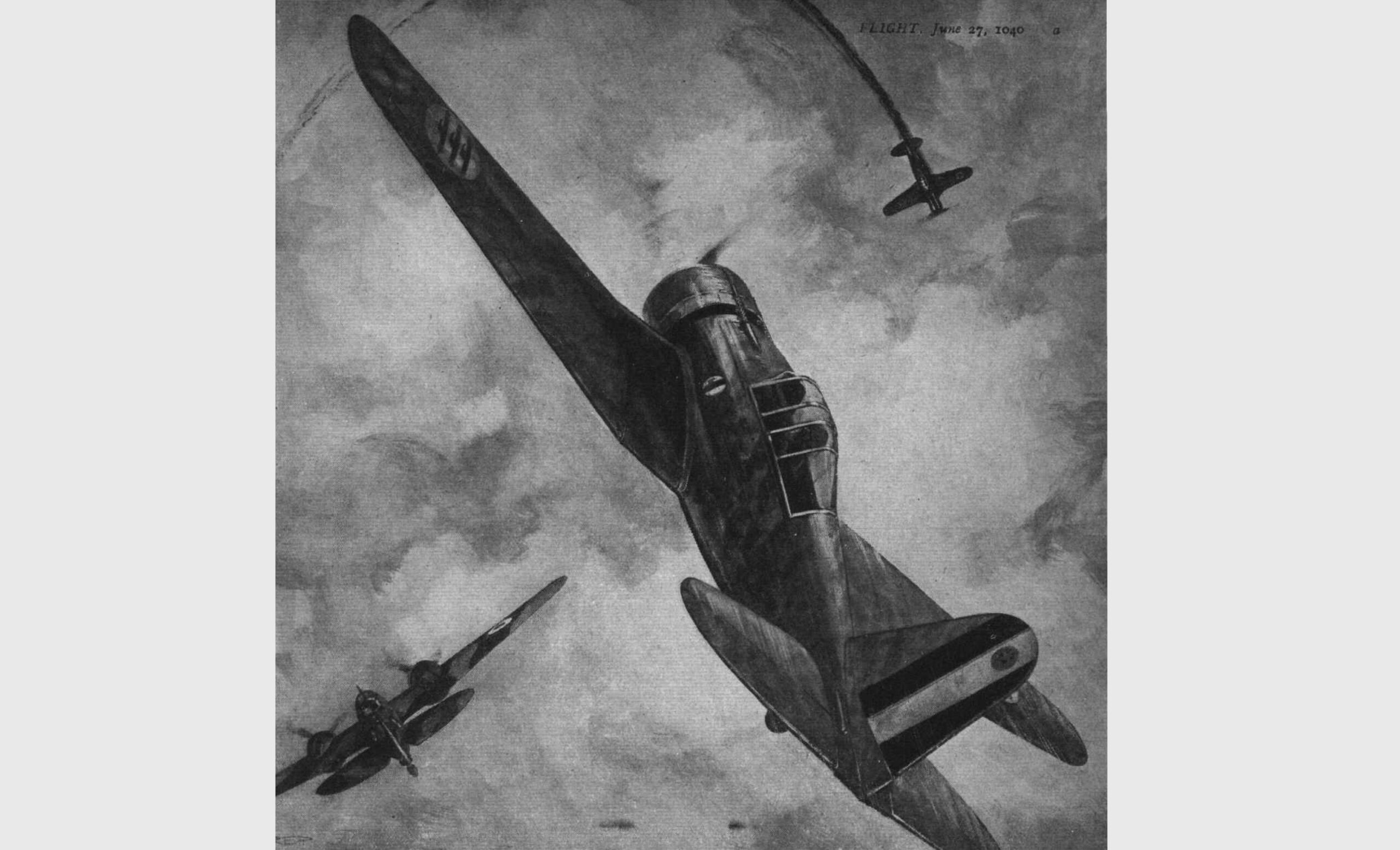

1940

1940

1940

1940